Leveraged Loans

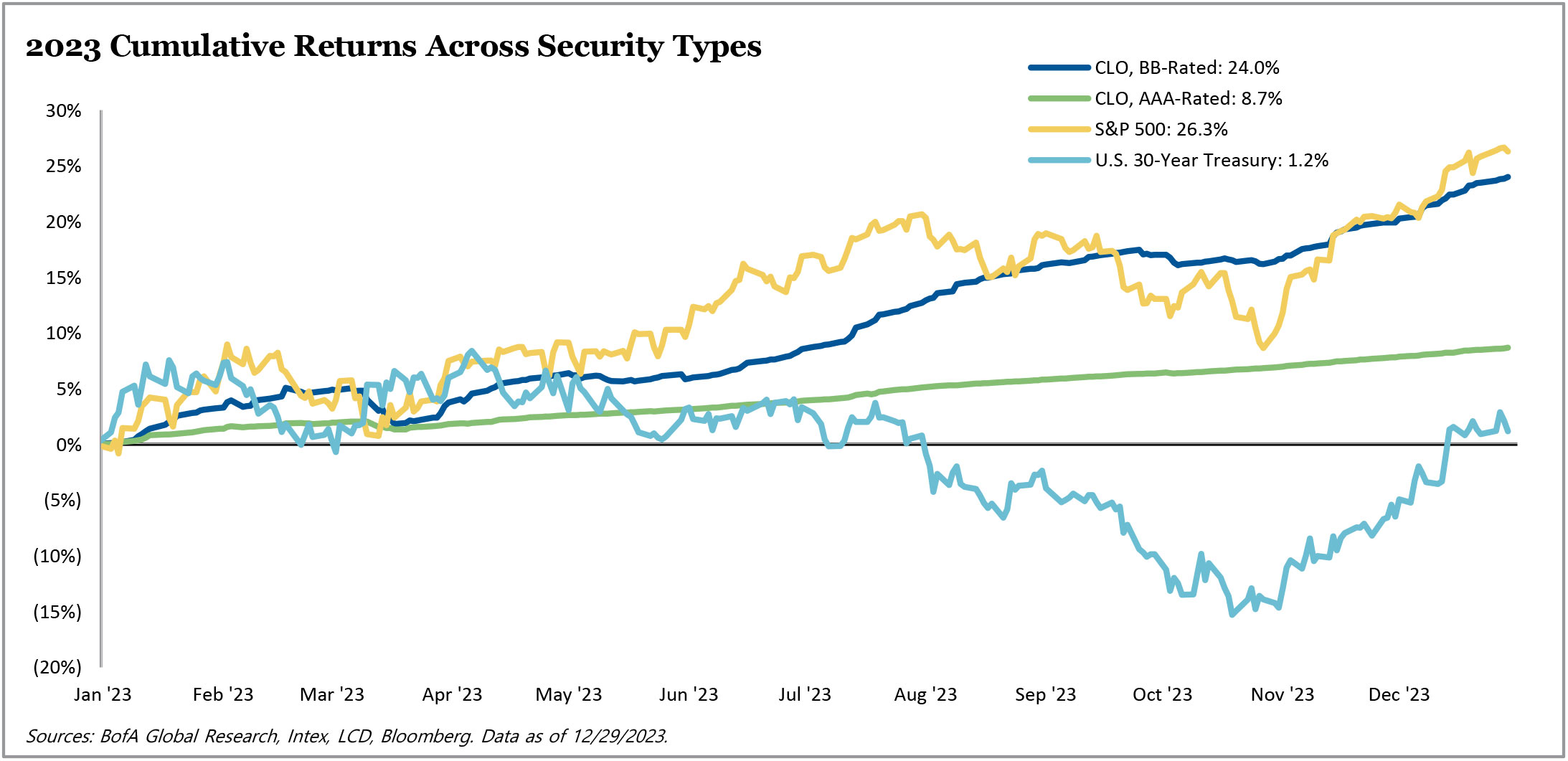

Leveraged loan performance remained strong in the fourth quarter of 2023. The J.P. Morgan U.S. Leveraged Loan Index posted a 2.79% return, ending the quarter with a yield of 8.6% and spread of 500 basis points. As of the end of December, the J.P. Morgan U.S. Leveraged Loan Index recorded a 13.17% full-year gain, slightly underperforming high yield and outperforming investment grade, which recorded full-year returns of 13.51% and 7.96%, respectively. In Europe, the J.P. Morgan European Leveraged Loan Index posted a 1.74% quarterly return, ending the fourth quarter with a spread of 542 basis points and yield of 7.96%. On a full-year basis, the J.P. Morgan European Leveraged Loan Index returned 13.56%. Additionally, BB-rated CLO tranches were among the best performers in the asset class in 2023, with a full-year return of 24.0% – just shy of the 26.26% annual gain for the S&P 500.

Leveraged loan performance remained strong in the fourth quarter of 2023. The J.P. Morgan U.S. Leveraged Loan Index posted a 2.79% return, ending the quarter with a yield of 8.6% and spread of 500 basis points. As of the end of December, the J.P. Morgan U.S. Leveraged Loan Index recorded a 13.17% full-year gain, slightly underperforming high yield and outperforming investment grade, which recorded full-year returns of 13.51% and 7.96%, respectively. In Europe, the J.P. Morgan European Leveraged Loan Index posted a 1.74% quarterly return, ending the fourth quarter with a spread of 542 basis points and yield of 7.96%. On a full-year basis, the J.P. Morgan European Leveraged Loan Index returned 13.56%. Additionally, BB-rated CLO tranches were among the best performers in the asset class in 2023, with a full-year return of 24.0% – just shy of the 26.26% annual gain for the S&P 500.

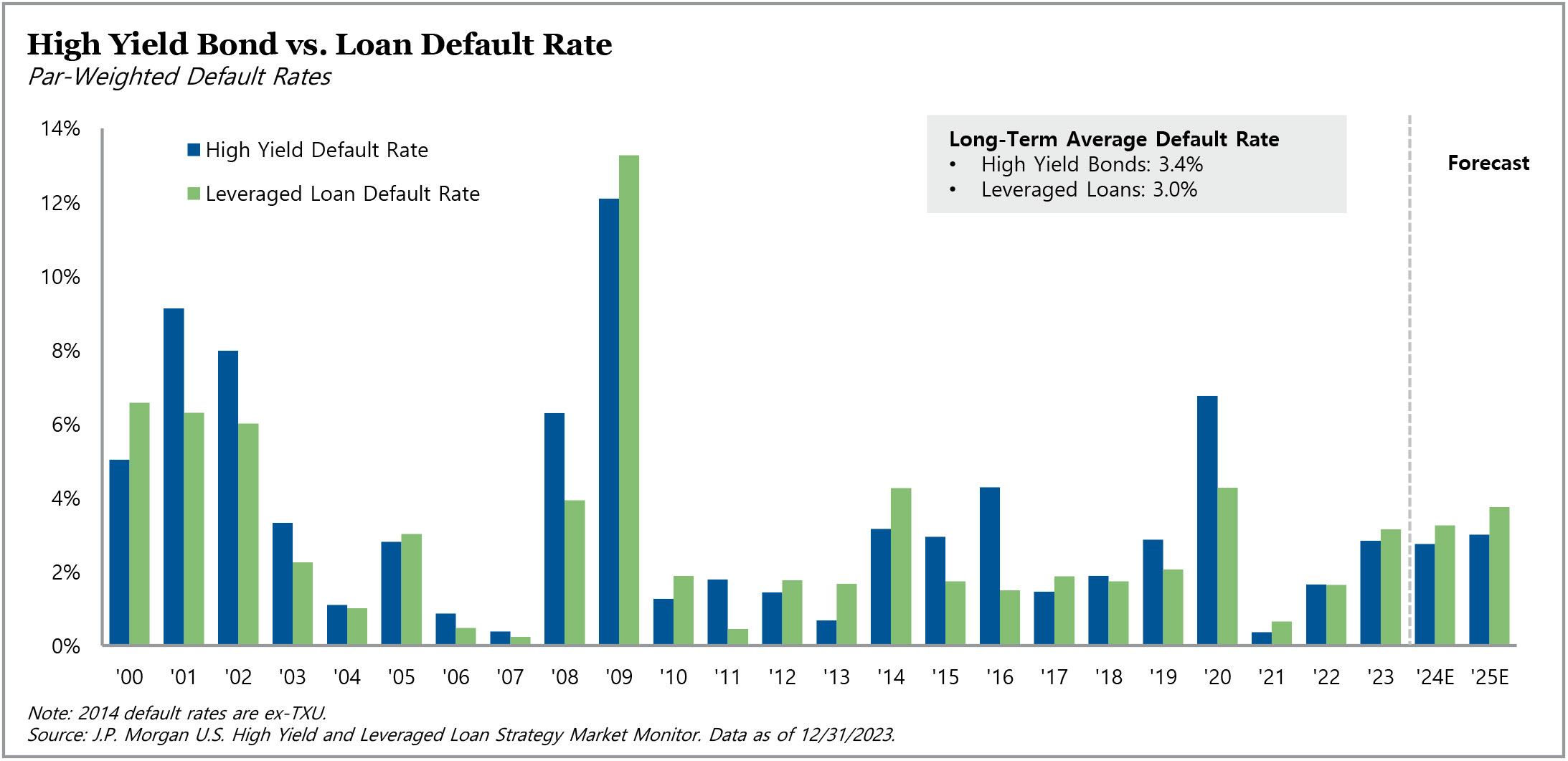

Market participants spent much of 2023 discussing a potential wave of defaults, as the rapid increase in interest rates put persistent pressure on leveraged issuers’ cash flows. Against this backdrop, the default rate for leveraged loans was 3.15% in the U.S. as of the end of the fourth quarter – a manageable rate for most diversified loan investors. Looking ahead, J.P. Morgan is forecasting that the U.S. loan default rate will rise to 3.25% in 2024, hovering above the long-term average of 3.0%.

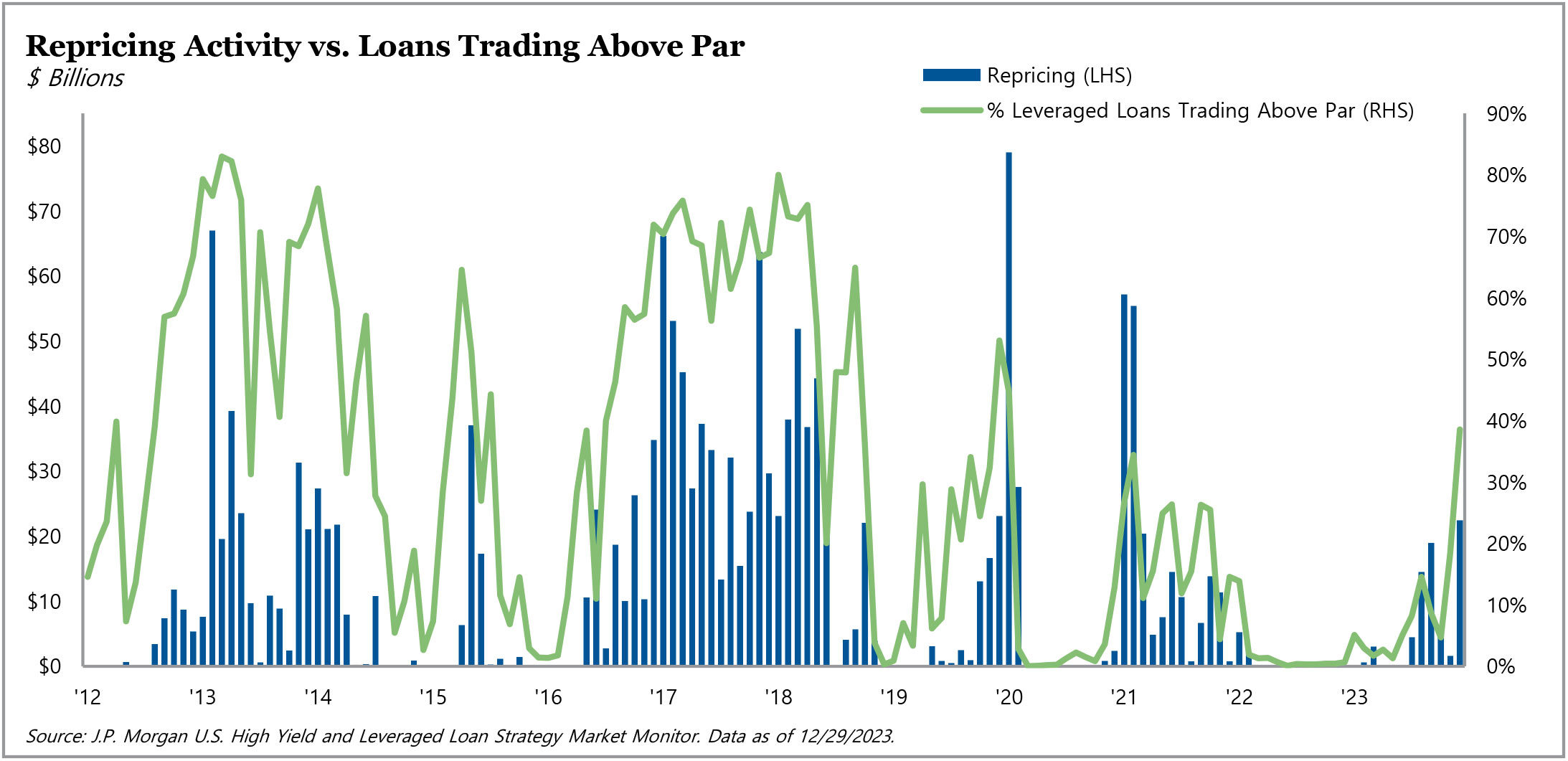

Turning to supply, gross U.S. institutional loan issuance – including refinancing activity – totaled $113 billion in the fourth quarter and $370.1 billion in full year 2023. Notably, December saw $52.5 billion in gross new issuance, 84% of which was attributable to refinancing on the back of rapidly falling yields. Looking ahead, we expect a wave of loan refinancings will occur in 2024, as nearly 40% of the leveraged loan index now trades above par. Consensus suggests issuance volume will be higher this year, driven by refinancings.

From a demand perspective, CLOs comprise roughly two-thirds of overall leveraged loan ownership, and leveraged loan issuance totaled $139.3 billion in 2023. Interestingly, private credit CLOs have historically made up 10% of total annual leveraged loan issuance, but in 2023, they accounted for 24% of total issuance. We view private credit as another source of funding for leveraged debt issuers and believe it will have a role to play in the broadly syndicated loan (BSL) market moving forward.

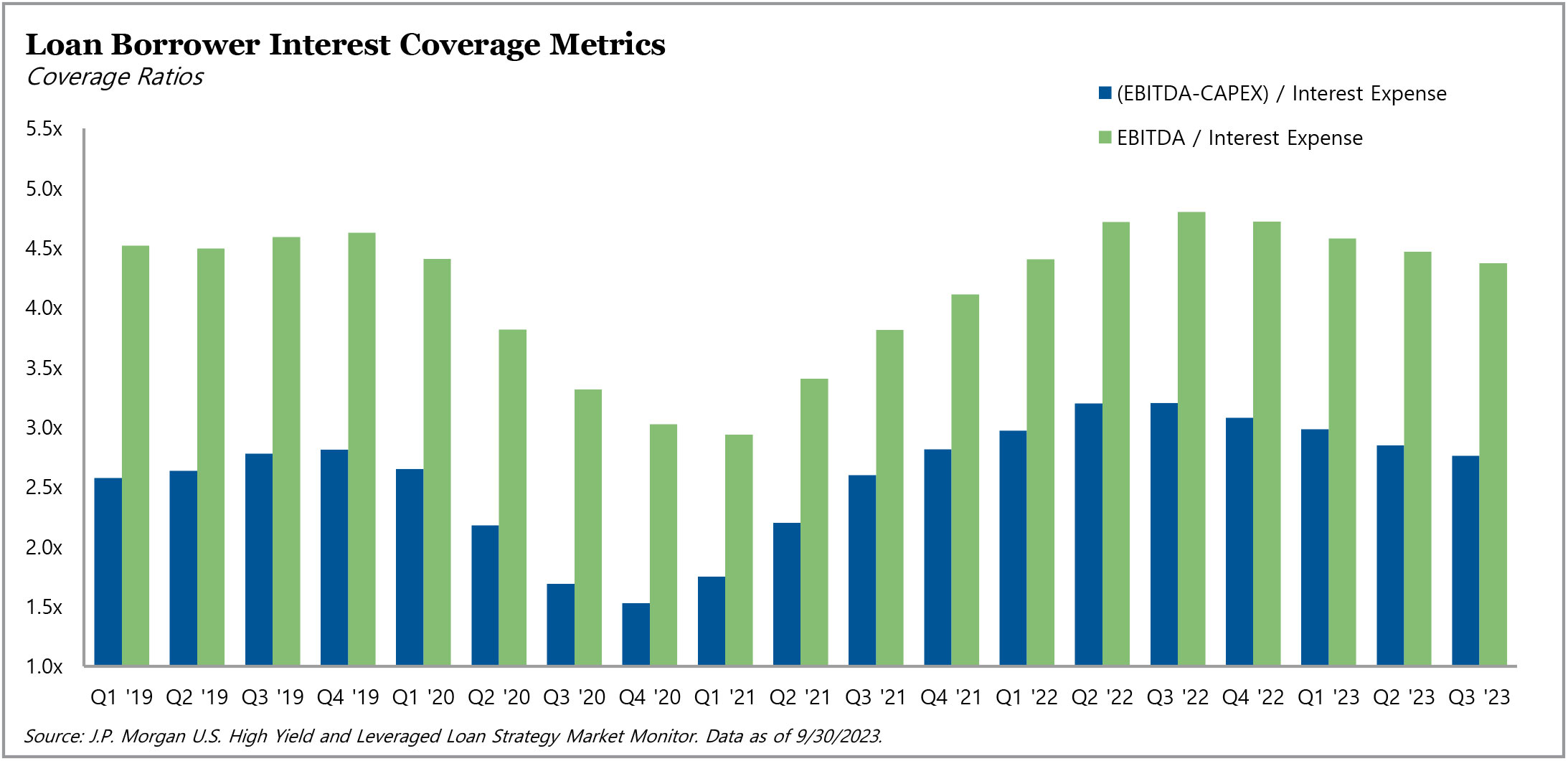

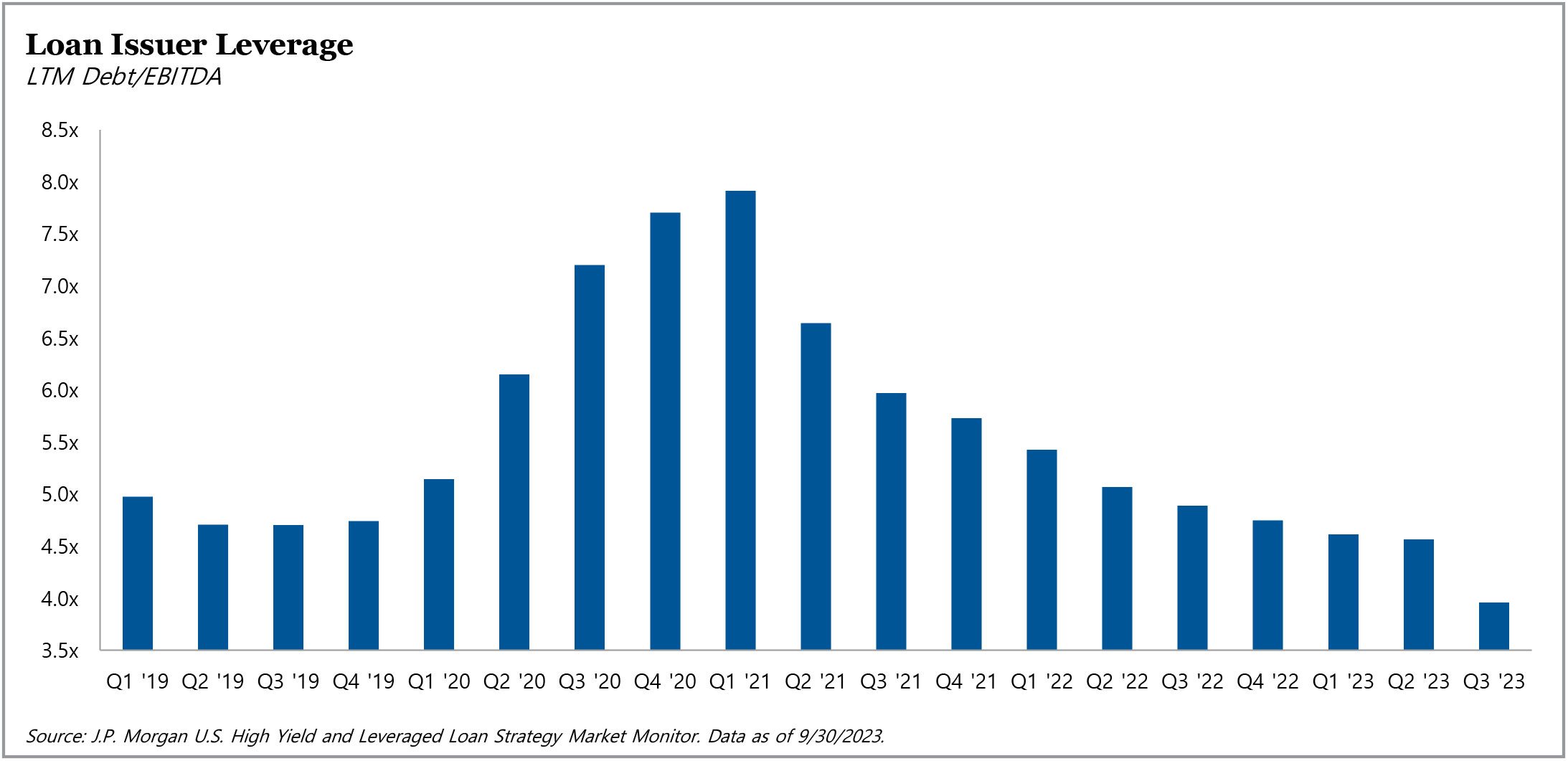

Looking back, fundamentals as of the end of the third quarter of 2023 were mixed, but we believe they were weakening off a strong base. Looking ahead, we expect market participants will remain focused on monitoring corporate issuers’ margins and access to liquidity.

For more information on TPG AG CLOs, visit angelogordon.com/strategies/credit/clo/

2023 was a ‘Goldilocks’ year for CLO liabilities, as the full-year return for BB-rated CLO tranches was just shy of that for equities, but with far less volatility. Looking ahead, technicals suggest it may be another strong year for the liability stack.

As prices rallied in December, a larger percentage of loans traded above par, triggering a wave of refinancings.

Borrowers’ coverage metrics continue to reflect the impact of rising interest rates and are expected to continue to erode over the coming quarters.

Leverage for loan issuers is at a four-year low, albeit comfortably above the average among high yield issuers.

We continue to expect default rates for leveraged loans to rise in 2024.