U.S. Real Estate

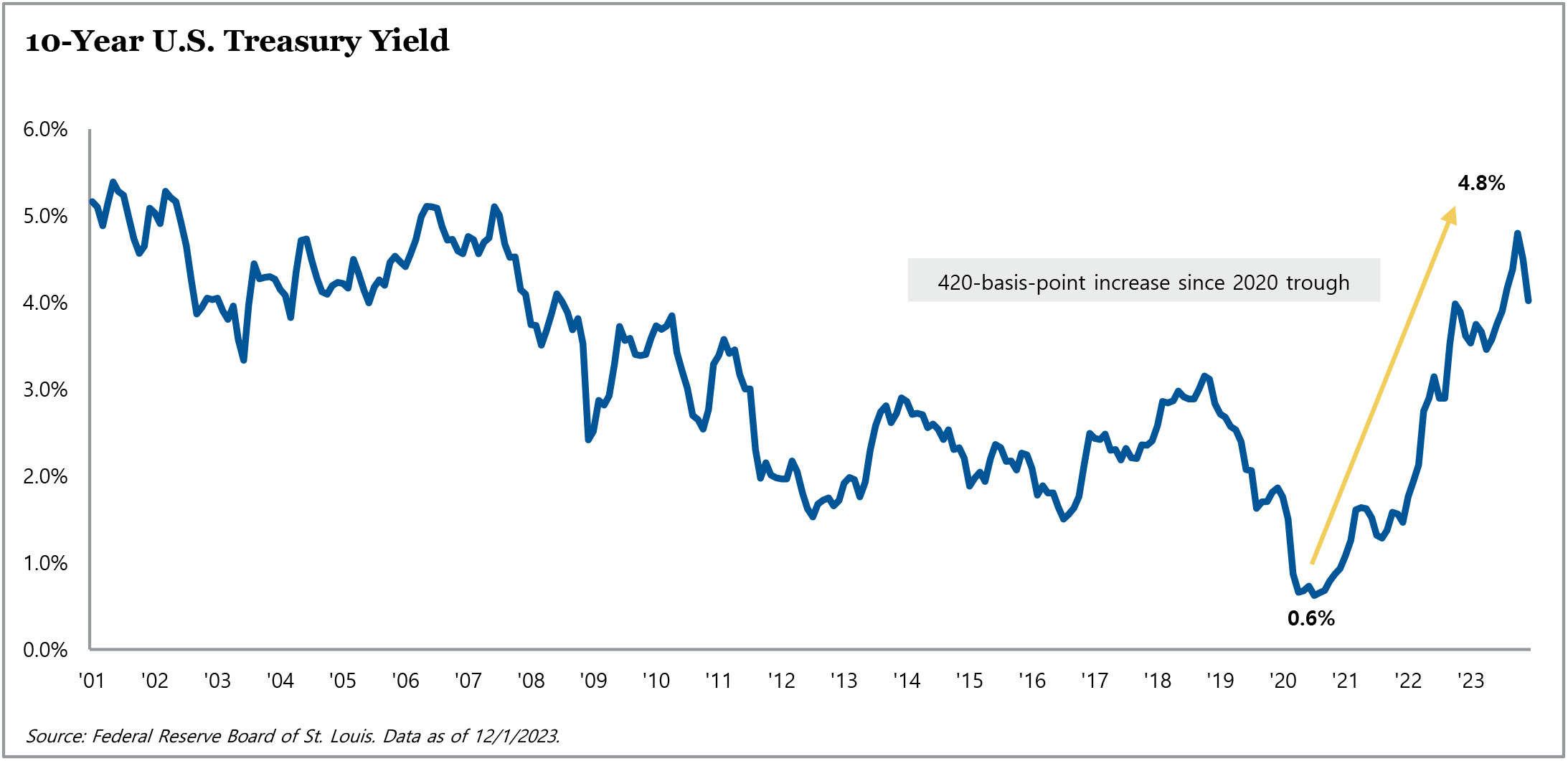

The fourth quarter of 2023 ended positively, with a marked, significant shift in market sentiment. Contrary to expectations, a recession did not materialize in 2023, and there now appears to be a consensus view that the likelihood of a soft landing is increasing. Interest rates seem to have peaked, as the 10-year Treasury yield hit a high of 5.02% in October but was back to roughly where it started 2023 by December, near 4.0%. Significant progress has been made in combatting inflation, as annual year-over-year growth of the U.S. consumer price index (CPI) at the end of December 2023 had dropped to the same level seen in February 2019, and the labor market dialed back its pace of growth. The national unemployment rate experienced a noticeable decline to 3.7% by December – well below the long-term average – and real GDP growth increased at a 3.3% annualized rate in the fourth quarter of 2023.

The fourth quarter of 2023 ended positively, with a marked, significant shift in market sentiment. Contrary to expectations, a recession did not materialize in 2023, and there now appears to be a consensus view that the likelihood of a soft landing is increasing. Interest rates seem to have peaked, as the 10-year Treasury yield hit a high of 5.02% in October but was back to roughly where it started 2023 by December, near 4.0%. Significant progress has been made in combatting inflation, as annual year-over-year growth of the U.S. consumer price index (CPI) at the end of December 2023 had dropped to the same level seen in February 2019, and the labor market dialed back its pace of growth. The national unemployment rate experienced a noticeable decline to 3.7% by December – well below the long-term average – and real GDP growth increased at a 3.3% annualized rate in the fourth quarter of 2023.

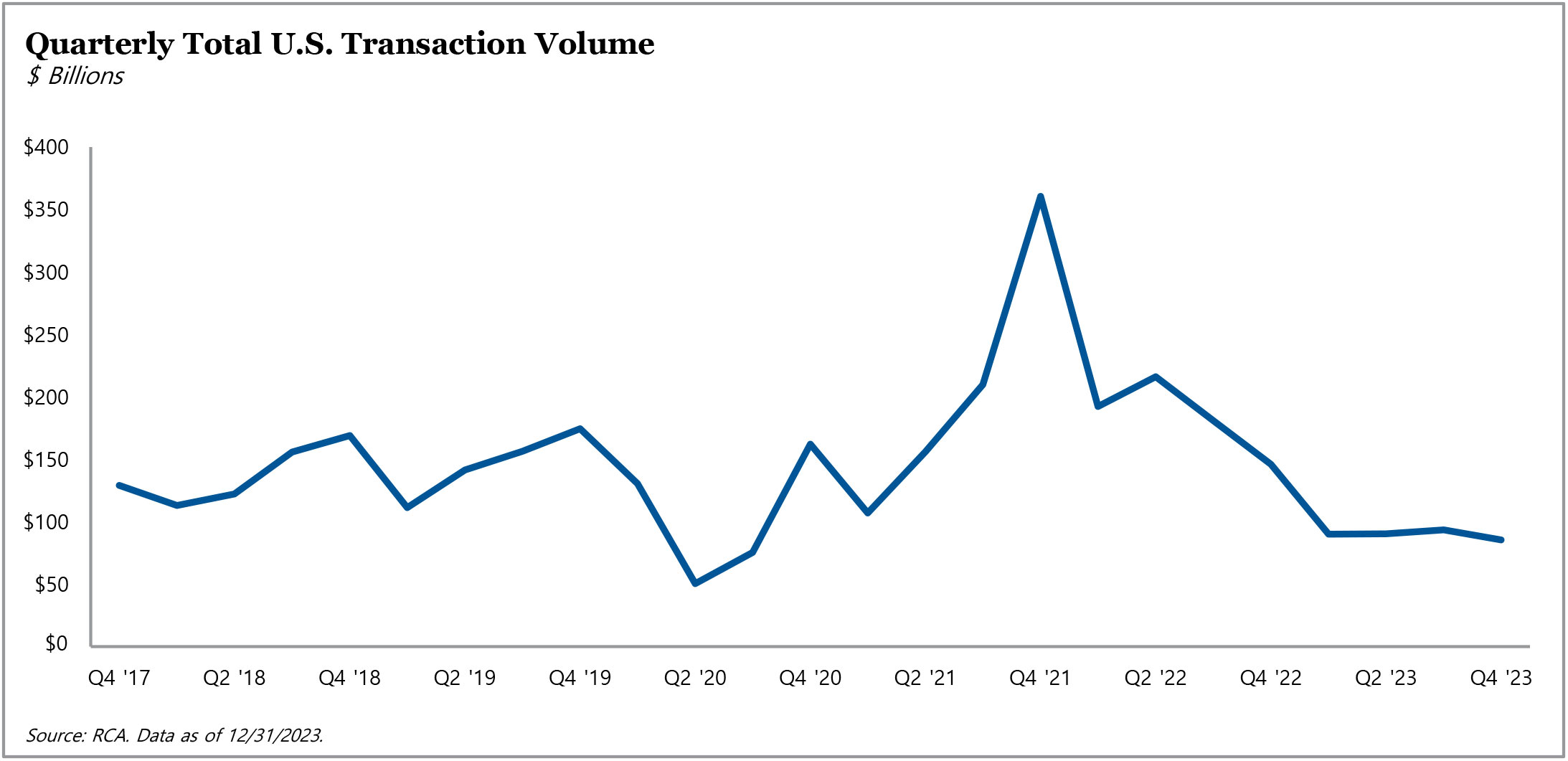

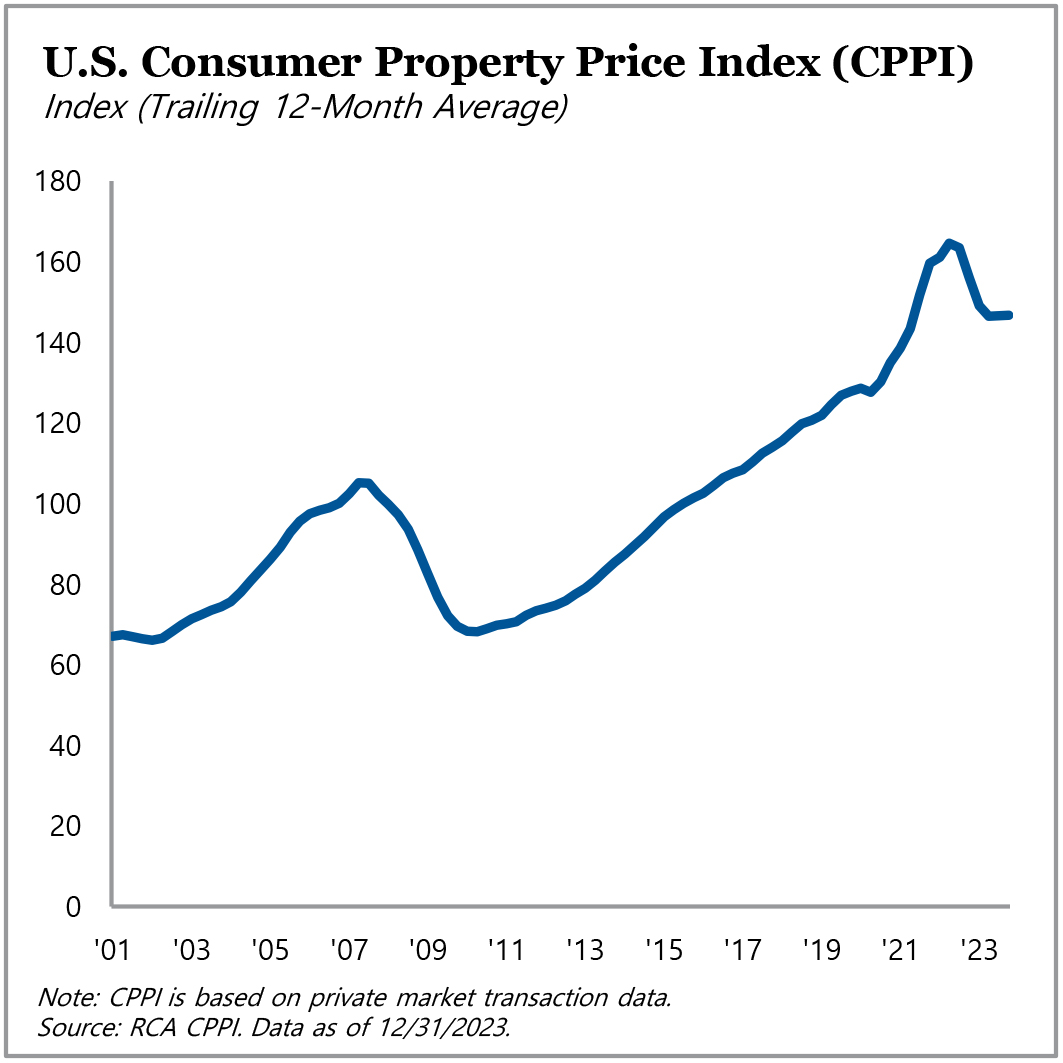

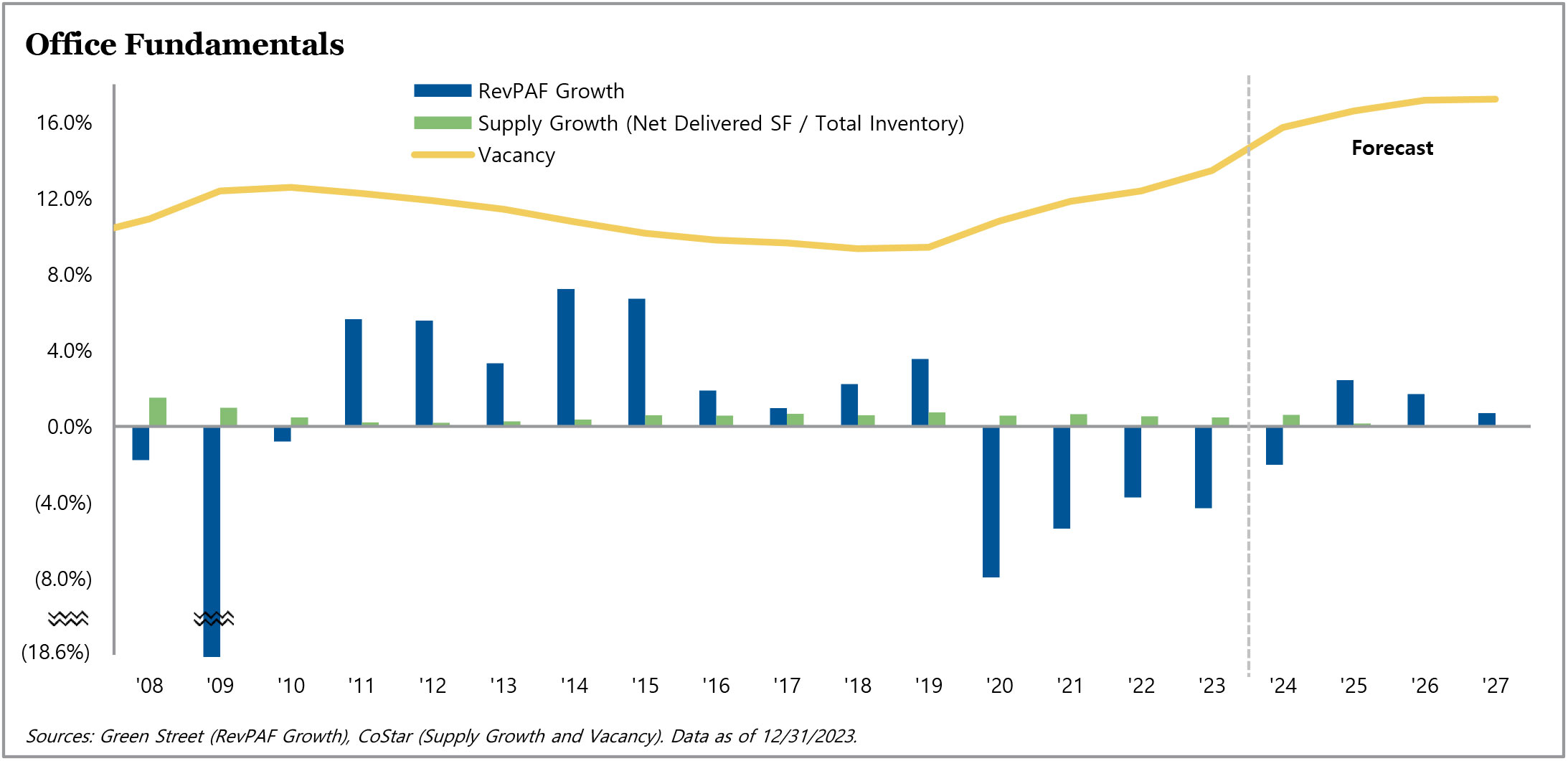

In 2023, real estate capital markets experienced a 51% year-over-year decline in transaction volume due to economic uncertainty, historic interest rate increases, and a sharp reduction in credit availability. This drop in transaction volume was met with a decline in real estate prices, which were down 5.9% on average year-over-year through December 2023. The office and apartment sectors saw the most pronounced year-over-year deterioration in pricing, with declines of 16.1% and 8.4%, respectively. In contrast, industrial was the only major property type to experience an increase in pricing in 2023 – recording a gain of 0.5%.

If interest rates continue to stabilize, we anticipate the market will react positively, reducing the bid-ask spread between buyers and sellers and leading to more transactions. Moreover, the impending surge of debt maturities – with many loans originated in a much lower rate environment – will likely lead to forced capital events and distressed asset sales. Although distressed sales only accounted for 1.7% of all sales in 2023, the upcoming $900 billion of debt maturities over the next two years and $2 trillion by 2027 should bode well for increased transaction volume.

For more information on TPG AG U.S. Real Estate, visit angelogordon.com/strategies/real-estate/u-s-real-estate/

Following a rapid increase from 2020 lows, it appears the 10-year Treasury yield may have peaked after reaching 5% in October 2023. By year-end, the 10-year yield had retreated to below 4%, roughly where it started 2023.

Economic uncertainty, interest rate hikes, and a dearth of available financing led full-year 2023 transaction volume to decline 51% year-over-year.

Estimates of U.S. commercial property prices were down year-over-year from 2022, but these declines decelerated by mid-year and prices remained stable in the fourth quarter.

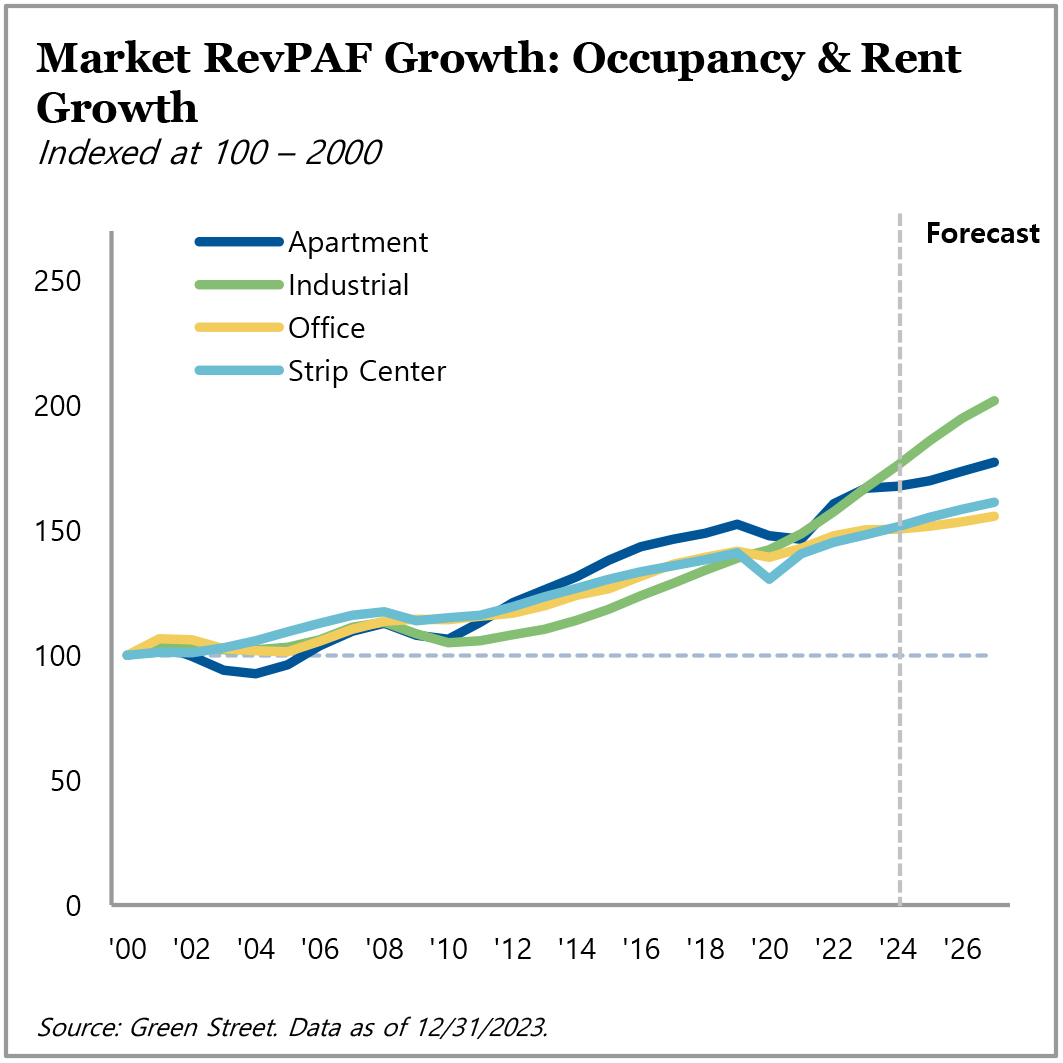

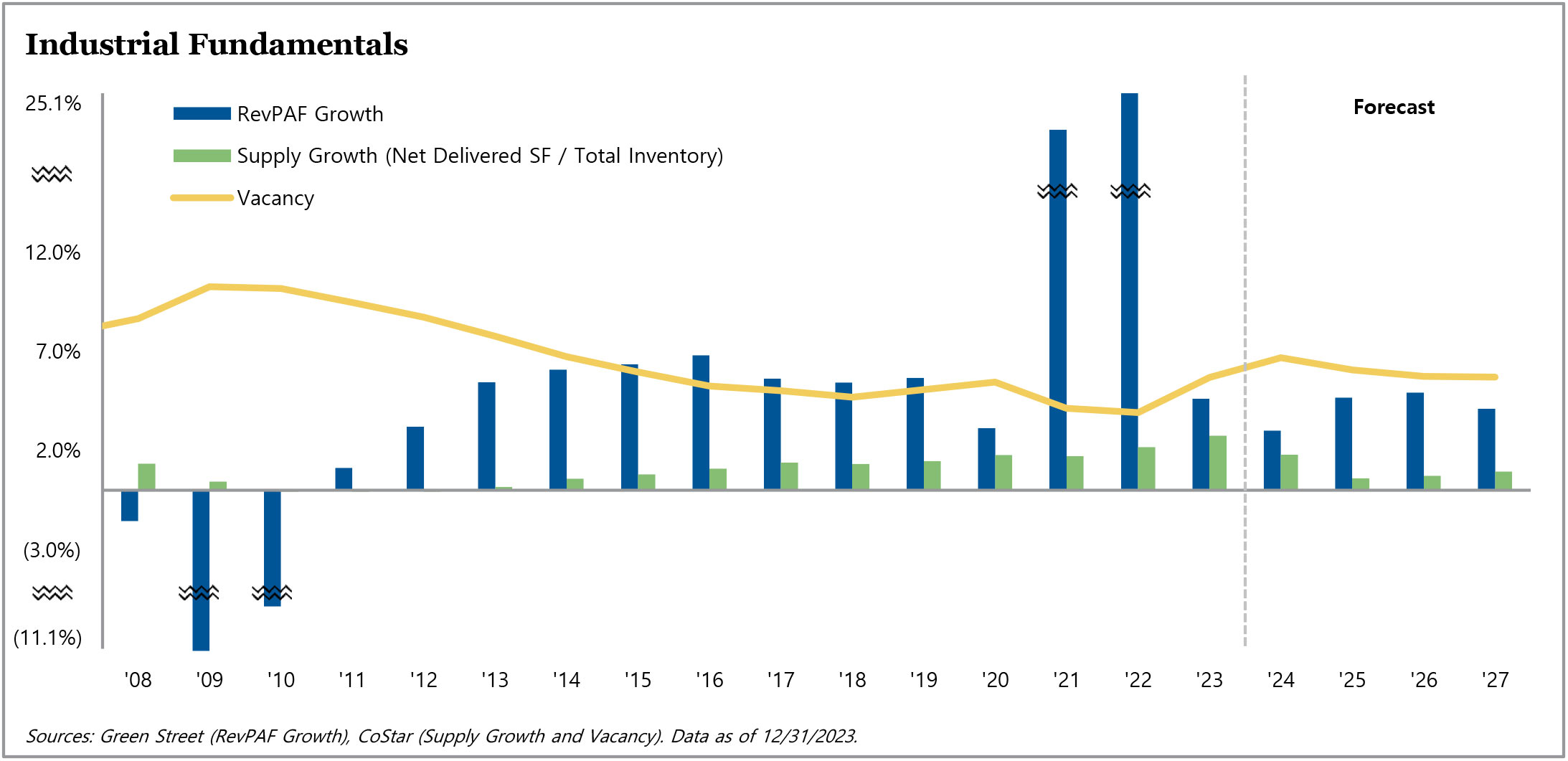

U.S. real estate fundamentals remained relatively stable across property sectors, with industrial experiencing the lowest vacancy and highest rent growth of the major sectors.

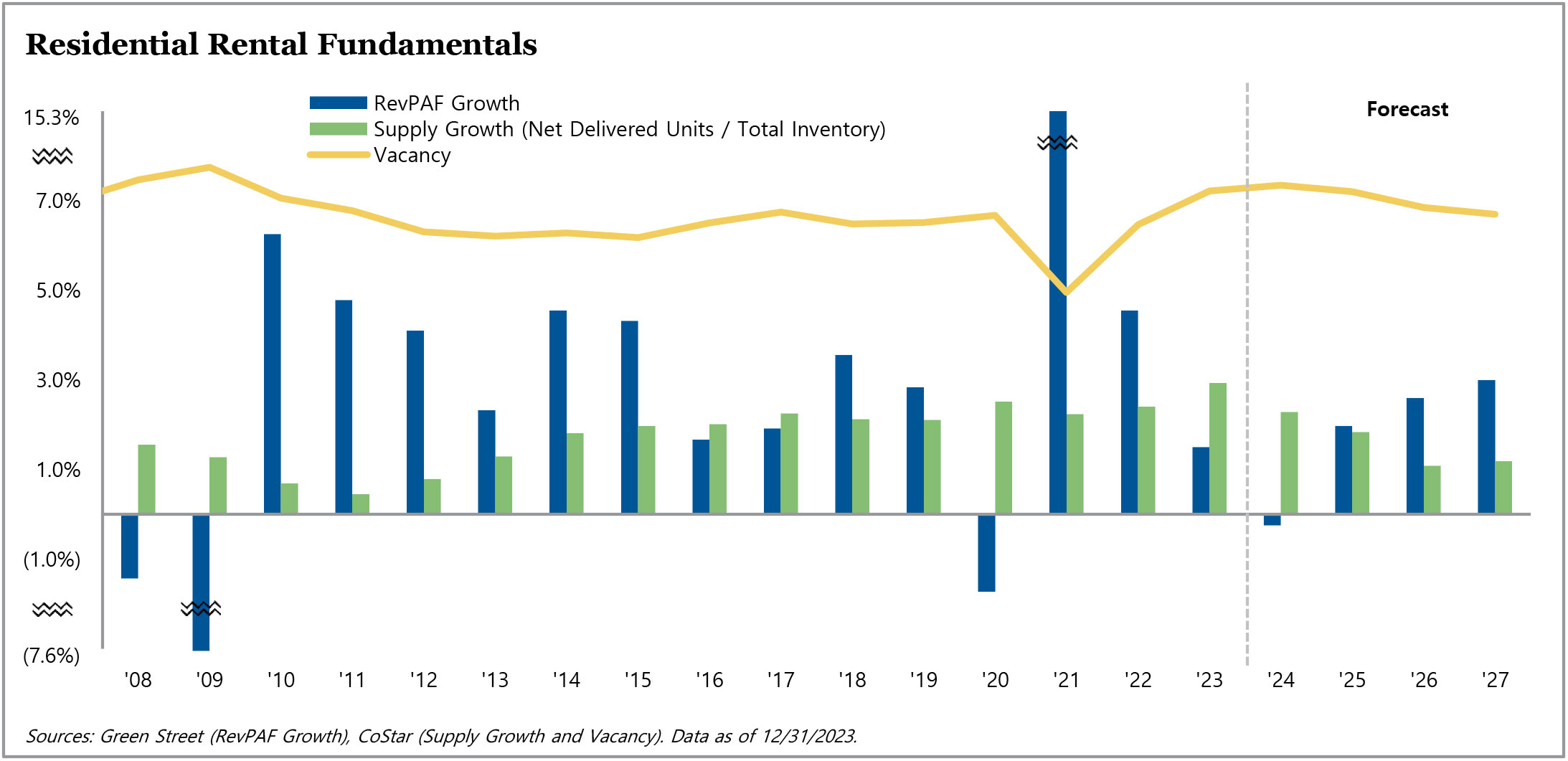

Rental residential has benefitted from necessity-based demand, increasing home ownership costs, and broad undersupply of housing since the GFC, but affordability, consumer headwinds, and elevated supply in certain markets may lead to softening.

Industrial fundamentals have remained relatively strong despite an uptick in supply growth and moderating demand levels compared to 2021 and 2022.

Office continues to struggle post-pandemic due to broad oversupply, limited leasing activity, and a lack of capital markets demand.

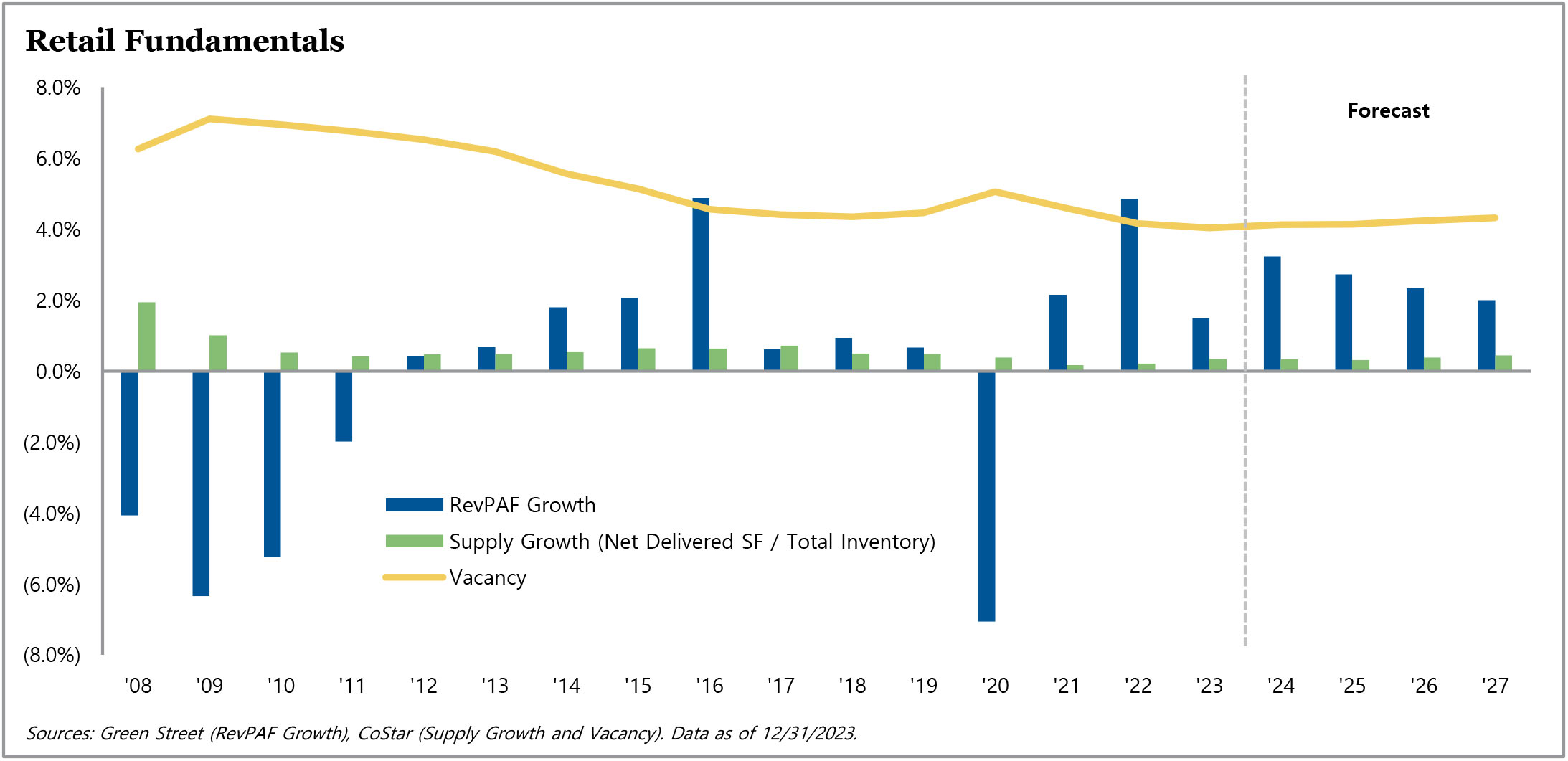

The retail sector has benefited from strong consumer demand, stable vacancy, and limited new supply, with necessity-oriented centers experiencing the strongest performance.