Asia Real Estate

China

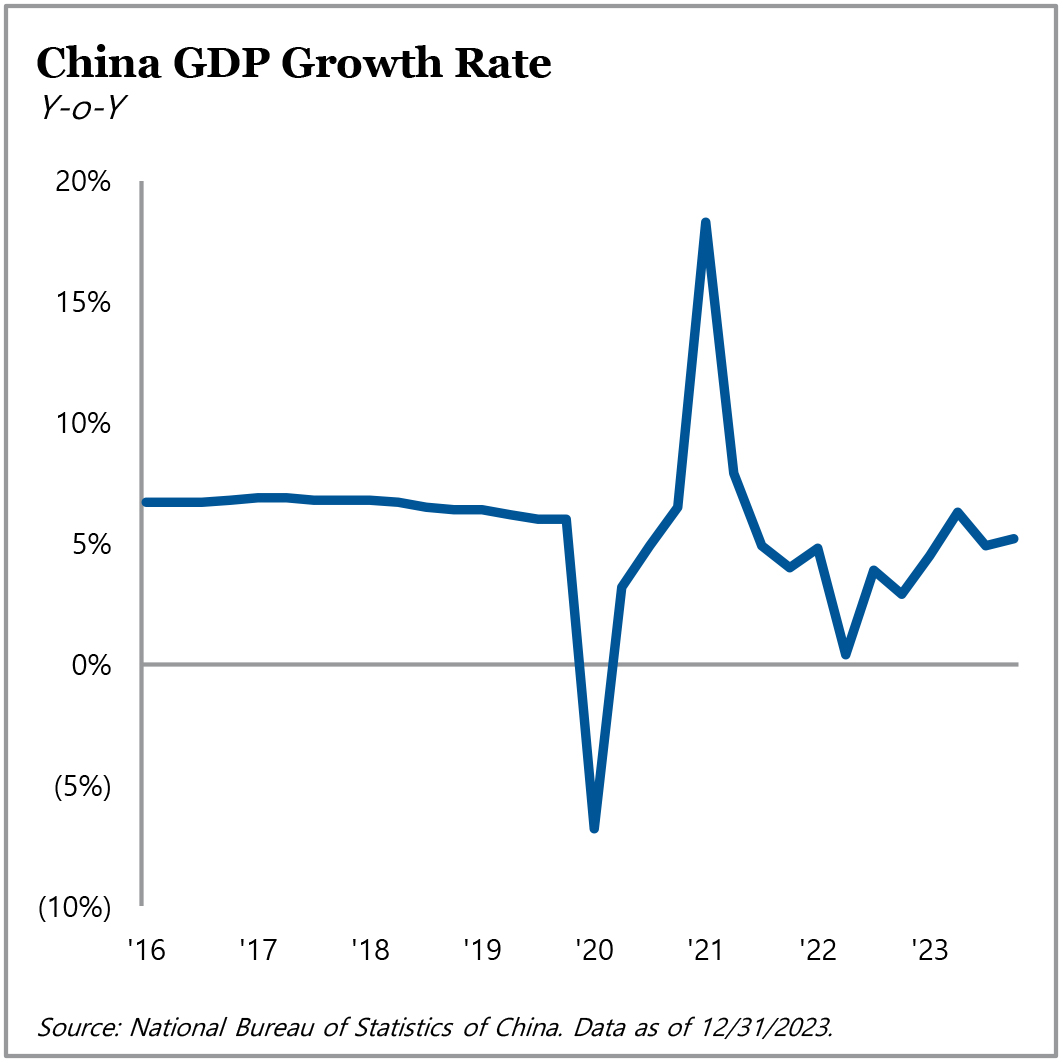

Despite geopolitical tensions and overseas interest rate hike impacts, China’s economy continued to gain traction and grew 4.9% year-over-year in the third quarter of 2023, following expansion of 6.3% in the previous quarter. Since reopening from zero-COVID in December 2022, China has shifted its focus to economic growth and rolled out a series of accommodative macroeconomic policies throughout 2023. The People’s Bank of China cut the reserve requirement ratio by 25 basis points in September, following a 25-basis-point cut in March. The one-year loan prime rate (LPR) was lowered by 10 basis points in August, following an earlier 10-basis-point cut for one- and five-year LPR in June. In the first three quarters of 2023, exports increased 0.6% year-over-year and value-added industrial output rose by 4.0%. Domestic retail sales increased 6.8% in the first three quarters, and online retail sales increased 8.9%. China remains highly focused on developing its advanced manufacturing sector, particularly in industries such as life sciences, integrated circuitry, and new energy. While total fixed-asset investment activity grew only 3.1% year-over-year in the first three quarters, fixed-asset investment in high-tech industries grew 11.4% year-over-year.

Despite geopolitical tensions and overseas interest rate hike impacts, China’s economy continued to gain traction and grew 4.9% year-over-year in the third quarter of 2023, following expansion of 6.3% in the previous quarter. Since reopening from zero-COVID in December 2022, China has shifted its focus to economic growth and rolled out a series of accommodative macroeconomic policies throughout 2023. The People’s Bank of China cut the reserve requirement ratio by 25 basis points in September, following a 25-basis-point cut in March. The one-year loan prime rate (LPR) was lowered by 10 basis points in August, following an earlier 10-basis-point cut for one- and five-year LPR in June. In the first three quarters of 2023, exports increased 0.6% year-over-year and value-added industrial output rose by 4.0%. Domestic retail sales increased 6.8% in the first three quarters, and online retail sales increased 8.9%. China remains highly focused on developing its advanced manufacturing sector, particularly in industries such as life sciences, integrated circuitry, and new energy. While total fixed-asset investment activity grew only 3.1% year-over-year in the first three quarters, fixed-asset investment in high-tech industries grew 11.4% year-over-year.

In Beijing, the recovery in office leasing demand that started in early 2023 did not continue, and leasing softened in the third quarter. New supply of 186,900 square meters was delivered to the office market. Net absorption amounted to roughly 71,200 square meters, and TMT companies accounted for nearly one-third of the leasing demand. Overall, Grade A office rents decreased by 1.3% in the third quarter, and the office market’s overall vacancy rate increased slightly from 10.3% to 11.1%. In the Zhongguancun submarket of Beijing, known as China’s Silicon Valley, rents were down 1.8% quarter-over-quarter and vacancy increased to 17.1%.

The industrial and logistics market improved in the third quarter, with net absorption of 161,000 square meters. Five large new projects were delivered in the Shanghai logistics market in the third quarter, adding approximately 293,000 square meters. Continued large supply caused vacancy to climb to 14.9% in the third quarter, while industrial rents rose 1.8% year-over-year.

In terms of overall market activity, year-to-date transaction volume registered RMB 149.0 billion, a decline of 5% year-over-year due to the cautious market sentiment. Business parks, logistics, and rental apartments remained the most popular investment asset classes.

China’s GDP improved modestly in the fourth quarter.

CNY values have remained weak against the USD.

Hong Kong

After growing 1.5% year-over-year in the second quarter of 2023, Hong Kong’s economy continued to improve in the third quarter – expanding 4.1% year-over-year – driven by the strong recovery of inbound tourism and private consumption. Total exports declined further in the third quarter, falling 8.6% year-over-year amid the challenging global market environment. Private consumption surged, increasing 6.3% year-over-year in the third quarter alongside continued economic recovery. Additionally, unemployment declined from 2.9% in the second quarter of 2023 to 2.8% in the third quarter.

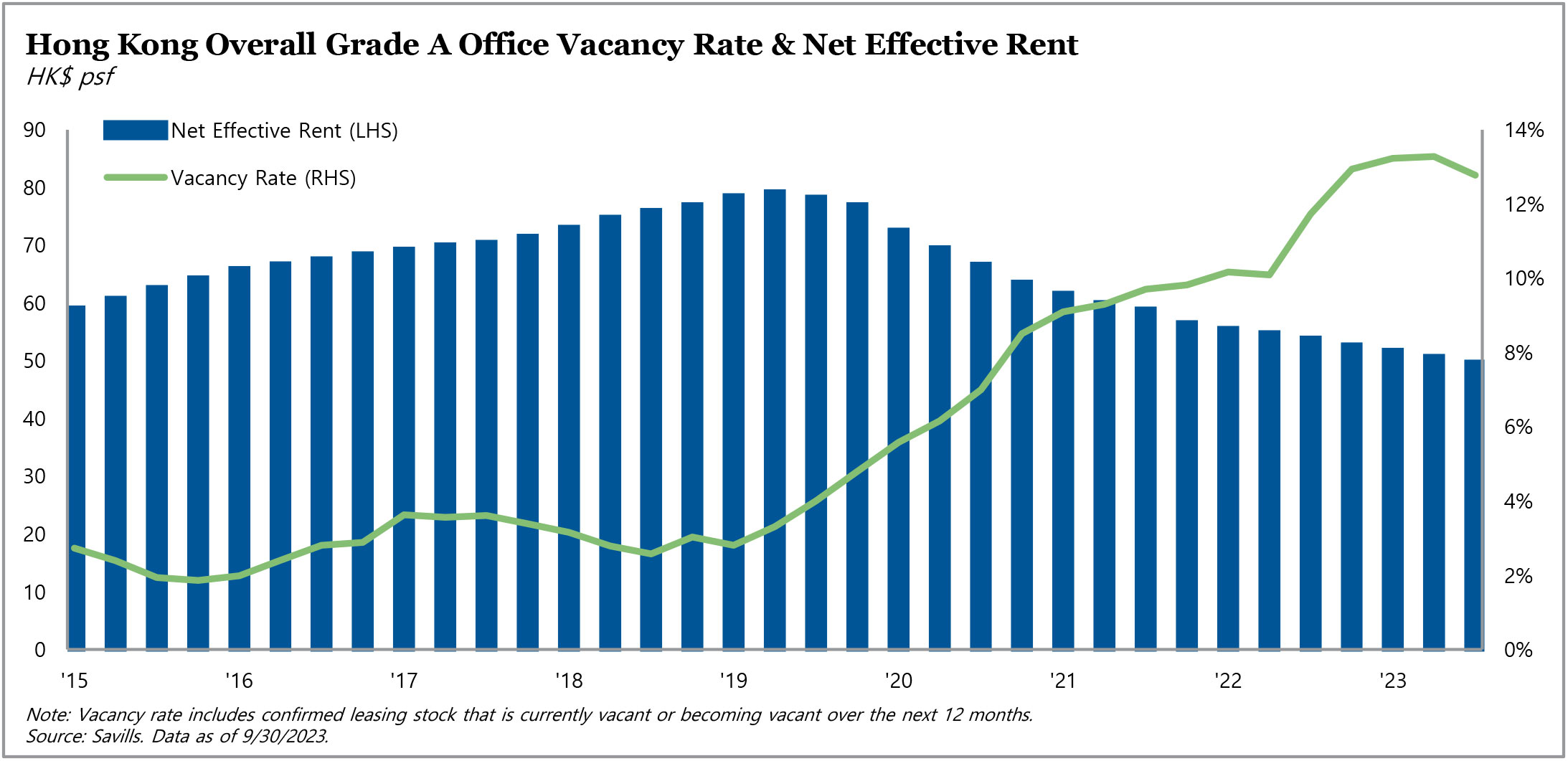

In the third quarter of 2023, residential prices retreated 8.1% year-over-year and 5.4% quarter-over-quarter – remaining below the high recorded in September 2021. This overall decline is mainly attributable to smaller residential units, which recorded an 8.8% year-over-year decrease in prices, as compared to the 4.6% price decline for larger units. On the other hand, mass residential rents grew by 6.6%, and townhouse rents grew by 8.6%. Commercial real estate investment transaction volume reached HK$26.2 billion in the first three quarters of 2023, just 35% of the previous year’s total. Investment demand in the third quarter was broad-based, supported by business entities for self-use, as well as local and non-local investors. The office sector continued to remain weak, both in terms of tenant demand and investor interest. As of September 2023, Hong Kong’s office vacancy decreased slightly to 12.8%, while rents fell by 2.0% in the third quarter.

Hong Kong’s office vacancy remained elevated given the slow recovery of office fundamentals.

Japan

In the third quarter of 2023, Japan’s real GDP shrank 2.9% quarter-over-quarter on an annualized basis, impacted by weaker private consumption and slower corporate investments. Japan’s labor market remained healthy, with unemployment at 2.5% as of November 2023. Inflation was 2.5% – down from the 41-year high of 4.2% that was recorded in January – and real wages fell 3.0% year-over-year, continuing their 20-month streak of declines. Subsiding price pressures and sluggish real wage growth have provided some relief to the Bank of Japan, which has repeatedly defended its loose monetary policy by arguing that inflation accompanied by real wage growth is what is needed to change its policy stance. As a result, the Japanese interest rate market remained stable, with Japan’s base rate (TIBOR) remaining below 10 basis points.

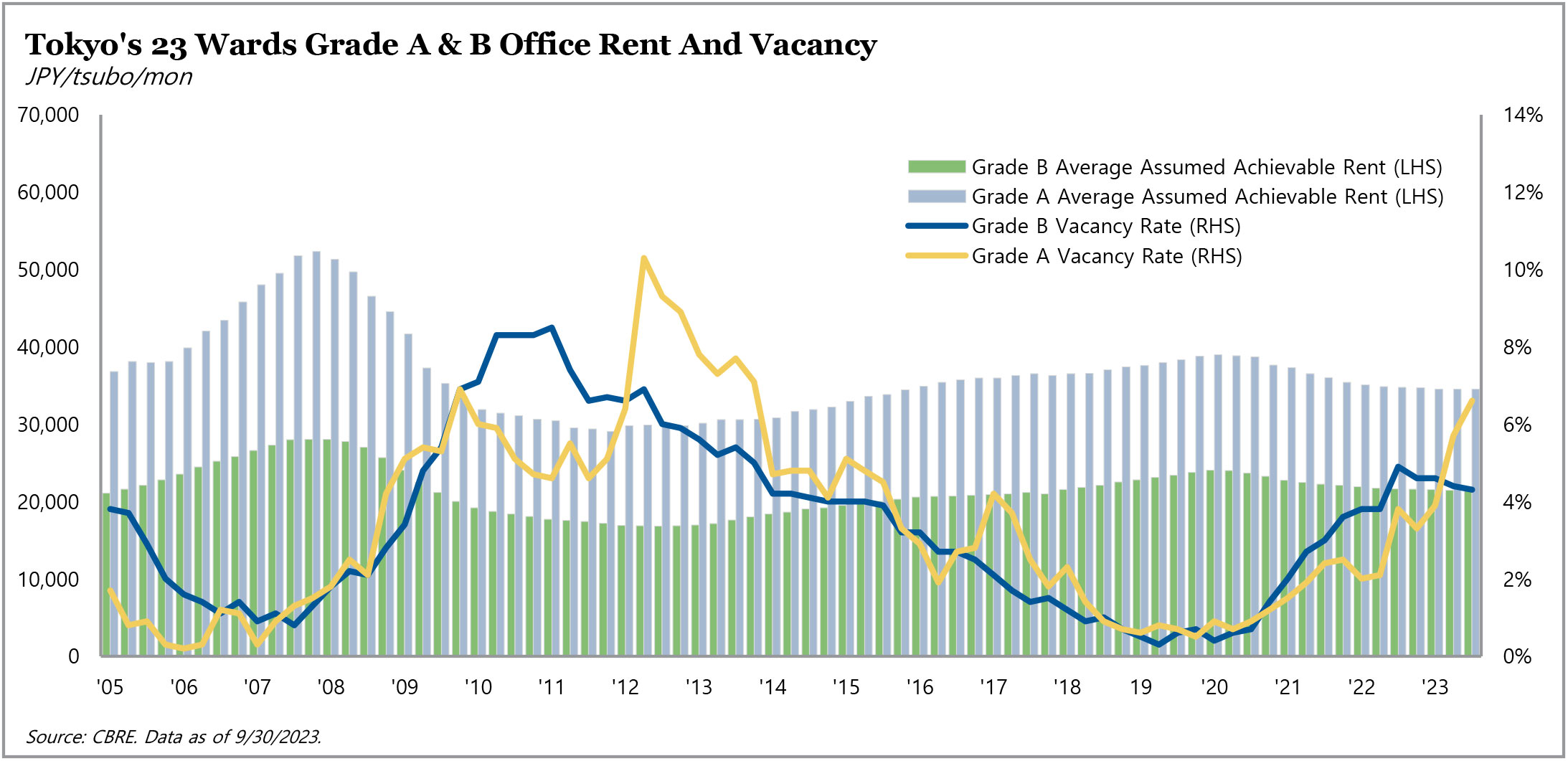

Office real estate fundamentals softened slightly due to new supply, but also continued to be supported by strong tenant demand. All-grade vacancy rates increased from 4.9% to 5.2% in Tokyo but decreased from 3.7% to 3.3% in Osaka quarter-over-quarter. During the quarter, Tokyo saw a 0.9% increase in the Grade A vacancy rate to 6.6%, as new supply delivered vacancies. We continued to observe a trend of Japanese companies seeking to upgrade their office space to attract and retain talented employees. We expect office demand will remain stable, with vacancies continuing to be filled by relocations from suburban areas, consolidations, and expansions.

Logistics vacancy in Tokyo rose from 8.2% to 8.9% quarter-over-quarter, with the delivery of 234,000 tsubo of new supply. Quarterly net absorption was 171,000 tsubo, above last year’s quarterly average of 122,000 tsubo in the greater Tokyo area. The vacancy rate for multi-tenant facilities remained unchanged at 8.2%, and for facilities that were built more than one year ago, vacancy remained flat at 2.1%. The strong demand witnessed during the third quarter originated from a wide range of industries, including e-commerce operators, retailers and wholesalers, manufacturers of consumer goods, and service providers. However, we’ve also seen tenants become increasingly selective with the continued influx of new supply, resulting in greater polarization between property types and submarkets.

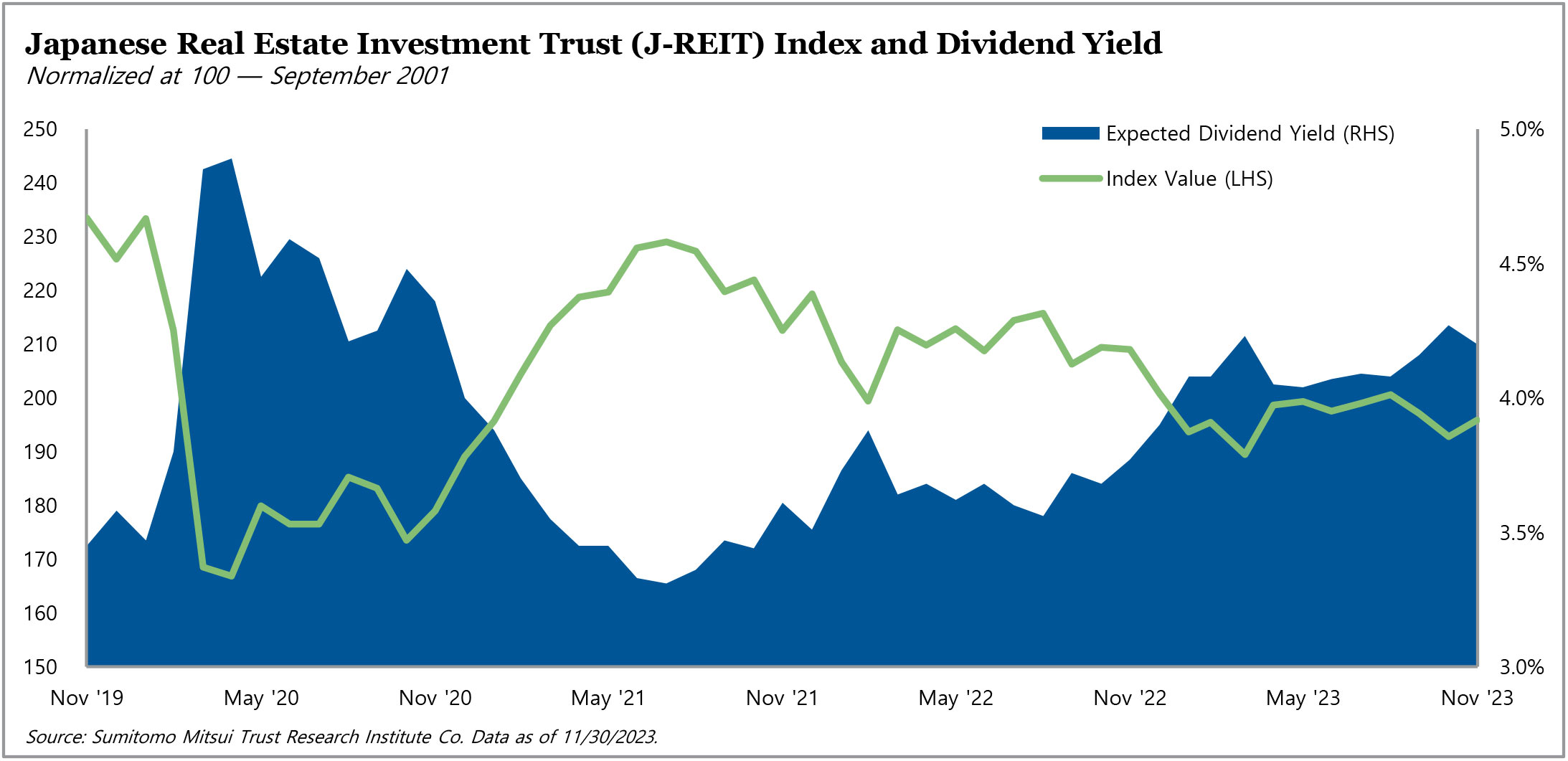

Transaction volume in the third quarter of 2023 was down 9% year-over-year – but still slightly above the average volume registered for the same period over the past four years. Japanese REITs (J-REITs) were increasingly active during the third quarter, with investment volumes up 60%. On the other hand, foreign buyers remained bearish, with volumes decreasing by 80%.

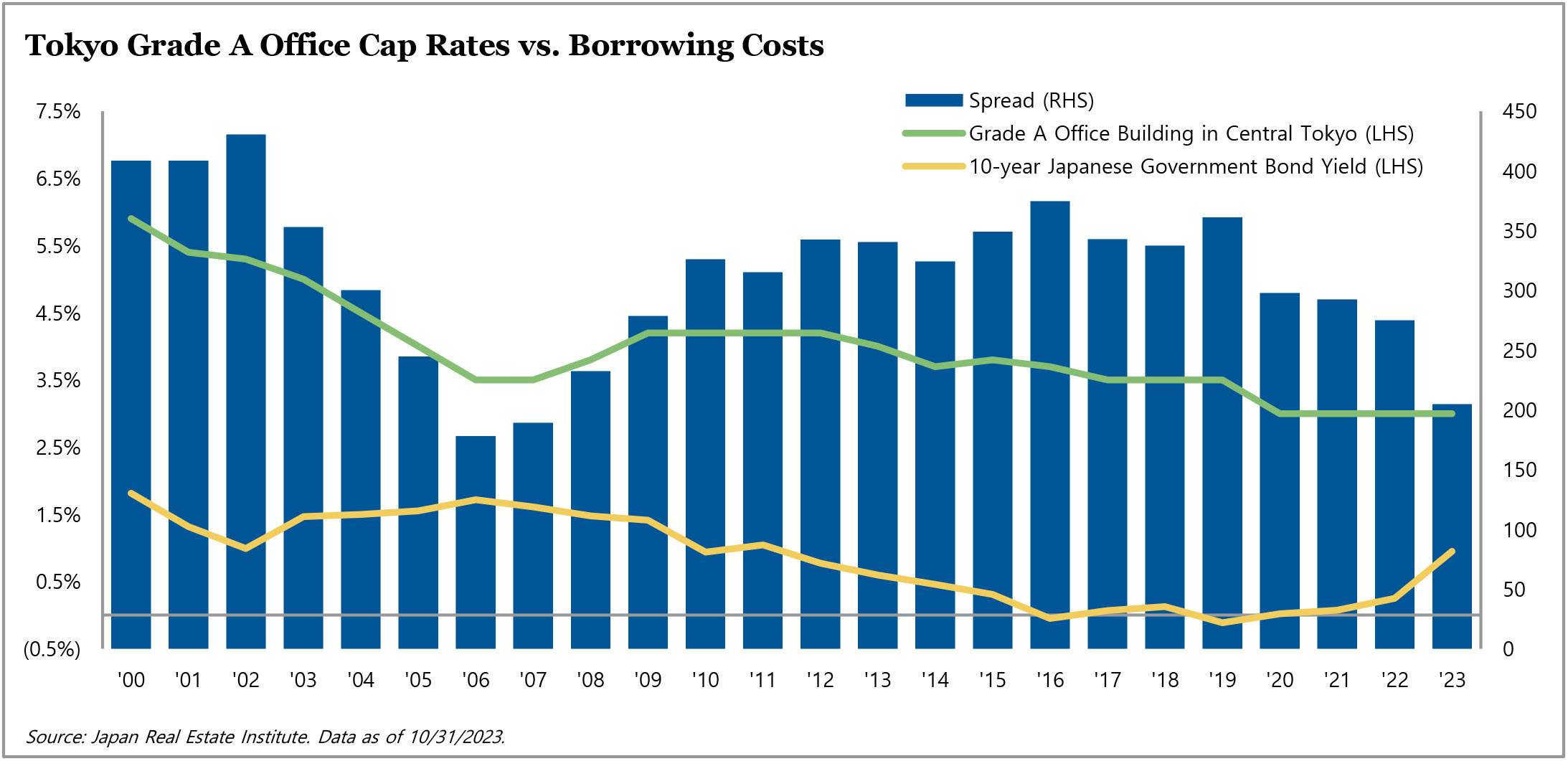

Despite Japan maintaining its low-rate policy, we have seen an uptick in long-term interest rates.

J-REIT performance has improved, which has led to an increase in new property acquisitions.

Tokyo Grade A office vacancy edged up due to new supply, while overall market fundamentals remained stable.

South Korea

The Bank of Korea (BoK) held its base rate at 3.50% in the third quarter, leaving it unchanged since January 2023. Consequently, the rate gap between South Korea and the U.S. stands at an all-time high of 200 basis points, as the U.S. Federal Reserve kept its benchmark interest rate steady following a 25-basis-point increase in July 2023. In the third quarter, South Korea’s GDP continued its economic growth of 0.6% quarter-over-quarter, showing further signs of recovery. The continued growth momentum was mainly driven by positive net exports with a rebound in the global semiconductor industry coupled with an expansion of infrastructure investment by several large trading partners. Overall, the BoK maintained its 2023 economic growth and inflation expectations, at 1.4% and 3.5%, respectively – both unchanged from the previous May forecast.

On the real estate front, office cap rates stood at 4.4% in the third quarter of 2023 – in line with the previous quarter. Spreads between prime office cap rates and Korean government bond yields (i.e., 10-year treasury bonds) tightened once again and stood at approximately 40 basis points. This spread tightening can be attributed to higher treasury yields, which stood at 4.0% at the end of the third quarter – up 30 basis points quarter-over-quarter.

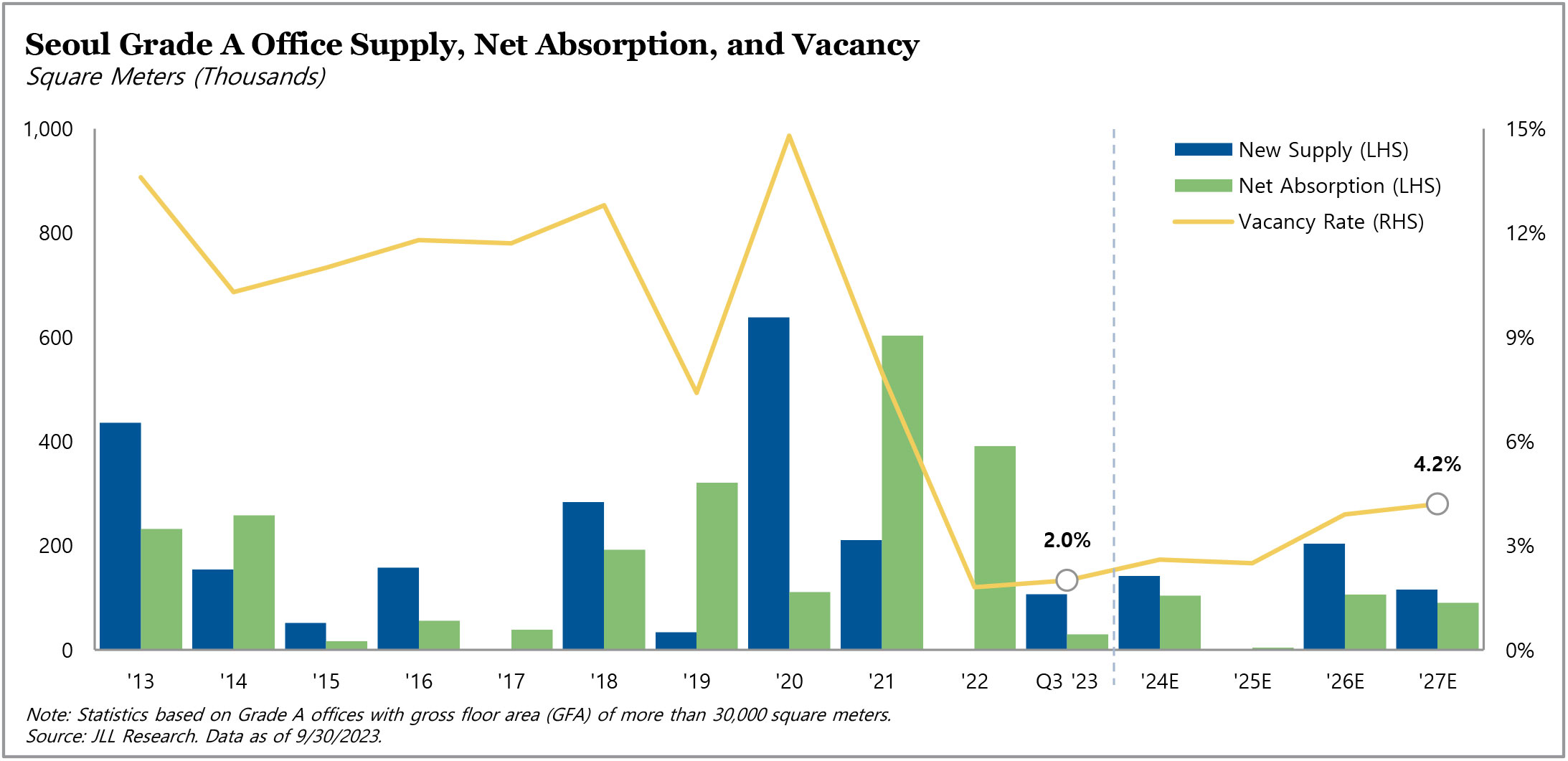

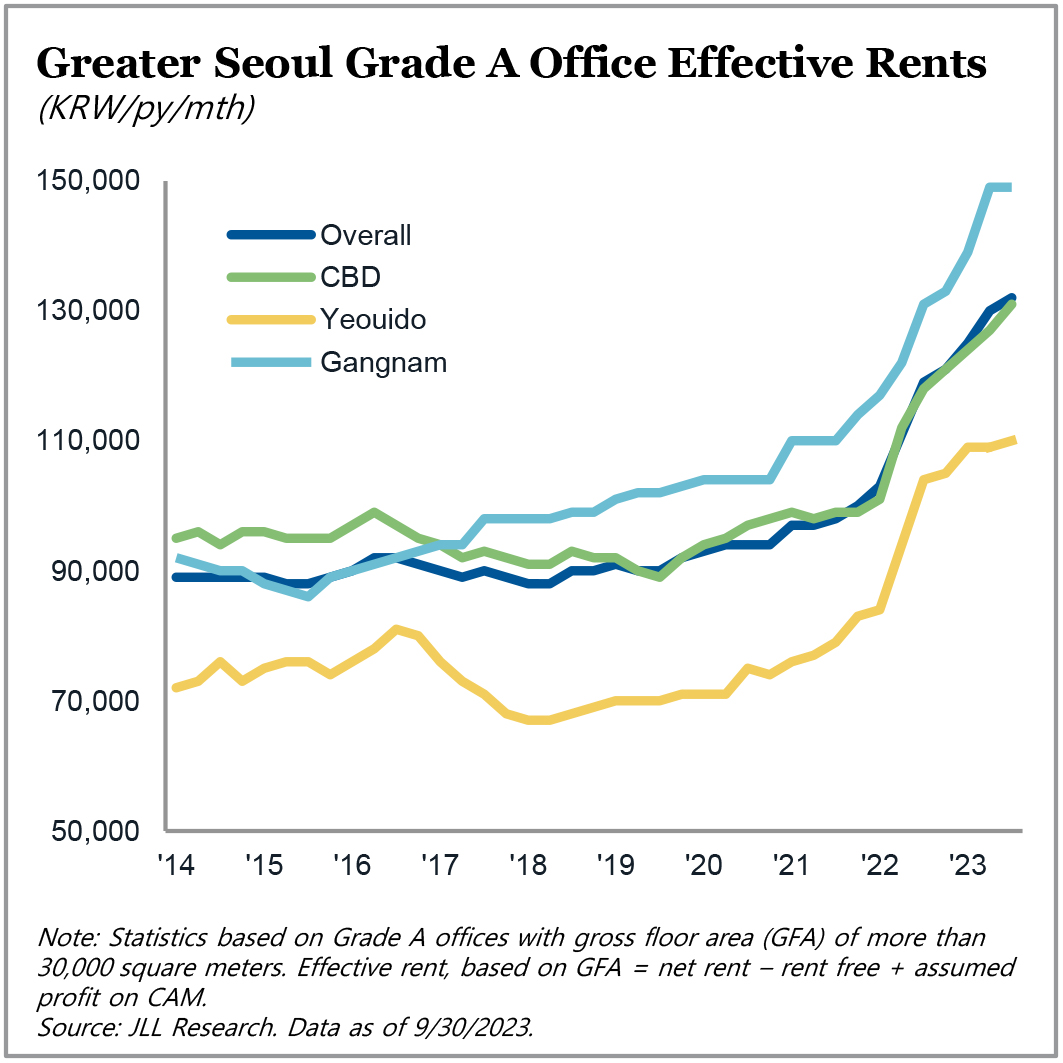

Despite spread compression in the capital markets, office fundamentals remained robust. Prime office vacancy in Seoul remained at 2.0% at the end of the third quarter. With sufficient demand and limited ongoing supply, vacancy rates are projected to remain below 5.0% for the next four years. Additionally, overall office rents increased 10.9% year-over-year, with the Gangnam Business District exhibiting a 13.7% rent growth year-over-year. Investment activity totalled ₩2.7 trillion in the third quarter – down 32.5% year-over-year. On a year-to-date basis, transaction volume totalled ₩7.7 trillion – down 40.8% year-over-year, mainly due to investor concerns over rising financing costs.

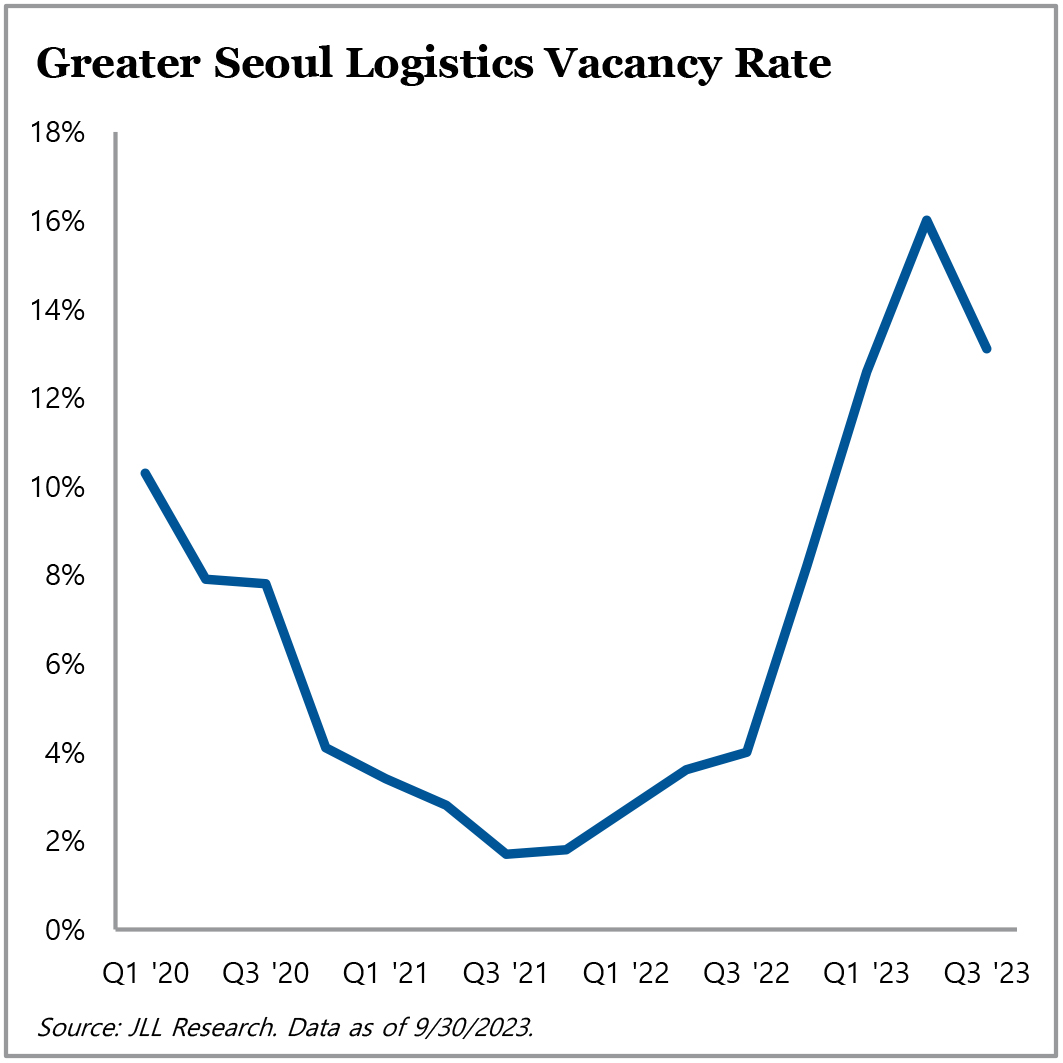

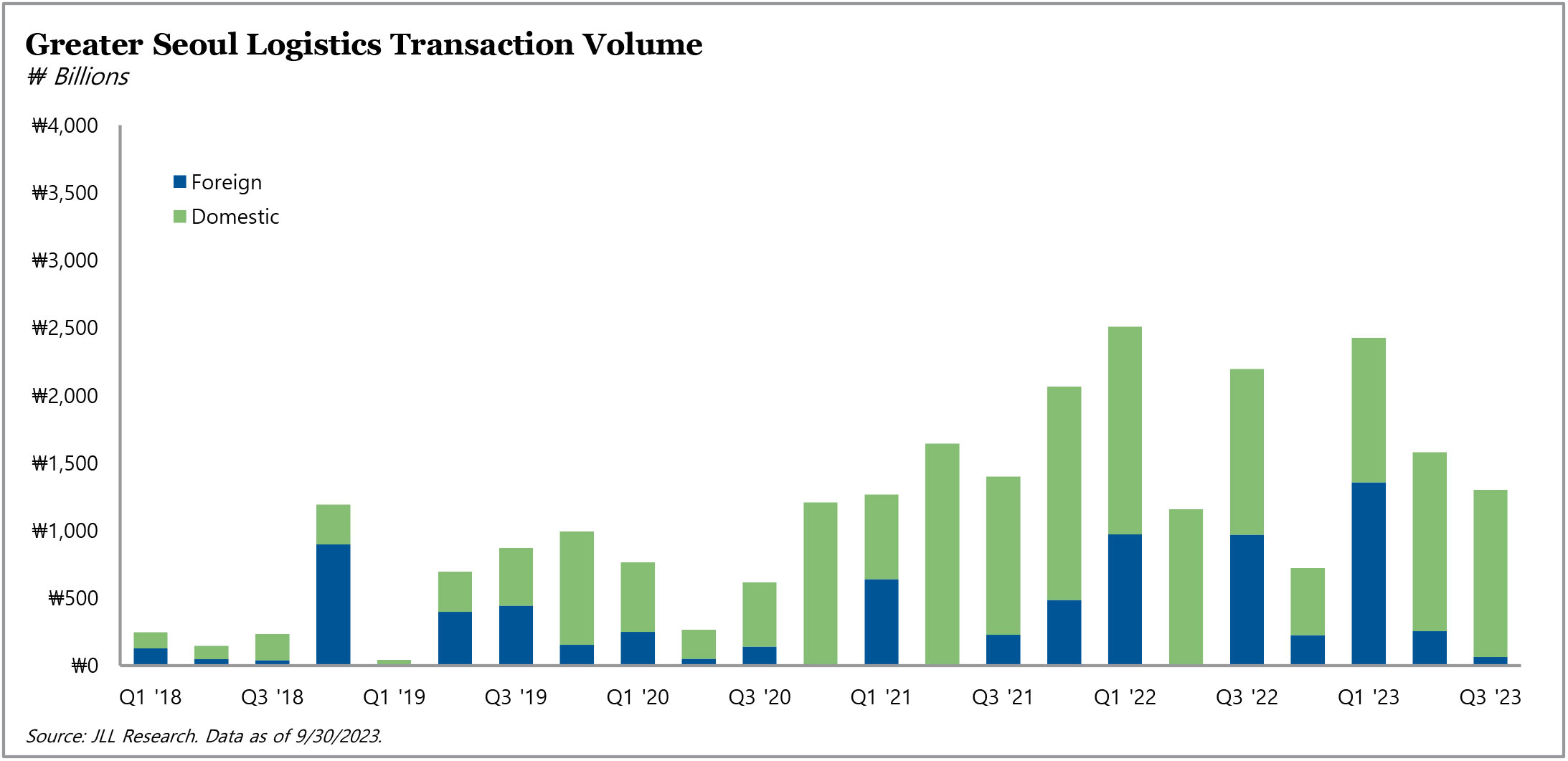

Logistics vacancy in Greater Seoul decreased to 13.1% in the third quarter – down by 2.9 percentage points quarter-over-quarter. Despite a supply spike in the prior quarter, demand for logistics space in Greater Seoul remained strong, with net absorption at an all-time high of 366,000 pyung (13 million square feet). According to JLL, the vacancy rates in key logistic submarkets are expected to further improve over the next two years, with reduced future supply and resilient demand. Meanwhile, logistics transaction volume amounted to ₩1.3 trillion in the third quarter – down 40.7% year-over-year. On a year-to-date basis, transaction volume reached ₩5.3 trillion – down 9.4% year-over-year.

For more information on TPG AG Asia Real Estate, visit angelogordon.com/strategies/real-estate/asia-real-estate/

Prime office vacancy in Seoul ended the third quarter near a historical low, underpinned by robust demand, limited supply, and minimal impact from remote working.

Office rents in Greater Seoul hit an all-time high across all four major submarkets given strong underlying fundamentals.

Logistics vacancy soared due to large-scale supply delivered in the first half of 2023; however, demand remains robust and future supply is expected to moderate.

Logistics transaction volume was down significantly due to the current high-rate environment.