Europe Real Estate

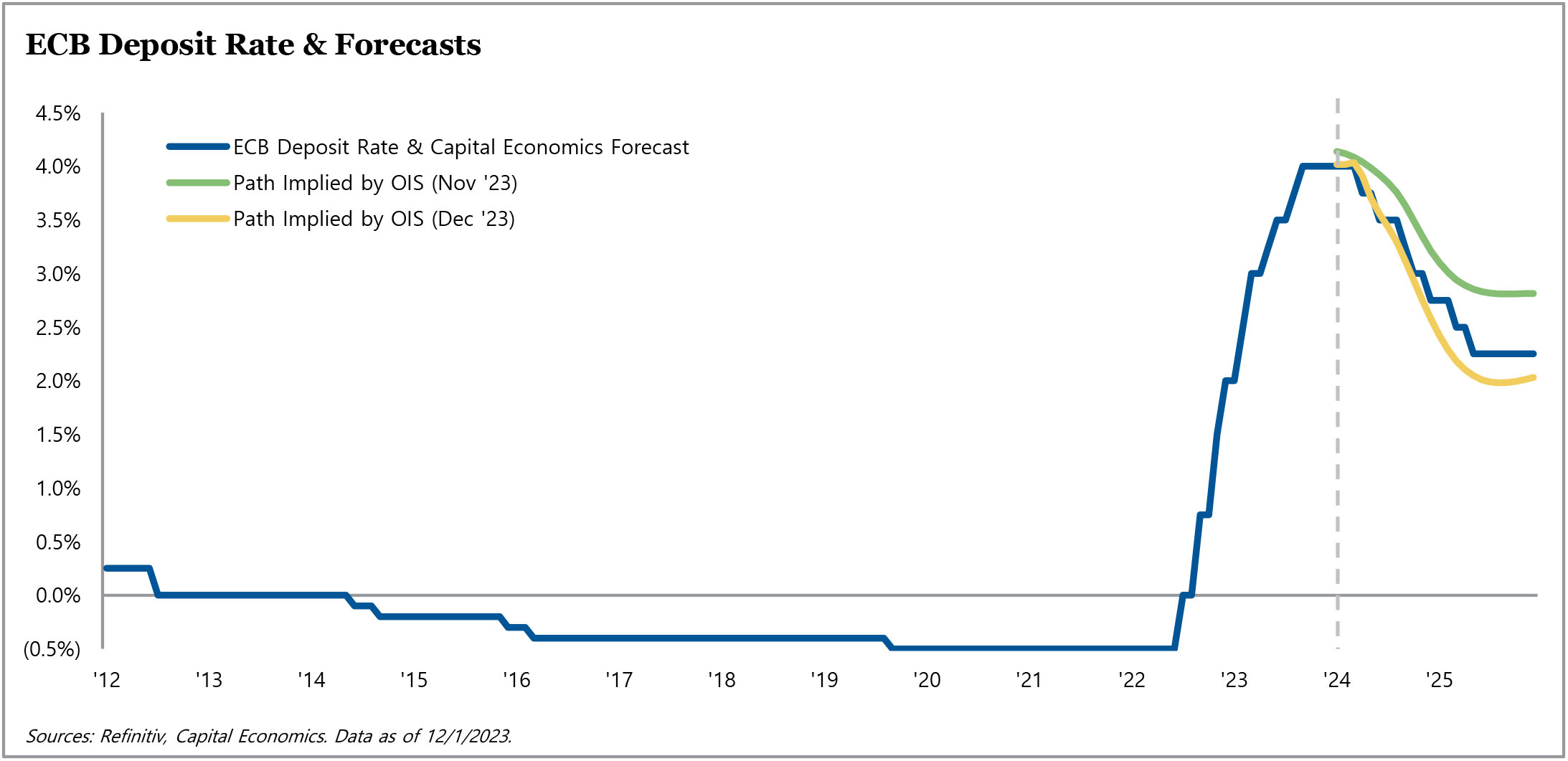

The effects of higher interest rates continue to impact European economies and expose distress in the real estate markets. Eurozone GDP stagnated in the fourth quarter and will probably remain flat for at least the first half of this year. Although headline inflation moved closer to the 2% target, the ECB held base rates at 4% in mid-December. With their updated expectations for inflation dropping to 2.7% this year, it is likely that the central bank will cut rates in 2024.

The effects of higher interest rates continue to impact European economies and expose distress in the real estate markets. Eurozone GDP stagnated in the fourth quarter and will probably remain flat for at least the first half of this year. Although headline inflation moved closer to the 2% target, the ECB held base rates at 4% in mid-December. With their updated expectations for inflation dropping to 2.7% this year, it is likely that the central bank will cut rates in 2024.

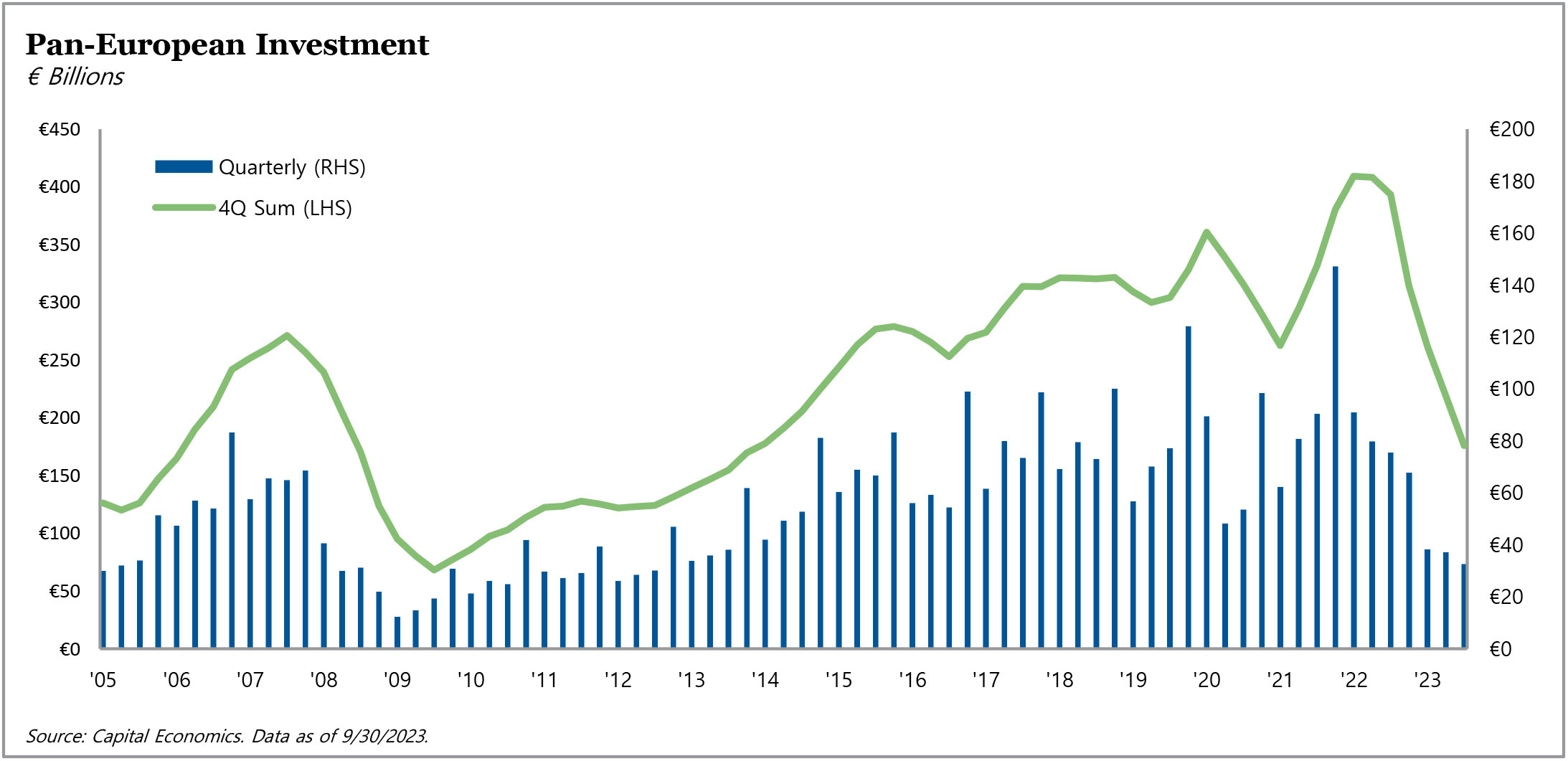

As interest rates have increased rapidly in an effort to bring down inflation, real estate owners have been faced with muted investment markets, difficult financing environments, and severe valuation corrections. Investment across the region dropped to €33 billion during the third quarter, and the four-quarter rolling total of €176 billion was down 55% year-over-year. Overall 2023 investment statistics are not yet available, but the full-year decline will likely be even more significant. Over the course of 2023, we saw major price drops across asset classes, and some additional decreases are expected in 2024, although less severe than last year.

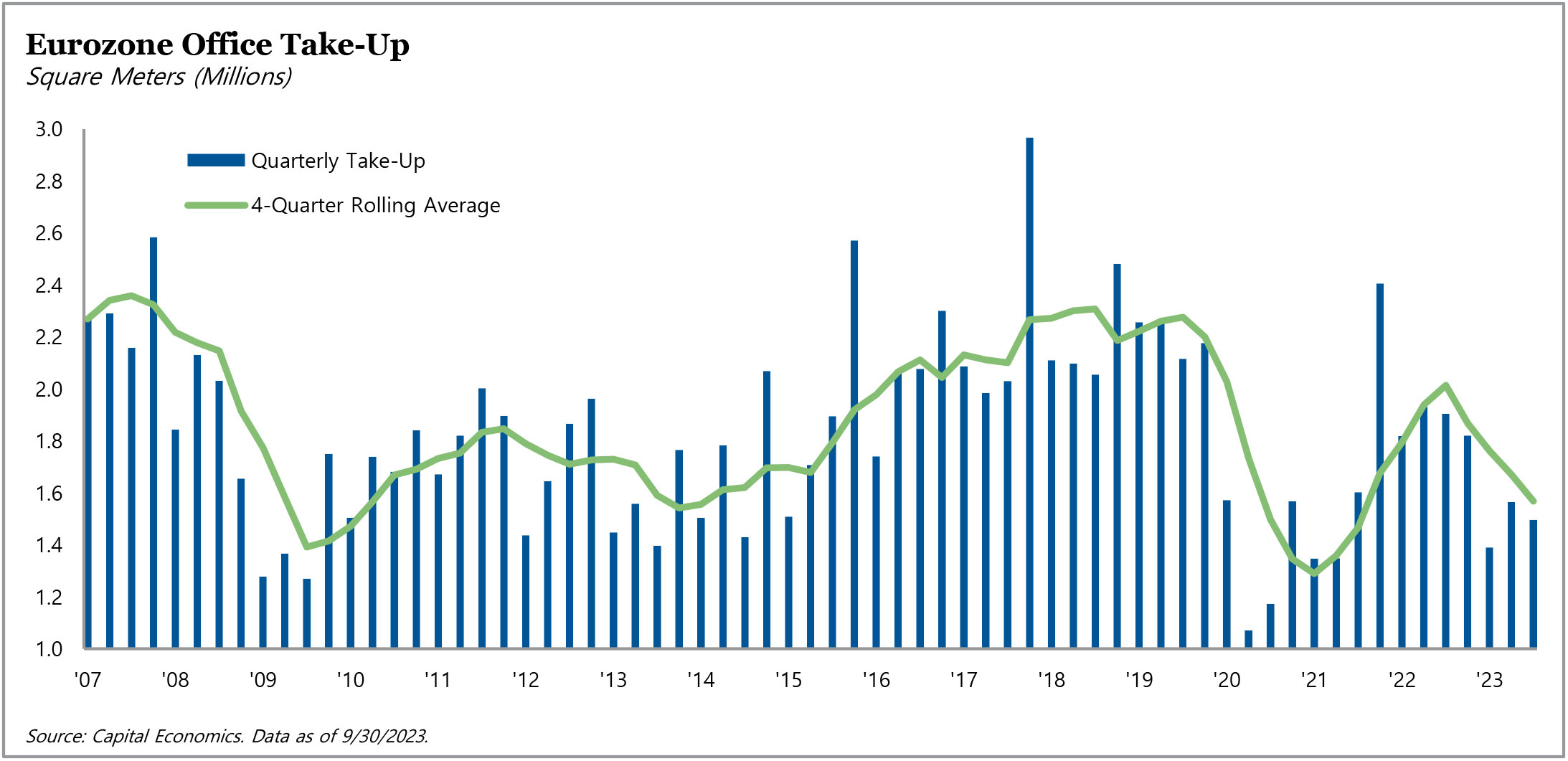

Occupier markets were also slow at the end of the year. European office take-up totaled 1.5 million square meters in the third quarter, 25% below the five-year third quarter average. Office vacancy inched up to circa 7% in the third quarter, and vacancy is expected to continue rising over the next few years. Annual rent growth for prime eurozone office reached 3.5% at the end of 2023, but that growth will likely slow this year as occupiers slow expansion.

Reflecting on 2023, it seemed as though the new environment ‘pulled back the curtain’ and revealed that some prominent investors were propped up by artificially low cap rates and strong occupational markets based on minimal supply rather than fundamental growth. While not surprising, these corrections have pushed many investors out of the market. As interest rates drop during 2024, there may be meaningful increased liquidity and activity in the real estate investment markets. However, with price drops still expected, owners will likely not be able to achieve recent peak prices. As a buyer, there will be significant opportunities to purchase high-quality assets for discounted prices.

For more information on TPG AG Europe Real Estate, visit angelogordon.com/strategies/real-estate/europe-real-estate/

Interest rate moves have been dramatic and fast. While market forecasts indicate an expected near-term reduction in volatility, absolute rate movement since the Q1 2022 low has been extreme.

Real estate investment volume has fallen dramatically since the onset of the pandemic in 2020, and there are property owners who will be forced to sell because of debt maturities, equity redemptions, or funds coming to final term.

Office leasing has been trending downward since the onset of the pandemic and now stands close to post-GFC levels. Prime rents are increasing, but overall volumes are extremely low.