Middle Market Direct Lending

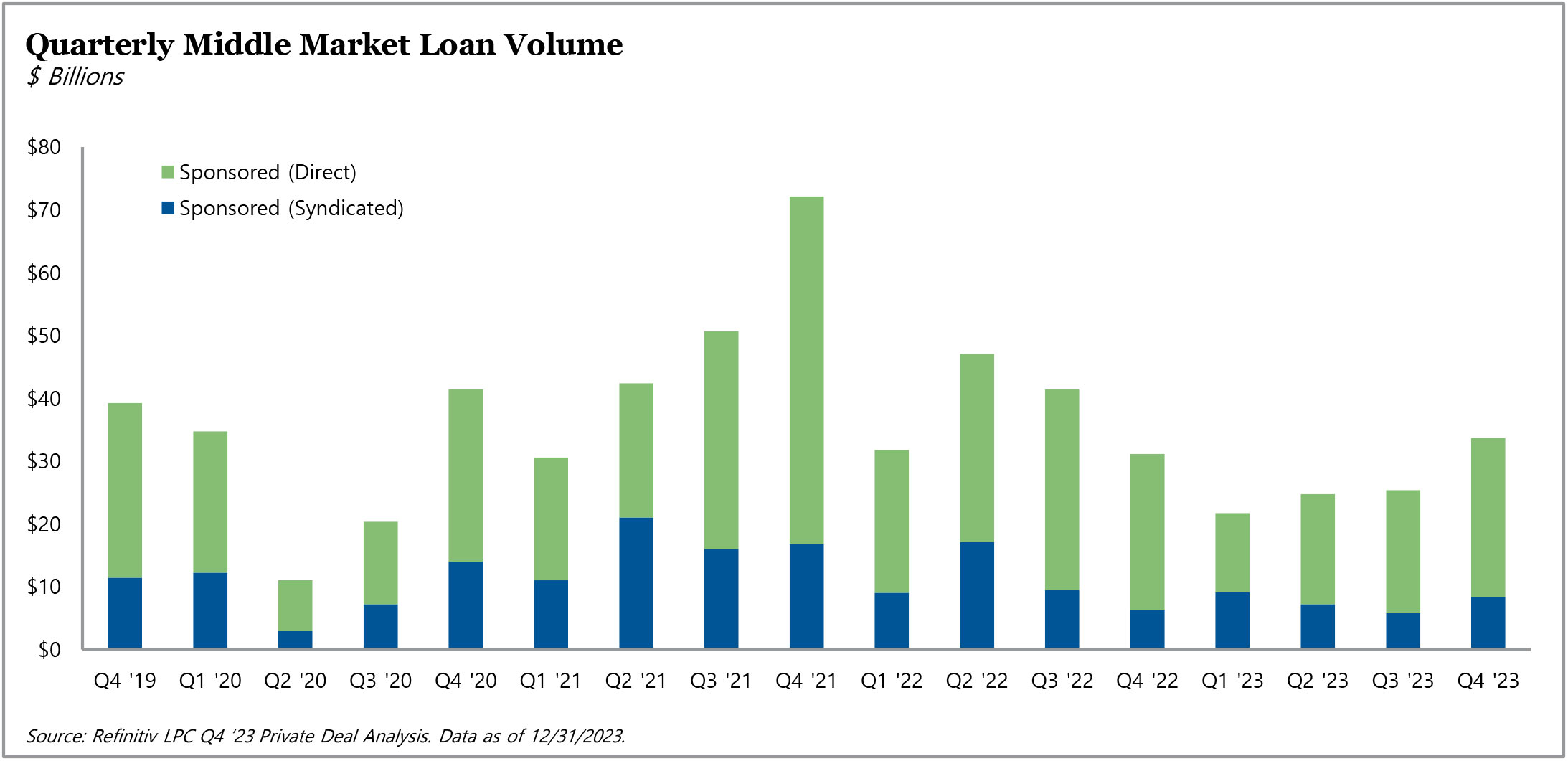

Total sponsored middle market volume, including direct and syndicated activity, amounted to $34 billion in the fourth quarter of 2023 – up 26% quarter-over-quarter and nearly 10% higher year-over-year. Private credit continued to be the preferred source of financing, with the ratio of direct lending to syndicated volume standing at 2.4x, and middle market direct lending M&A volume was the highest it has been since the fourth quarter of 2022. The increase in M&A lending was driven primarily by activity in the core and upper middle markets, but the lower middle market also experienced a 12% quarter-over-quarter increase in volume and has exhibited over 50% less volatility in quarterly volume over the course of 2023. Looking to activity by industry, business services and healthcare were the most active sectors during the quarter.

Total sponsored middle market volume, including direct and syndicated activity, amounted to $34 billion in the fourth quarter of 2023 – up 26% quarter-over-quarter and nearly 10% higher year-over-year. Private credit continued to be the preferred source of financing, with the ratio of direct lending to syndicated volume standing at 2.4x, and middle market direct lending M&A volume was the highest it has been since the fourth quarter of 2022. The increase in M&A lending was driven primarily by activity in the core and upper middle markets, but the lower middle market also experienced a 12% quarter-over-quarter increase in volume and has exhibited over 50% less volatility in quarterly volume over the course of 2023. Looking to activity by industry, business services and healthcare were the most active sectors during the quarter.

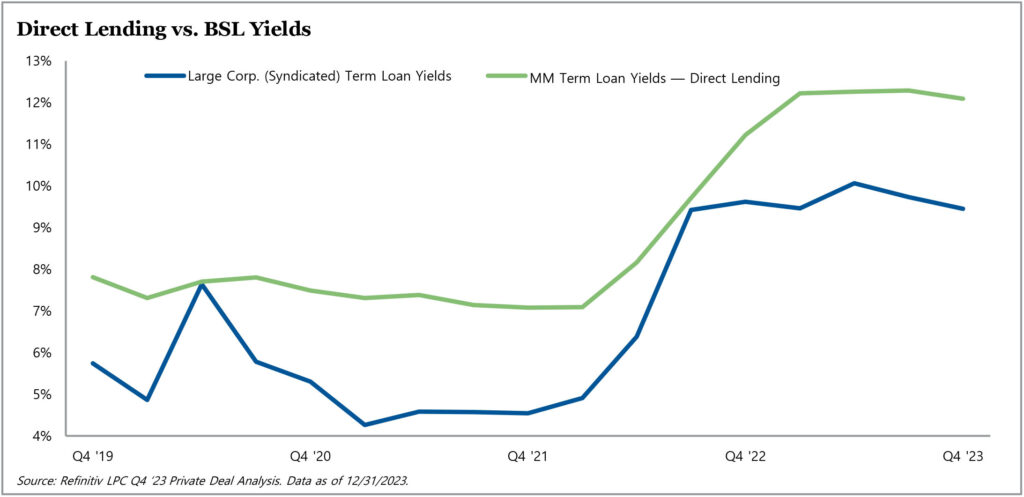

Terms for direct lender-led deals continued to be favorable during the fourth quarter, as evidenced by the increase in the yield premium for middle market deals over large corporate deals, which grew for the second consecutive quarter and ended the period at 265 basis points. All-in yields on first-lien term loans remained elevated, standing at over 12%, and yields were the highest for companies with EBITDA between $10-20 million, at 12.2%. The increase in all-in yields was driven by the lower and core middle markets, while the upper middle market experienced a slight decline. Spreads across the market moderated over the course of 2023, though the lower middle market experienced less pressure on spreads than the broadly syndicated loan market. At year-end, spreads for lower middle market loans averaged 620 basis points – down approximately 10 basis points since the start of the year – while broadly syndicated loan spreads stood at 410 basis points, down 75 basis points over the same period.

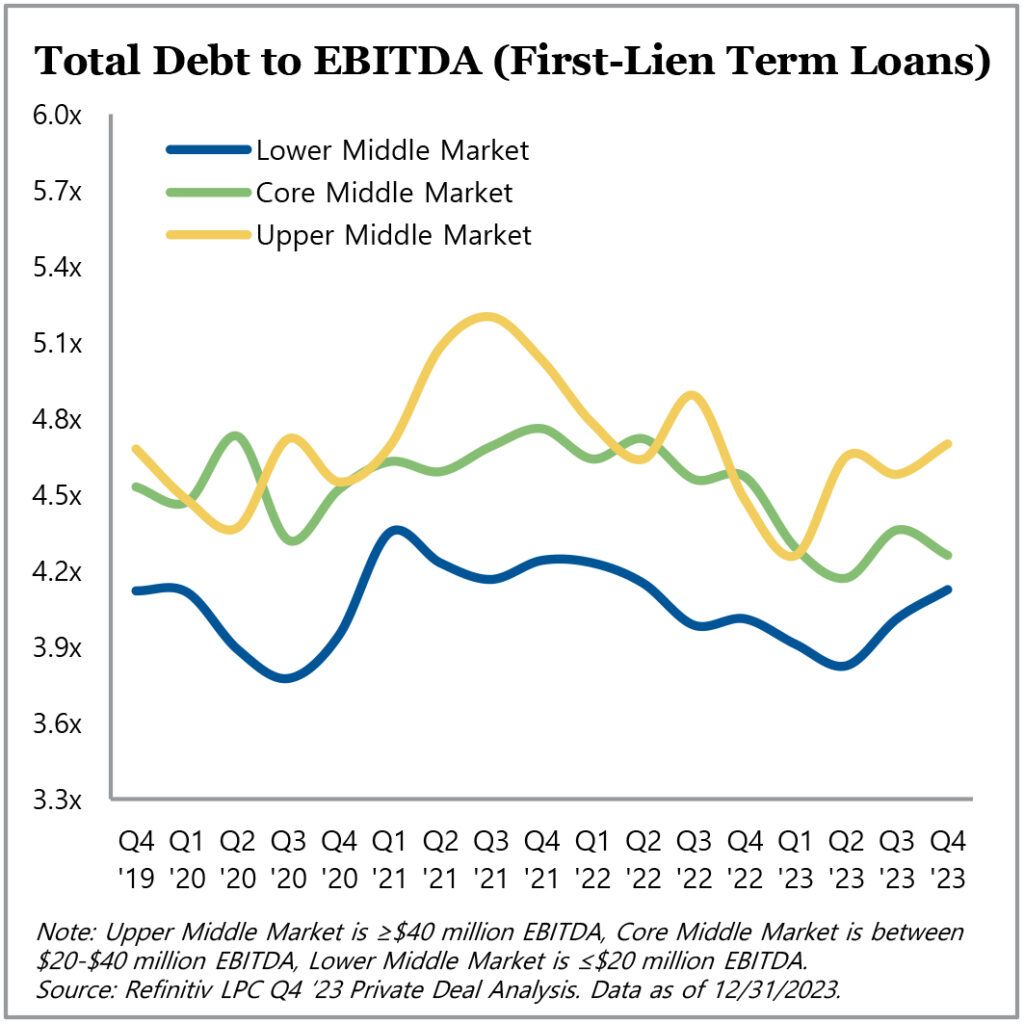

Direct lenders remained disciplined on leverage levels given the continued elevation of reference rates. Leverage for direct lending deals across the middle market declined quarter-over-quarter, while leverage for syndicated deals increased to the highest level recorded since the second quarter of 2022. Leverage was the lowest for companies with EBITDA between $10-20 million and the highest for companies with EBITDA above $40 million. Despite concerns that borrowers are facing challenges due to sustained higher interest costs, interest coverage ratios remained flat quarter-over-quarter, around 2.0x. Although at the low end of the historical “comfort zone” for lenders – which ranged from 2.0x to 3.0x – stable interest coverage ratios imply that companies are managing the elevated rate environment well, by passing through and/or cutting costs.

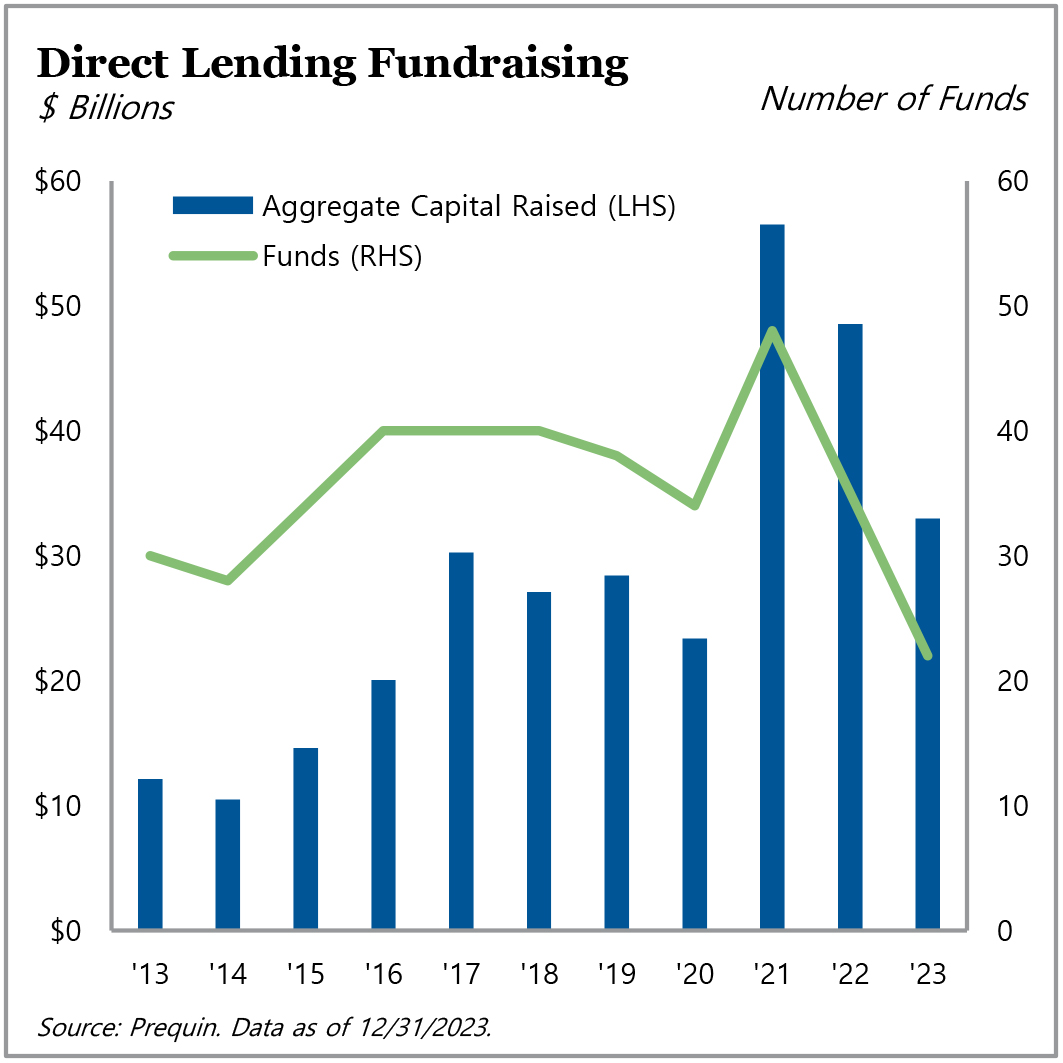

Fundraising activity in the U.S. direct lending market was nearly 35% lower year-over-year in 2023. However, according to Preqin data, the average fund size set a record for the second consecutive year, at nearly $1.6 billion; this dynamic implies that interest in the asset class and in partnering with fewer managers persists. Furthermore, with direct lending dry powder remaining elevated at nearly $210 billion, lenders are generally optimistic for an active 2024.

For more information on TPG AG Middle Market Direct Lending, visit angelogordon.com/credit/middle-market-direct-lending/

U.S. sponsored middle market loan volume totaled $34 billion in Q4 2023, representing an increase quarter-over-quarter and year-over-year.

The direct lender yield premium over large corporate deals increased to over 260 basis points in Q4 2023.

Total leverage remained relatively flat across the middle market and was most conservative in the lower middle market.

Fundraising in the U.S. direct lending market exceeded $30 billion in 2023, and average fund size hit a record for the second consecutive year.