Net Lease Real Estate

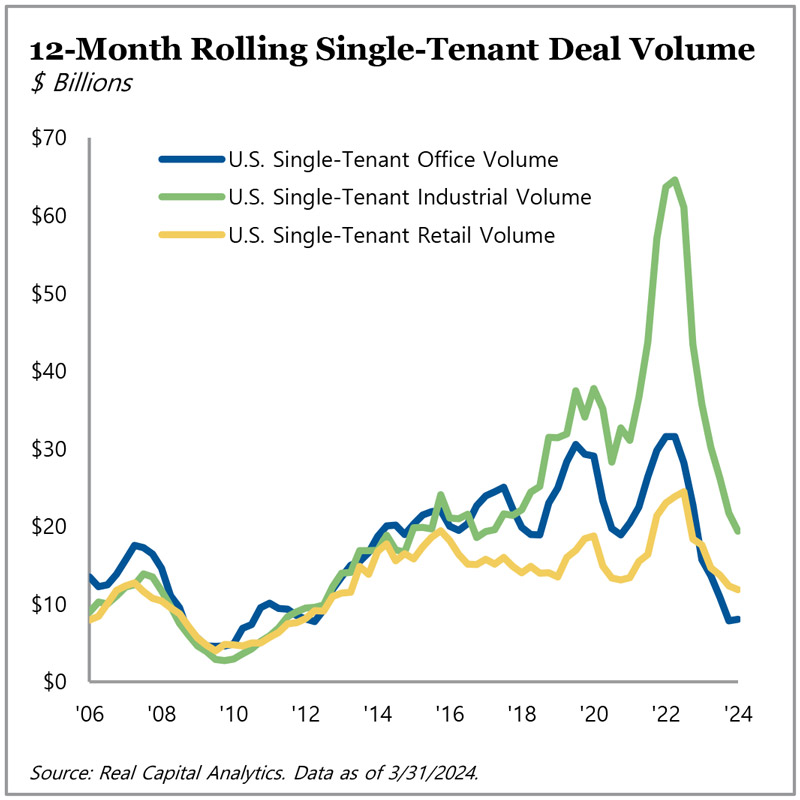

U.S. single-tenant transaction volume remained muted in the first quarter of 2024, with trailing 12-month volume totaling $39 billion, according to Real Capital Analytics (RCA). Since the peak in the second quarter of 2022, trailing 12-month transaction volume has declined by 67% and was seen across asset types, with office, industrial, and retail all down by more than 50%. While net lease volume is expected to stabilize more quickly than the broader economy, it remains well short of the investment pace seen in 2020 and 2021. CBRE forecasts investment activity will remain subdued for the remainder of the first half of 2024 but pick up around midyear.

U.S. single-tenant transaction volume remained muted in the first quarter of 2024, with trailing 12-month volume totaling $39 billion, according to Real Capital Analytics (RCA). Since the peak in the second quarter of 2022, trailing 12-month transaction volume has declined by 67% and was seen across asset types, with office, industrial, and retail all down by more than 50%. While net lease volume is expected to stabilize more quickly than the broader economy, it remains well short of the investment pace seen in 2020 and 2021. CBRE forecasts investment activity will remain subdued for the remainder of the first half of 2024 but pick up around midyear.

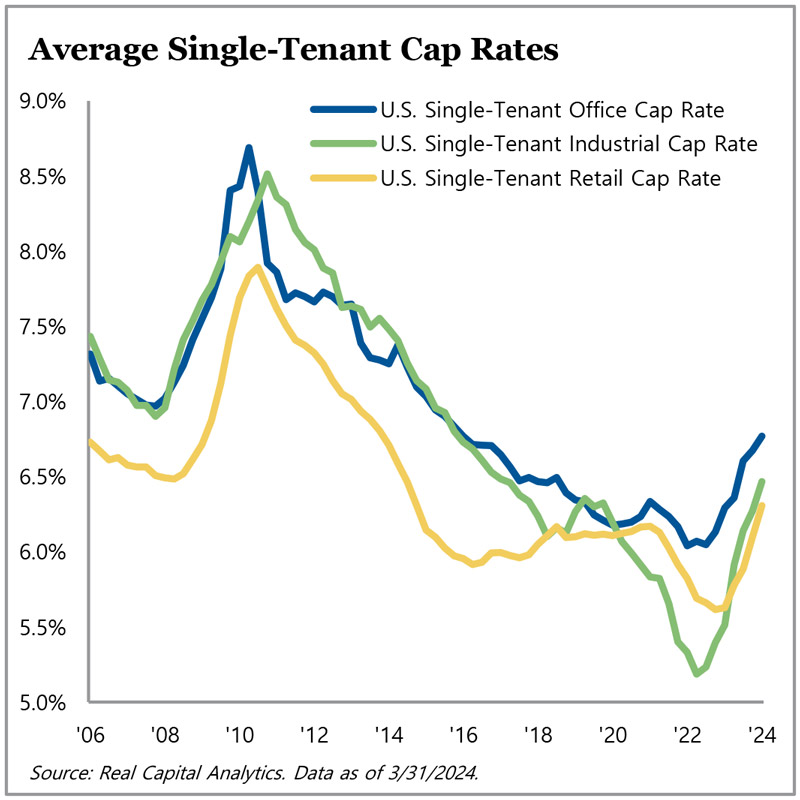

Single-tenant cap rates have continued to trend upward for the eighth consecutive quarter due to higher borrowing costs — a function of both the elevated U.S. 10-year Treasury yield and wider lending spreads over the base rate. As of the first quarter of 2024, trailing 12-month U.S. single-tenant cap rates averaged 6.51%, 16 basis points higher than the prior quarter. However, the rate of cap rate increases appears to be slightly tapering off. The cap rate spread to borrowing costs is tight relative to the past 13 years, but there has been an increase in the number of corporate property owners looking to do sale-leasebacks, even at higher cap rates, since their effective financing costs are lower than alternative forms of financing. Since 2006, single-tenant cap rates have averaged 6.8%, below recent opportunities that are between a 7% and an 8% cap rate.

For more information on TPG AG Net Lease Real Estate, visit angelogordon.com/strategies/real-estate/net-lease-re/

Aggregate single-tenant investment volume in the first quarter of 2024 was down 67% from the peak recorded in the second quarter of 2022.

Cap rates have continued to trend up from the troughs recorded in 2022.