High Yield Credit

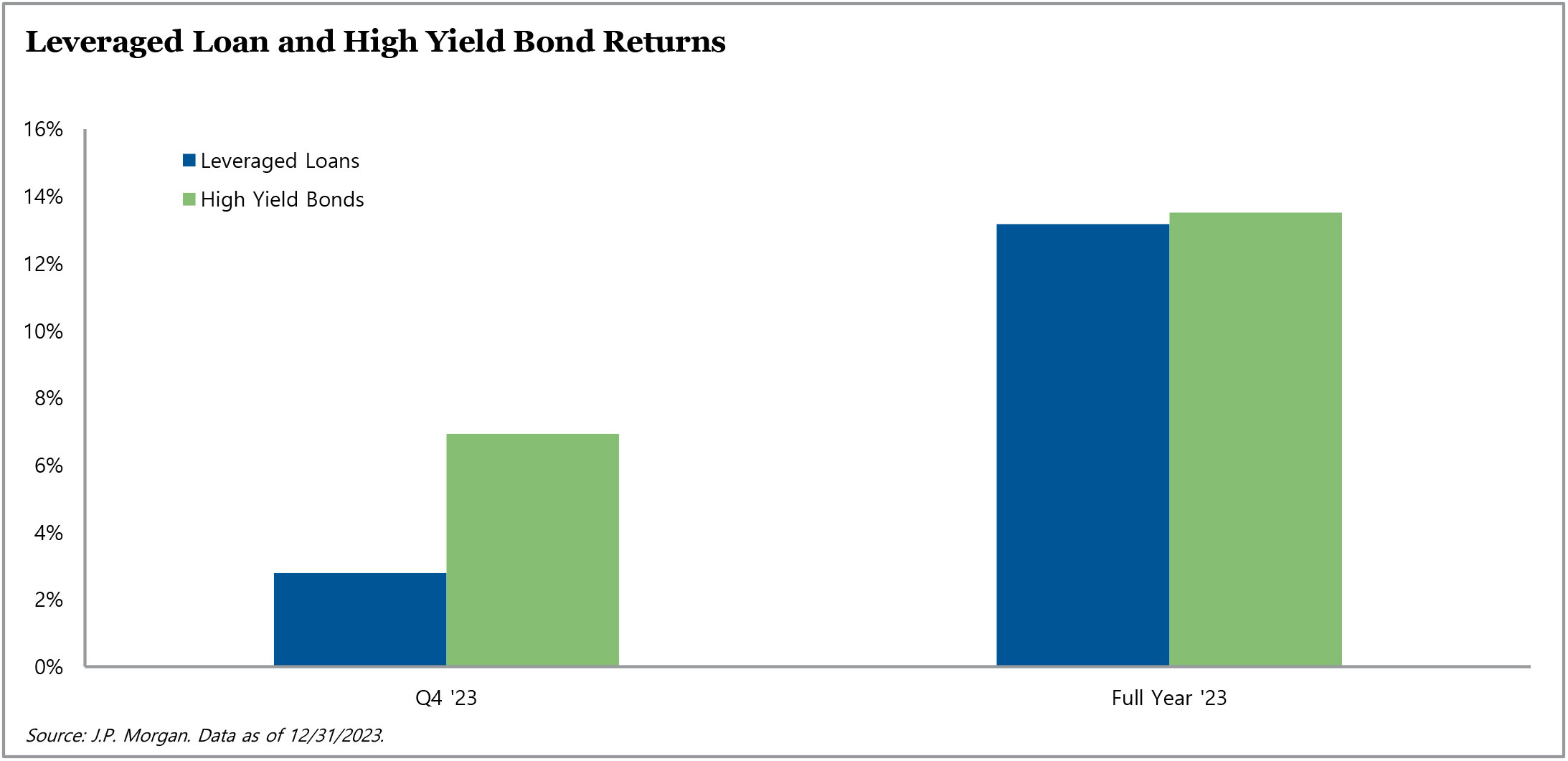

Both the U.S. and European high yield markets generated positive performance in the fourth quarter, with gains of 6.9% in the United States and 5.6% in Europe for the three-month period ended December 31, 2023. Easing inflation data and dovish Fed commentary led investors to price in earlier and more aggressive rate easing in 2024, which drove strong returns in November and December, as well as the full year. For the full year 2023, U.S. high yield produced a return of 13.5% and the European high yield return reached 12.7%, a substantial reversal on the 2022 full-year returns of -10.6% in the U.S. and -9.7% in Europe.

Both the U.S. and European high yield markets generated positive performance in the fourth quarter, with gains of 6.9% in the United States and 5.6% in Europe for the three-month period ended December 31, 2023. Easing inflation data and dovish Fed commentary led investors to price in earlier and more aggressive rate easing in 2024, which drove strong returns in November and December, as well as the full year. For the full year 2023, U.S. high yield produced a return of 13.5% and the European high yield return reached 12.7%, a substantial reversal on the 2022 full-year returns of -10.6% in the U.S. and -9.7% in Europe.

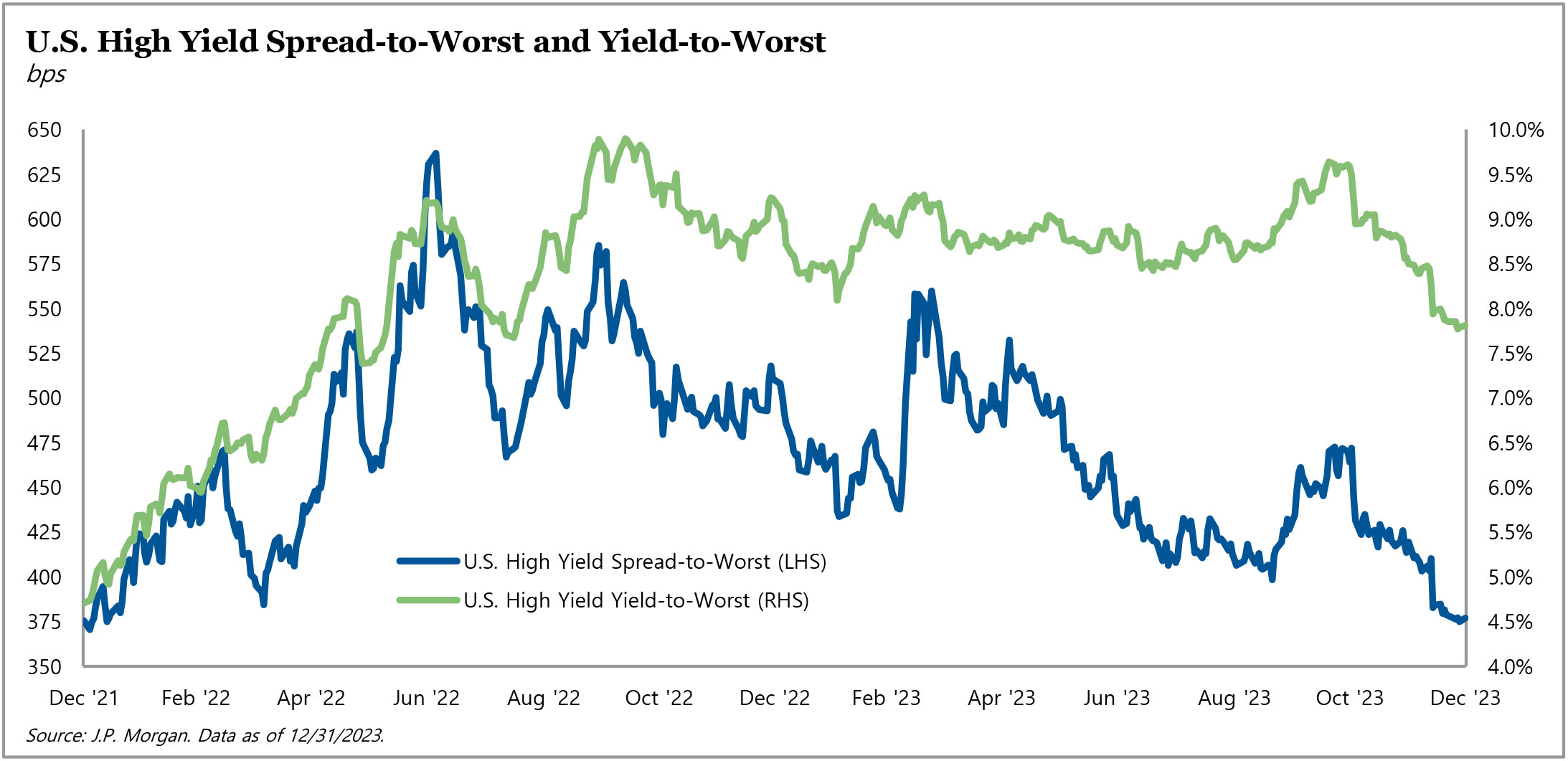

In the United States, high yield bond spreads tightened 43 basis points during the quarter, ending the year at 377 basis points compared to 490 basis points to start the year. Yields also tightened 115 basis points in the fourth quarter, ending the year at 7.8% compared to 9.2% to start the year. Lower-rated bonds outperformed relative to higher-quality bonds for the year; CCCs gained 19.9% while BBs generated a 11.8% return for the year. In Europe, high yield spreads tightened 44 basis points, ending the year at 449 basis points. Unlike in the United States, lower-quality CCCs lagged BBs modestly in Europe during the year, returning 11.0% versus 11.6%.

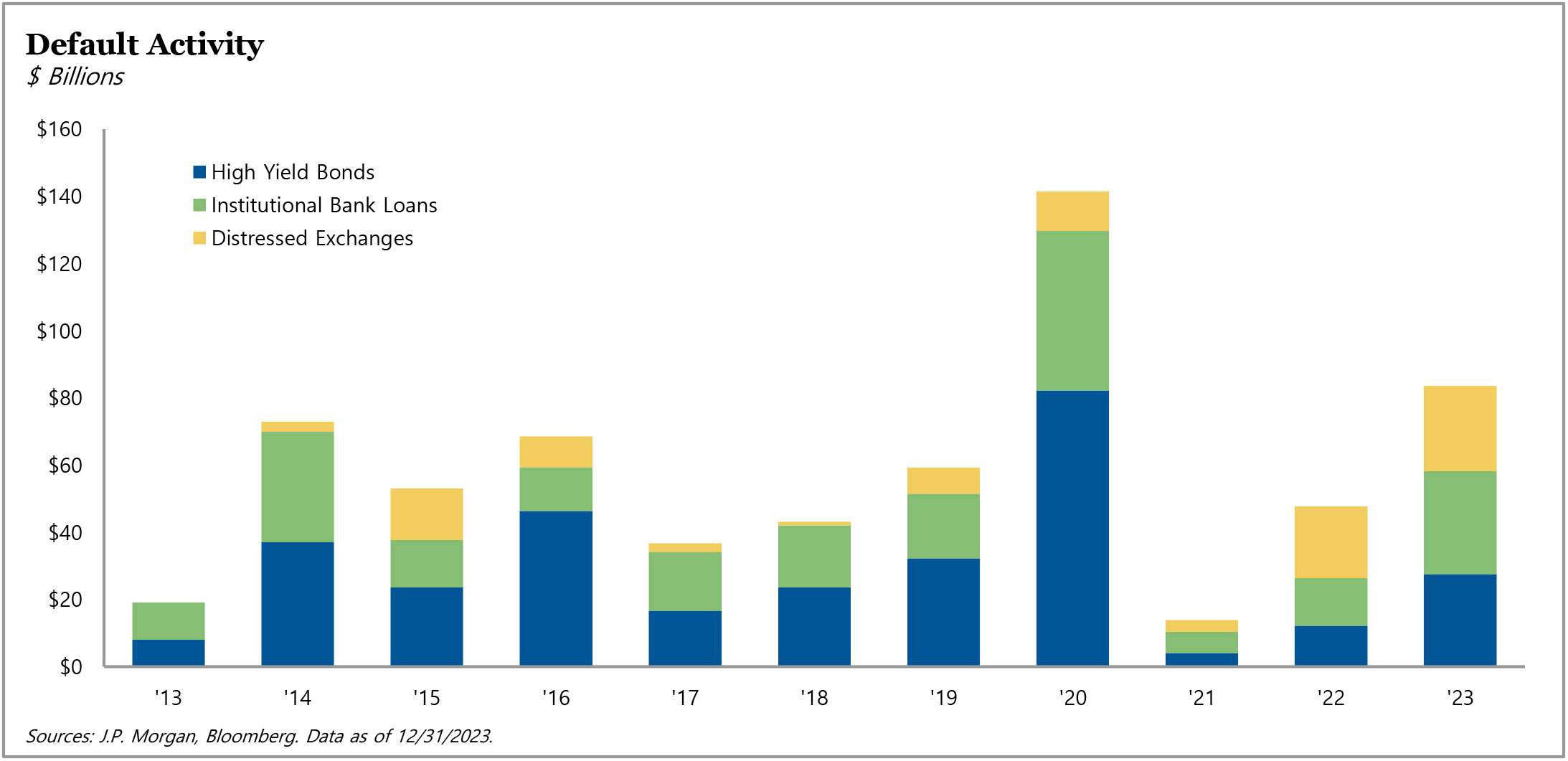

During the fourth quarter, 24 U.S. companies defaulted or completed a distressed exchange on a combined $20.5 billion of debt, increasing the full-year combined total to $83.7 billion, a 75% increase from 2022 and the fourth-largest annual total on record. This volume increased the 12-month trailing default rate up to 2.8%, though still below the long-term historical average. The European high yield market experienced two defaults during the quarter, resulting in the 12-month trailing default rate rising to 2.4%. For the full year 2023, 14 companies restructured, affecting a combined €11.4 billion of European currency bonds.

There was approximately $42 billion of new issuance volume in the U.S. in the fourth quarter. This increased the year-to-date issuance total to $175.9 billion, compared to $106.5 billion in 2022, which was near a record low. With that being said, 2023 was still the second-lightest new issue activity in the high yield market in over a decade. In Europe, high yield new issuance amounted to €10.4 billion during the quarter, bringing the year-to-date total to €56.9 billion – a 79% increase from 2022 but nearly one-third lower than the 10-year average.

U.S. high yield funds experienced $5.3 billion of net inflows in the fourth quarter, but even with this intake, the 2023 annual net outflows amounted to $7.9 billion. In Europe, high yield fund inflows of €930 million during the fourth quarter increased the 2023 annual net inflows to €2.1 billion.

For more information on TPG AG Credit Solutions, visit angelogordon.com/credit/credit-solutions/

Yields have remained elevated, but spreads have compressed.

Strong fourth quarter performance drove full-year returns in high yield.

Defaults ticked up in 2023, and distressed exchanges are becoming a larger percentage of volume.