Structured Credit

RMBS

RMBS spreads mostly tightened during the fourth quarter, capping a positive year overall. Credit risk transfer (CRT) tranches were tighter by up to 50 basis points, with tranches at or near investment grade tightening most in the fourth quarter. For the full year 2023, CRT posted impressive gains, particularly for deep-credit tranches, which were as much as 500 basis points tighter, while the middle was around 300 basis points tighter. Senior non-qualified mortgage (NQM) spreads were around 20 basis points tighter during the quarter, while BBB-rated NQM were wider depending on the profile. The NQM sector finished the year tighter but still remains wide of February 2022 levels, which we think suggests ample runway for additional upside potential. Year-to-date total returns were between 13% and 22% for mezzanine and subordinate CRT tranches, respectively, and around 6% to 7% for legacy RMBS.

RMBS spreads mostly tightened during the fourth quarter, capping a positive year overall. Credit risk transfer (CRT) tranches were tighter by up to 50 basis points, with tranches at or near investment grade tightening most in the fourth quarter. For the full year 2023, CRT posted impressive gains, particularly for deep-credit tranches, which were as much as 500 basis points tighter, while the middle was around 300 basis points tighter. Senior non-qualified mortgage (NQM) spreads were around 20 basis points tighter during the quarter, while BBB-rated NQM were wider depending on the profile. The NQM sector finished the year tighter but still remains wide of February 2022 levels, which we think suggests ample runway for additional upside potential. Year-to-date total returns were between 13% and 22% for mezzanine and subordinate CRT tranches, respectively, and around 6% to 7% for legacy RMBS.

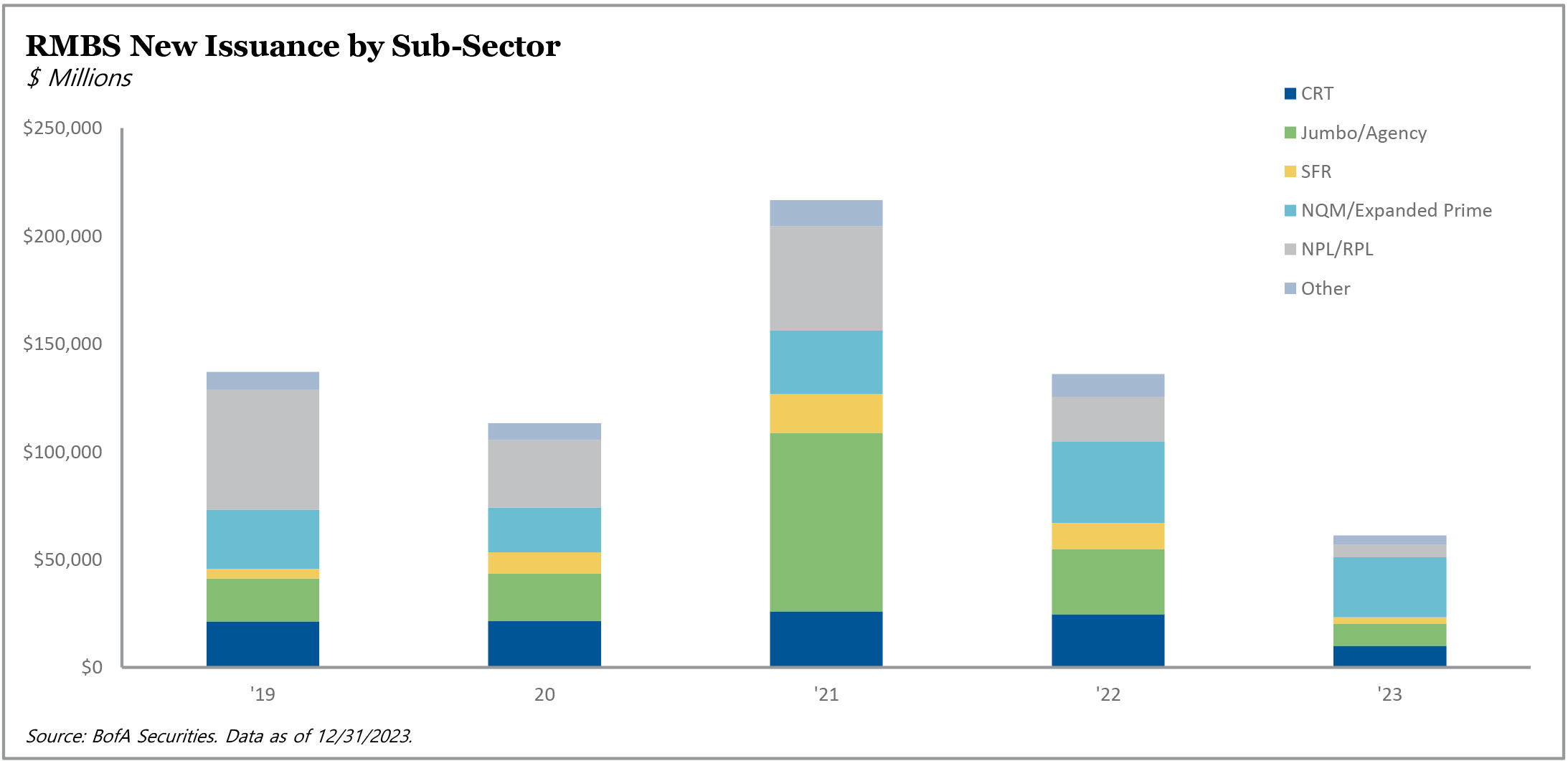

At $16 billion, fourth quarter RMBS issuance was in line with the prior two quarters. Issuance for all of 2023 underwhelmed, however, totaling only $65 billion – roughly half of the almost $137 billion recorded in 2022, making it the slowest year since 2016. Issuance of nearly every type of RMBS fell, in most cases sharply, except for the second lien/HELOC sector, which is still in its infancy. Issuance of benchmark CRT fell 60% to $8.3 billion amid lighter origination volumes and a shift away from high-cost subordinate tranches by issuers. Non-QM was the most active sector, posting $28 billion with a relatively modest 25% year-over-year decline in issuance. Sell-side analysts predict full-year 2024 issuance will be $65 to $90 billion, higher than 2023 but still down from $127 billion in 2022 and $213 billion in 2021.

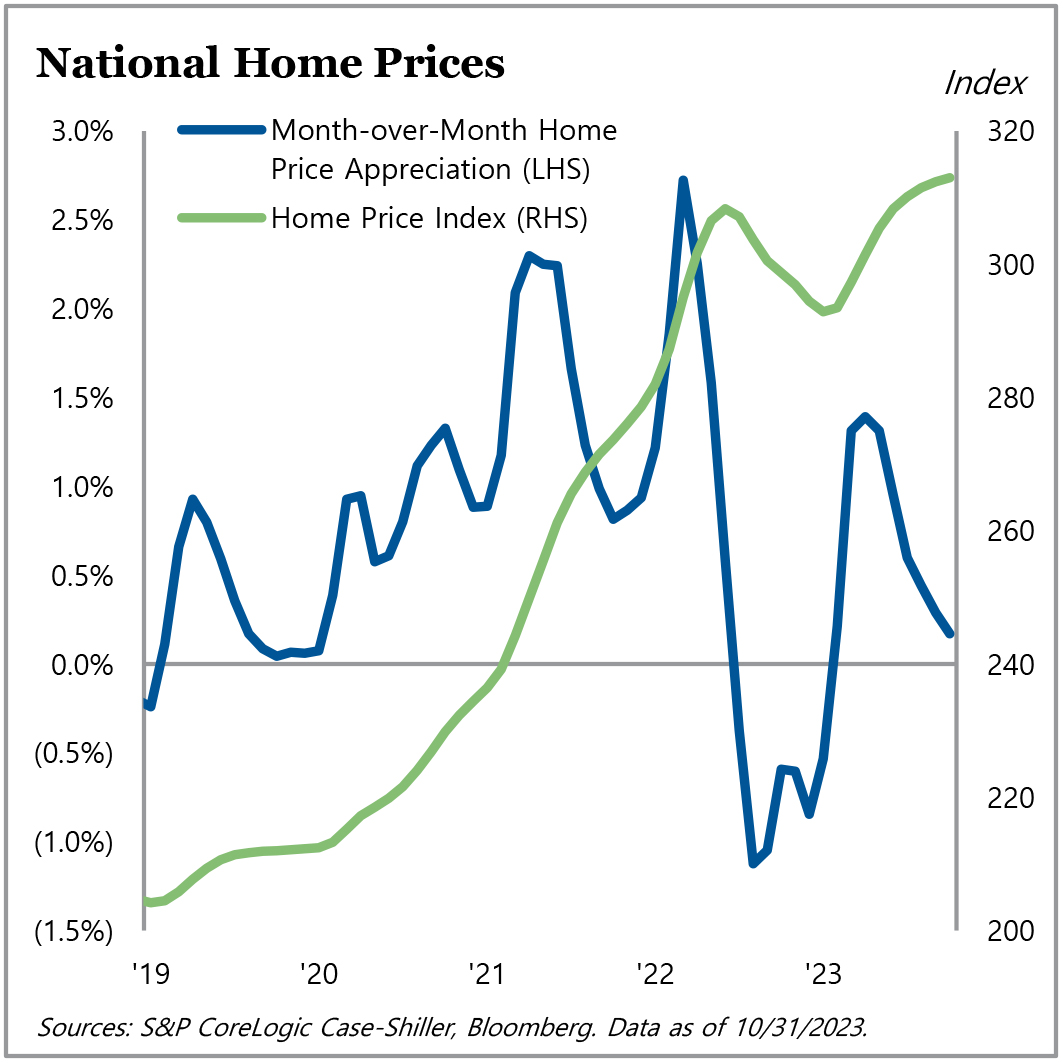

Home prices continued to rise, with the S&P CoreLogic Case-Shiller U.S. National Home Price Index up 6.3% through October 2023 and now exceeding the prior peak in June 2022 by 1.5%. A survey of research shows varied home price expectations in 2024, ranging from -5% to +4%. Our underwriting continues to be conservative and includes a 10% peak-to-trough decline in home prices before gradually returning to a longer-term rate of +3%.

Prevailing mortgage rates were considerably lower over the final two months of the year, falling to 6.4% after reaching 7.8% at the end of October – the highest level since 2000. Nationally, the average effective mortgage rate was 3.7% as of September. Current rates thus leave the well-publicized “lock-in effect” in force, albeit weakened modestly.

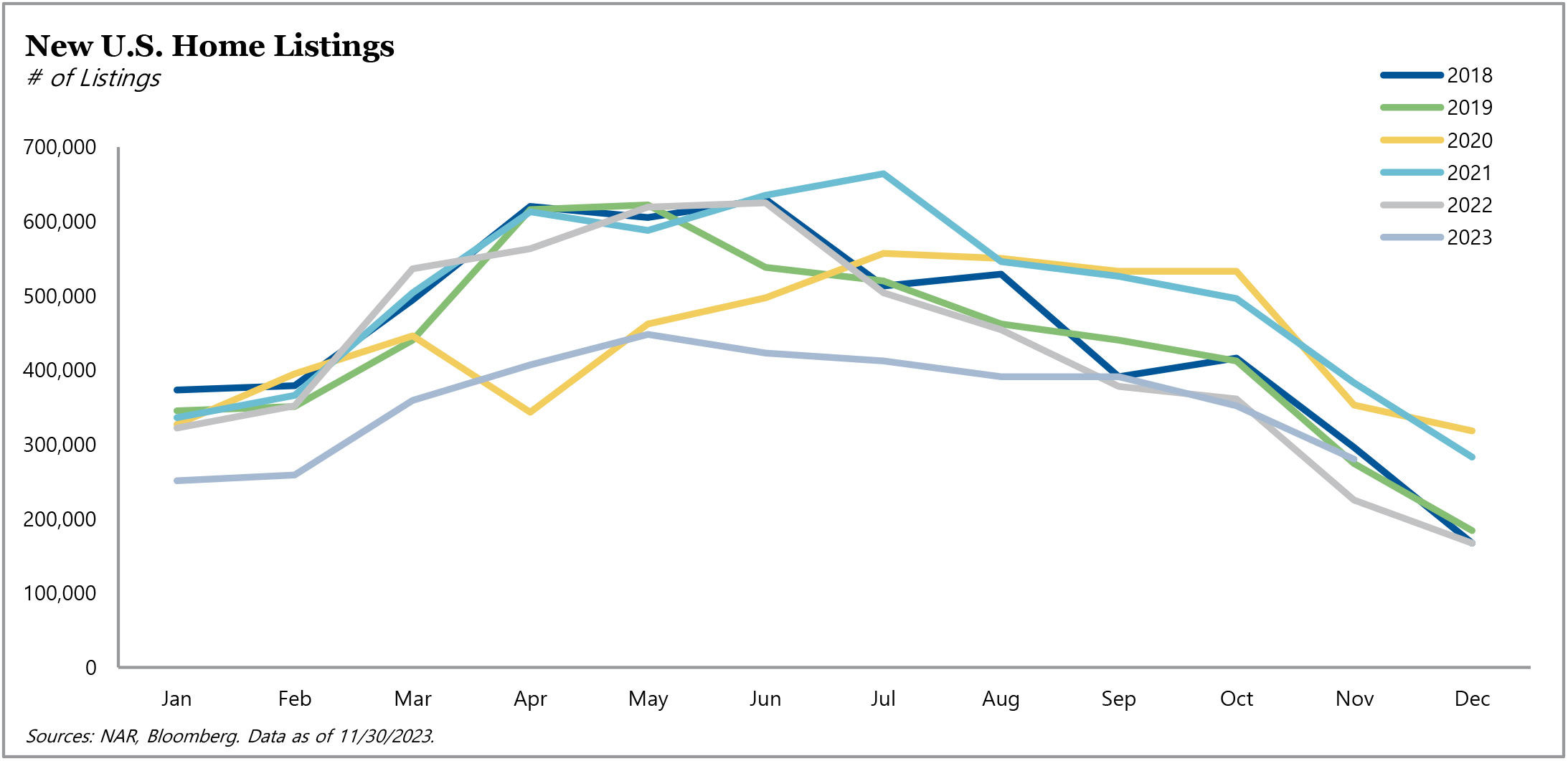

Total existing home listings were 1.13 million in November, in line with most of 2023 but down significantly from pre-pandemic years. New listings totaled 3.96 million year-to-date through November 2023, which was almost 1.7 million units less than the same period in 2021.

Muted housing activity has limited RMBS new issuance.

Home prices continued to set new record highs.

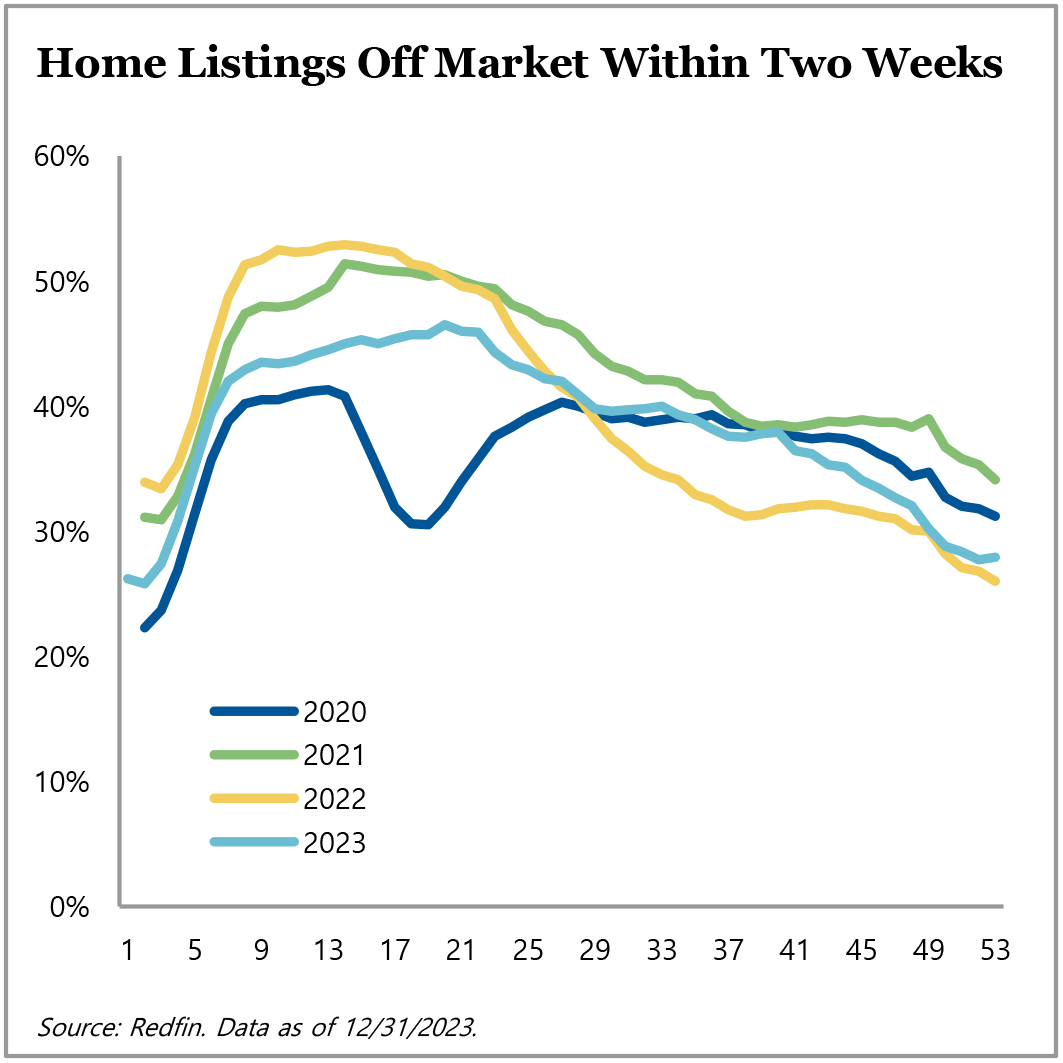

The percentage of listings going off market within two weeks seasonally declined.

Through November, new listings in 2023 were sharply lower.

ABS

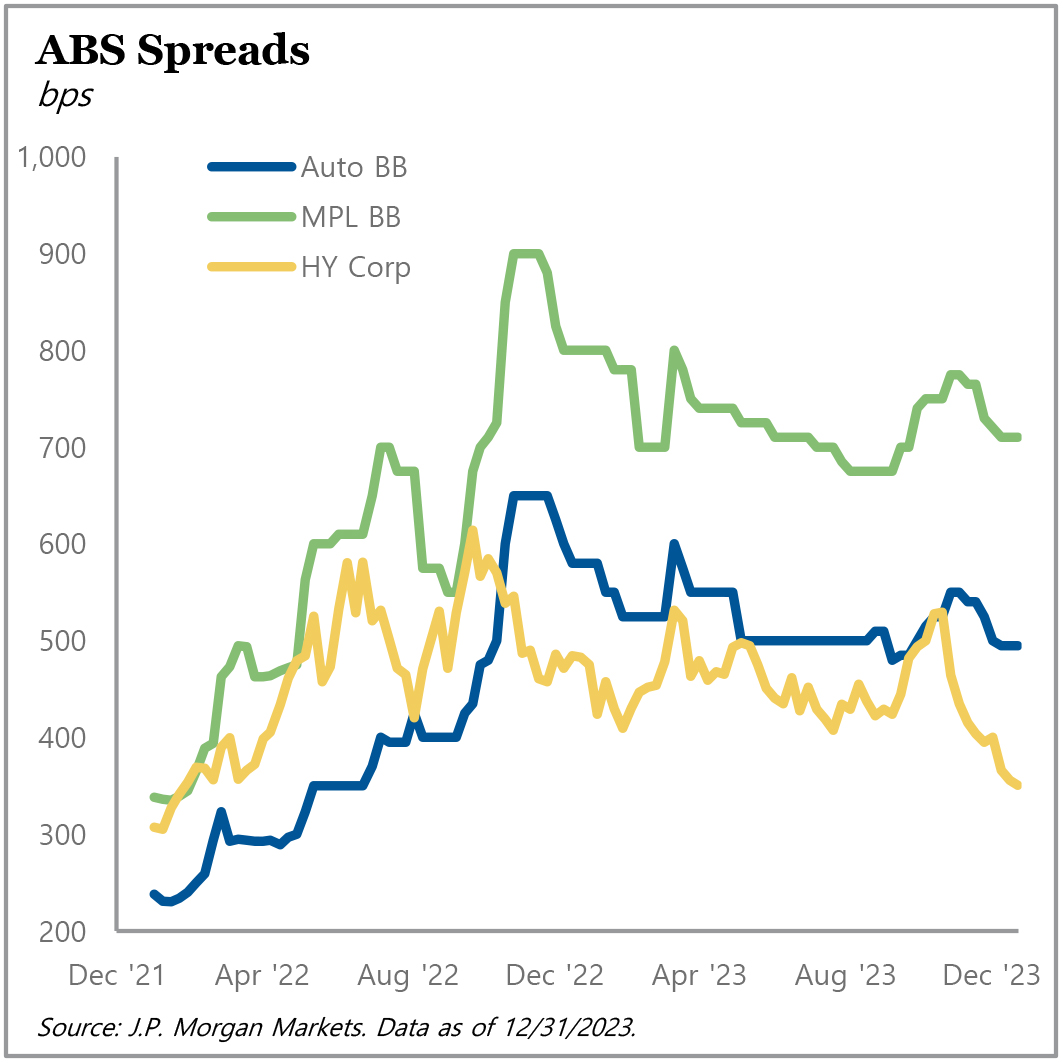

ABS spreads were mostly tighter during the fourth quarter, with benchmark ABS sectors like student loans and credit cards mostly 5-10 basis points tighter and other pockets of ABS up to 20 basis points tighter. The exception to the tightening was subordinate subprime auto ABS, which widened 10-25 basis points on weaker fundamentals and unfavorable headlines. For the year, however, ABS sectors were very mixed. Subprime autos saw the most tightening among benchmark sectors, around 125 basis points for BBB profiles and 20-30 basis points for other investment grade tranches, while credit cards were up to 70-80 basis points wider. Overall, aircraft led the year, tightening by 215 basis points while other esoteric assets were up to 40-60 basis points tighter. ABS spreads generally remain wide of February 2022 levels, with BB-rated auto and consumer loan spreads 200-300 basis points wider, for example.

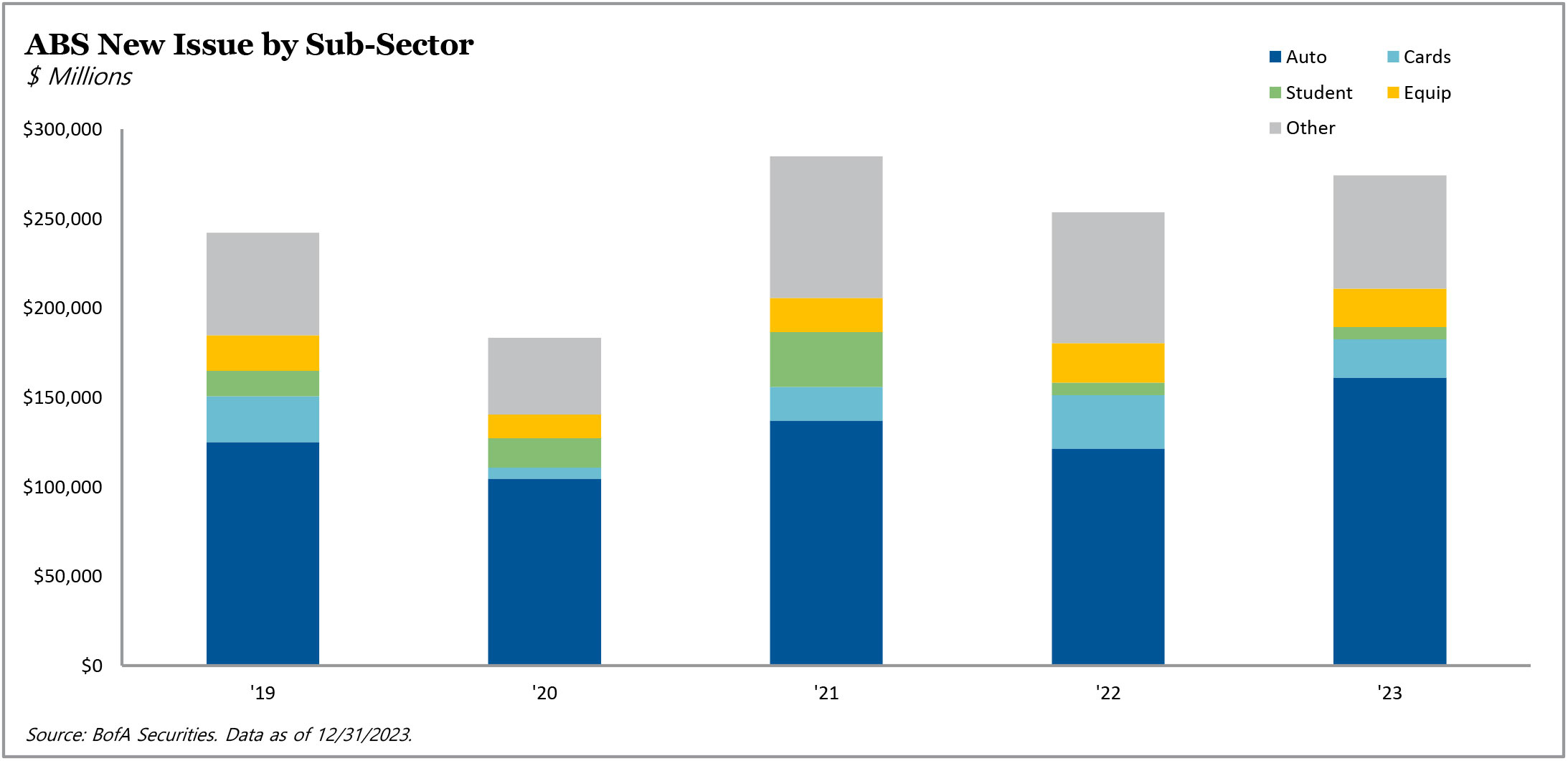

Primary issuance activity totaled $59 billion in the quarter, around 23% lower than the third quarter on less auto and esoteric ABS issuance. For the year, asset-backed markets fared better than residential, rising 8% to $274 billion on a sharp rise in auto ABS volumes. Issuance for autos rose almost $40 billion to $161 billion, more than offsetting lower esoteric ABS and credit card volumes. Student loan and equipment volumes changed little over the year.

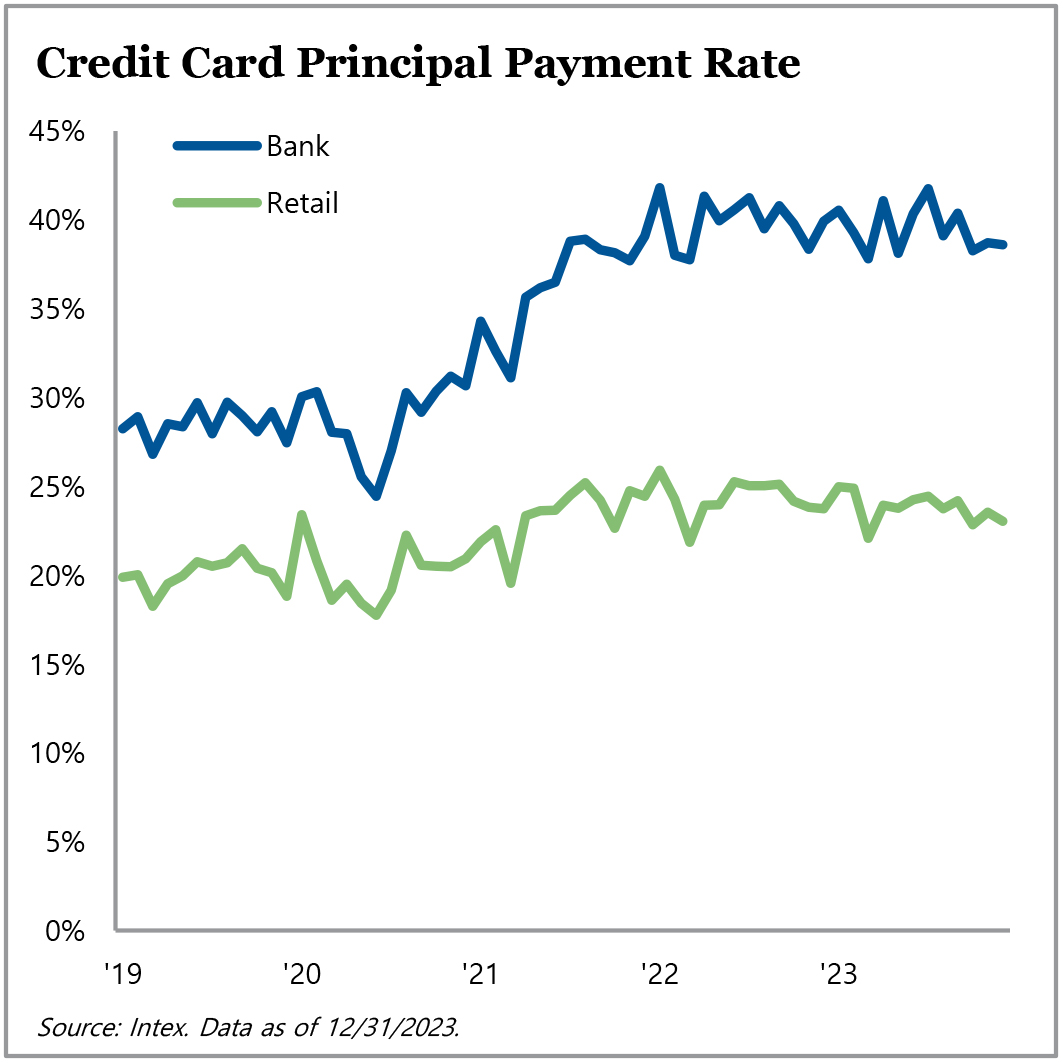

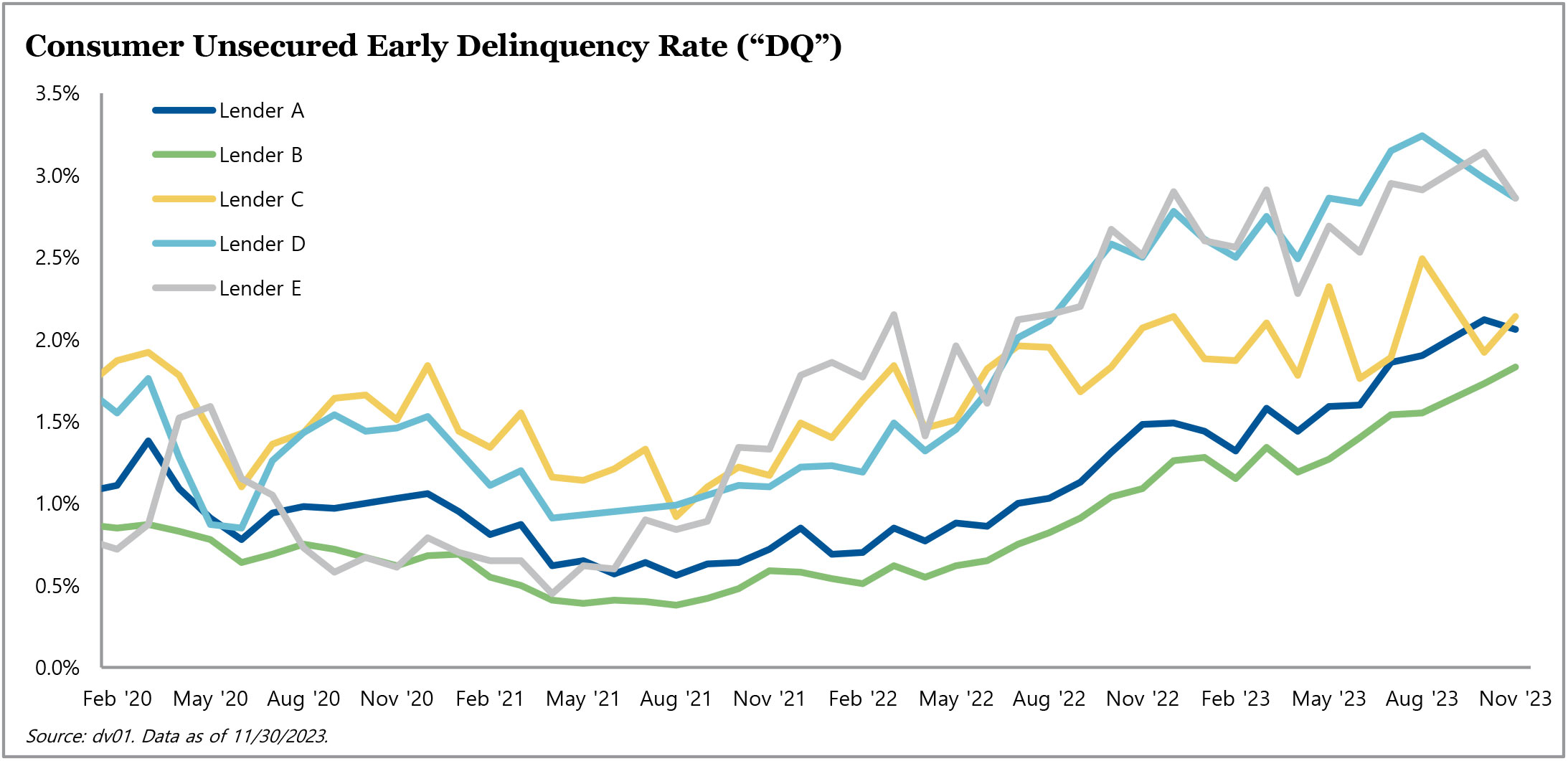

Consumer performance data has generally been within underwritten expectations, but certain sectors are already underperforming pre-pandemic levels. Unsecured consumer loans showed some signs of stabilization in the latest data after months of decline, though default rates have risen above pre-pandemic levels. Auto data were mixed, as delinquencies for one of the lower quality originator’s transactions improved moderately, but overall, sector-level delinquencies rose and prepayments remain near all-time lows. Meanwhile, credit card performance has been stable. As we have noted previously, while a slow grind to pre-pandemic levels has been emerging, credit cards continue to far outperform pre-pandemic levels. Overall, student loan performance was a little softer as delinquency rates seasonally rose and have surpassed pre-pandemic levels. Student loan delinquency rates should continue to rise until tax refunds are processed in the first half of 2024. Legacy private credit student loans continued to generate ample recovery proceeds.

Federal student loan payments resumed on October 1, with the 12-month on-ramp we discussed in last quarter’s commentary. Federal student loans are at the bottom of the consumer payment hierarchy given generous forbearance programs, small minimum payments, and long delays before any adverse action is taken. As a result, we believe this payment resumption will be uneventful to the broader consumer ABS complex, though the effect on consumer incomes and credit performance may not be fully observable until after the on-ramp period concludes.

Full-year 2023 ABS issuance was up 8% year-over-year.

As of year-end 2023, ABS spreads generally remained wide of February 2022 levels.

Credit card principal payment rates have been stable.

Delinquencies for unsecured consumer loans showed some signs of stabilization.

CMBS

Interest rates were the driving force, and major topic of conversation, in the commercial real estate and CMBS market in 2024. The story continued in the fourth quarter of 2023, when the 10-year U.S. Treasury yield topped 5% in mid-October. Sentiment among commercial real estate (CRE) participants reached rock bottom, and CMBS investors were reticent to transact. However, the combination of the Fed’s comments on November 1, the rally in the 10-year U.S. Treasury yield, and the market’s shift to a broader “risk-on” posture, led to a renewed sense of optimism that sparked life into the CMBS market through year-end.

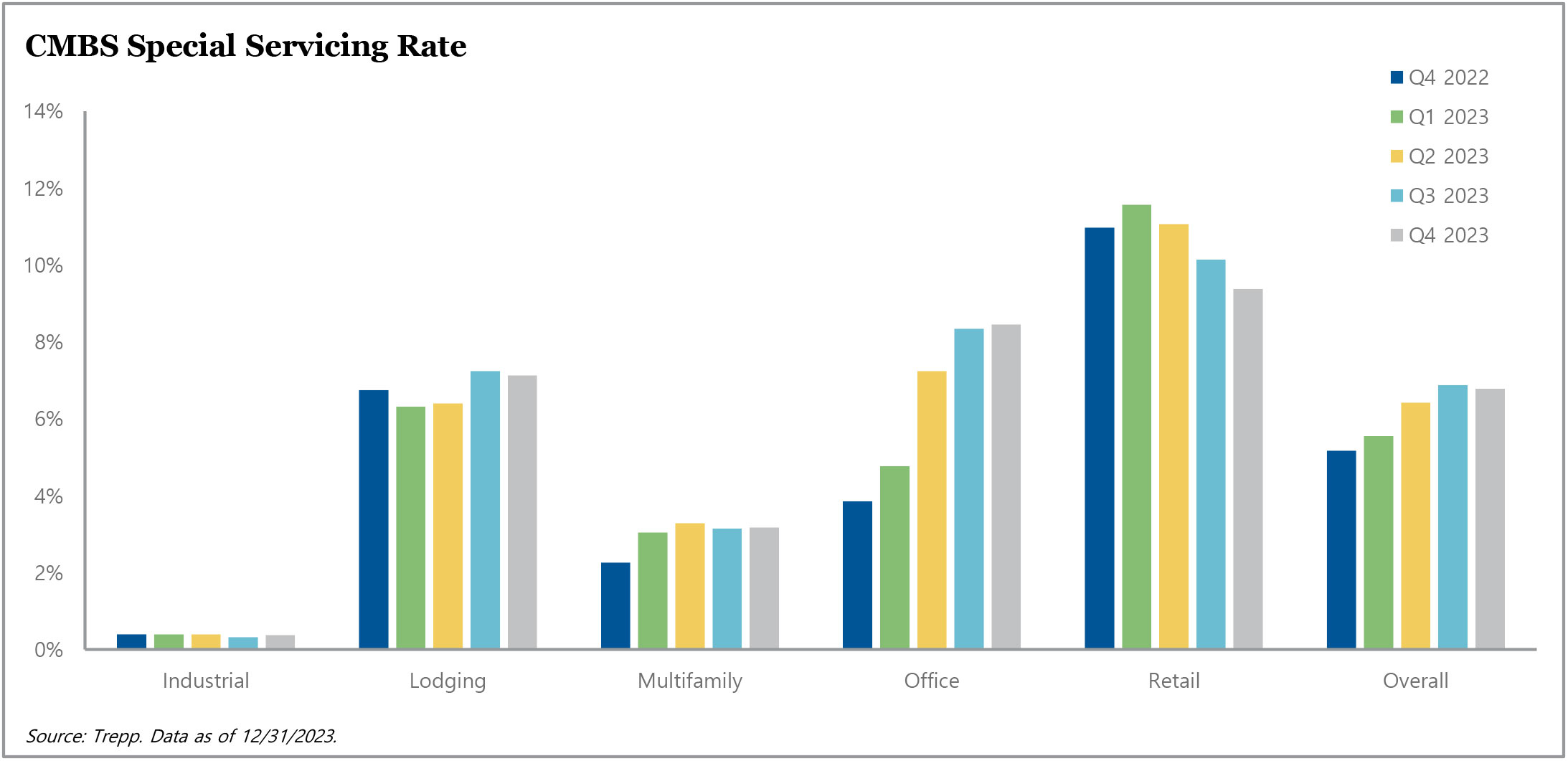

Fundamental operating trends during the first nine months of the year continued into the fourth quarter. The underlying data reflects improving or stable fundamentals for industrial (0.34%), lodging (7.13%), and retail (9.83%), while office (8.87%) and multifamily (3.25%) continued to see assets transferred to special servicing. We agree with J.P. Morgan’s view that “office is struggling from a structural problem while private label multifamily is dealing with a portion of the market with busted capital structures.” We expect the special servicing rate for office to increase in 2024 but the rate for multifamily to plateau below 4%.

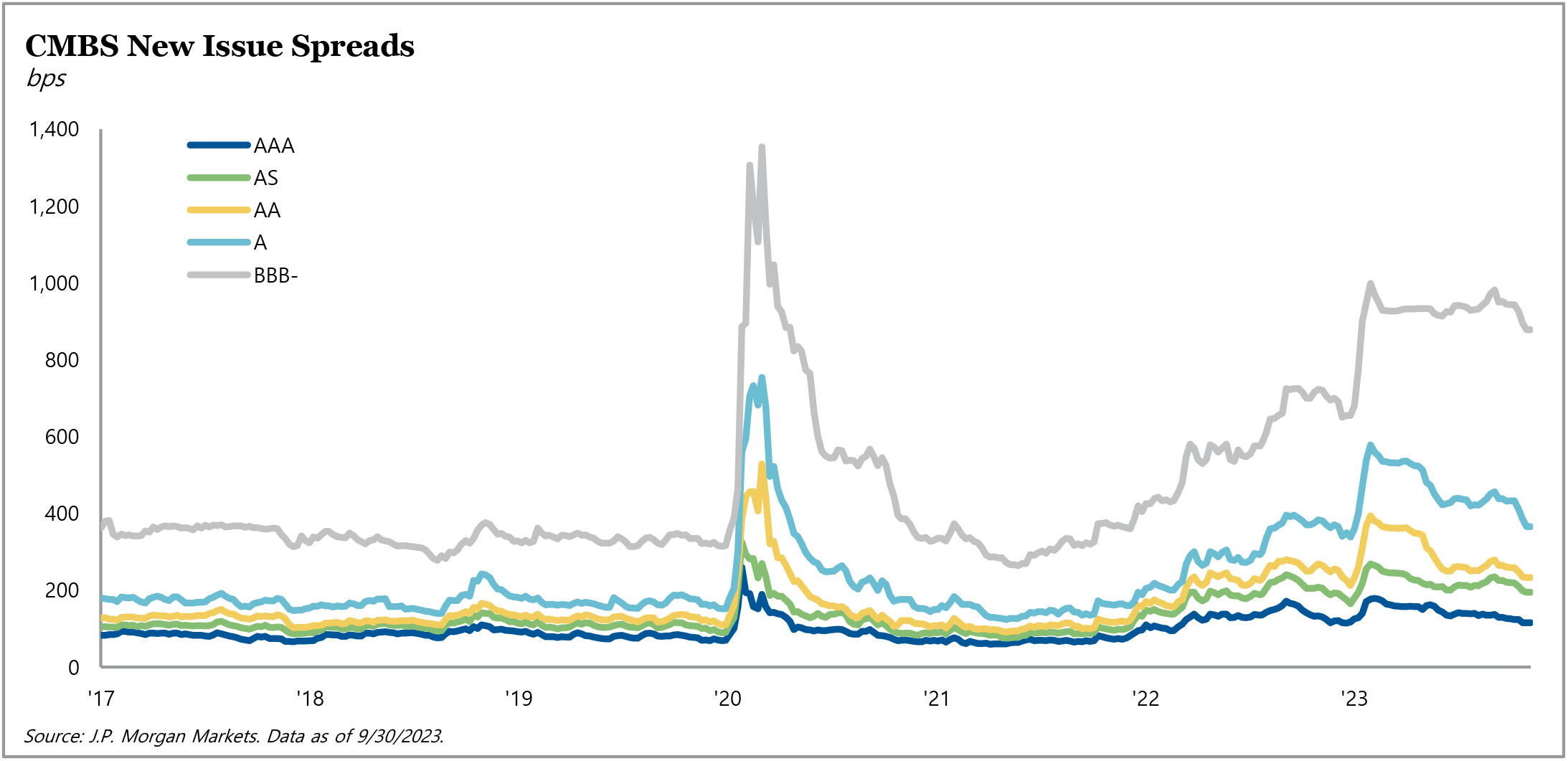

CMBS spreads approached 2023 wides in late October, as investor assumptions of an over 5% 10-year U.S. Treasury yield increased fears of widespread credit losses across CRE. That trend reversed on November 1 as spreads ended the year at their post-March tights, with AAA spreads at 115 basis points – a level last seen in the second quarter of 2022. This tightening of AAA bonds reflects the fact that investors assume a much lower probability that loans will be extended and will instead be able to pay off at maturity. Even with a greater than 100 basis point tightening in BBB- spreads, they ended the year hovering around 900 basis points, reflecting continued credit concern within CRE.

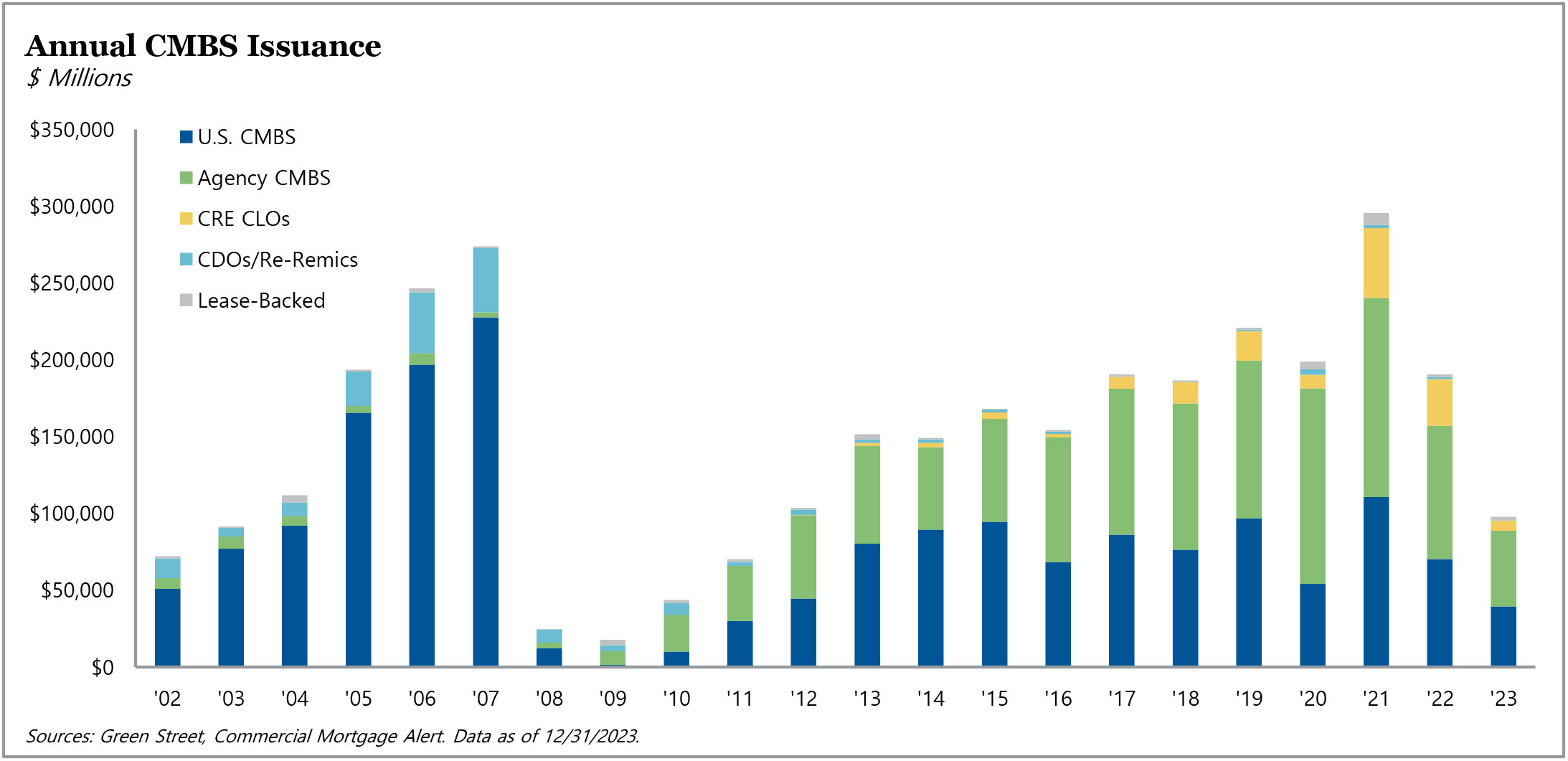

Emboldened by lower interest rates, stable and improving operating fundamentals, and tightening spreads, CMBS originators and issuers had a busy end of 2023. Issuances included 5-year conduit, 10-year conduit, and multiple SASB transactions collateralized by industrial, retail malls, other retail, and hotels; however, there was little multifamily issuance. Agency CMBS ended the year with sub-$50 billion of issuance, the lowest amount since 2011. As transaction volume picks up and existing lenders increasingly address maturing CRE loans, we expect CMBS issuance to trend higher in 2024.

Looking back on the fourth quarter of 2023, investor concerns felt in October have been replaced with a sense of optimism unseen in the first nine months of the year. We expect that investor response to the increased new issue pipeline will positively impact secondary-market spreads and lead to further increased transaction volume, potentially creating a positive feedback loop in the market.

For more information on TPG AG Structured Credit & Specialty Finance, visit angelogordon.com/credit/structured-credit-specialty-finance/

In the fourth quarter, office and multifamily continued to see assets transferred to special servicing, while other sectors reflected improving or stable fundamentals.

As transaction volume picks up and existing lenders increasingly address maturing commercial real estate loans, we expect CMBS issuance to trend higher in 2024.

Although CMBS spreads ended the year at their tightest level since the bank failures in March 2023, they remained generally wide in comparison to normalized levels.