Merger Arbitrage

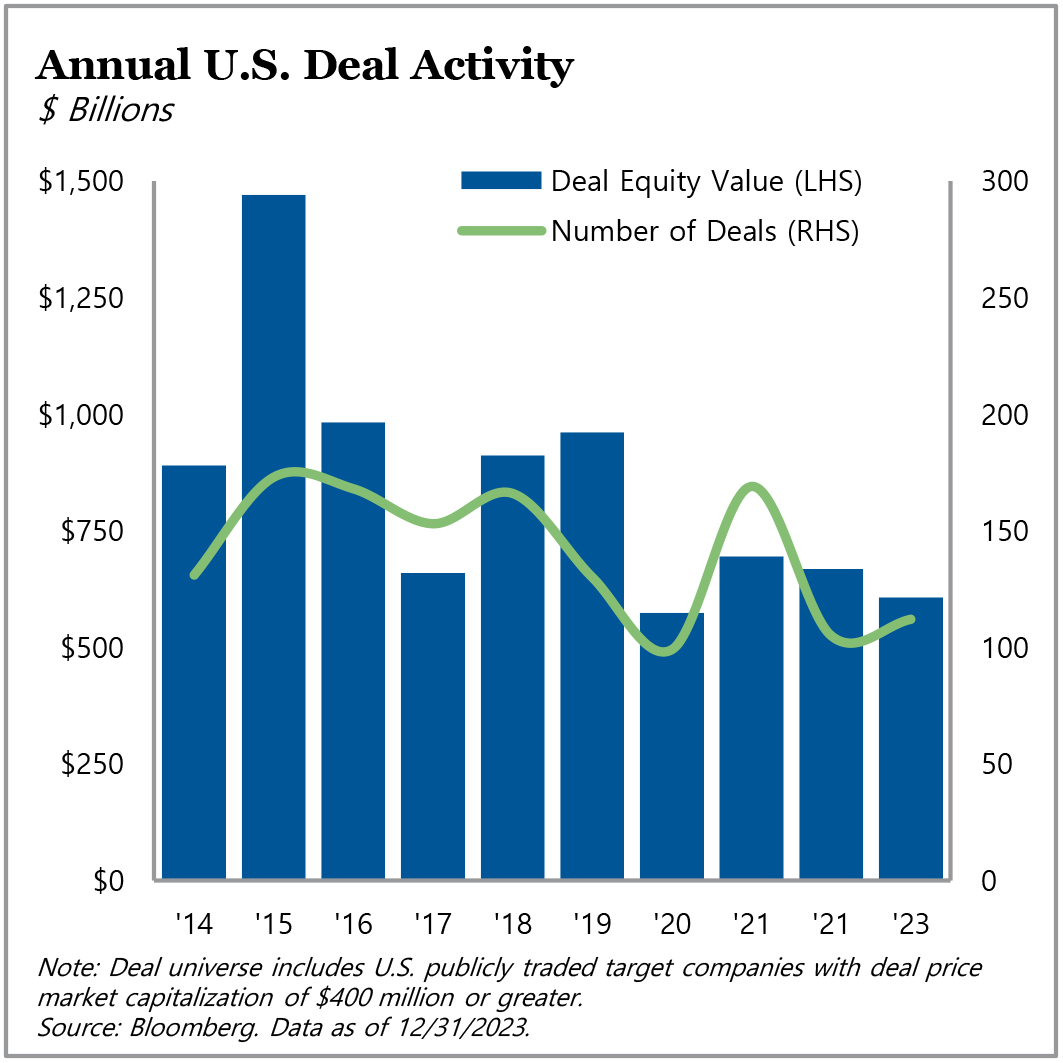

For full year 2023, U.S. M&A volume was down 9% while the number of deals announced increased 7% year-over-year. Deal volume in the second half of the year increased 57% compared to the first half, as interest rates declined, the prospect of a soft landing increased, and concerns about aggressive antitrust actions waned. At year-end, the U.S. deal universe had an average adjusted annualized spread of 11.4%, aggregate deal value declined to $283 billion, and the total arbitrage profit pool stood at $21.2 billion.

For full year 2023, U.S. M&A volume was down 9% while the number of deals announced increased 7% year-over-year. Deal volume in the second half of the year increased 57% compared to the first half, as interest rates declined, the prospect of a soft landing increased, and concerns about aggressive antitrust actions waned. At year-end, the U.S. deal universe had an average adjusted annualized spread of 11.4%, aggregate deal value declined to $283 billion, and the total arbitrage profit pool stood at $21.2 billion.

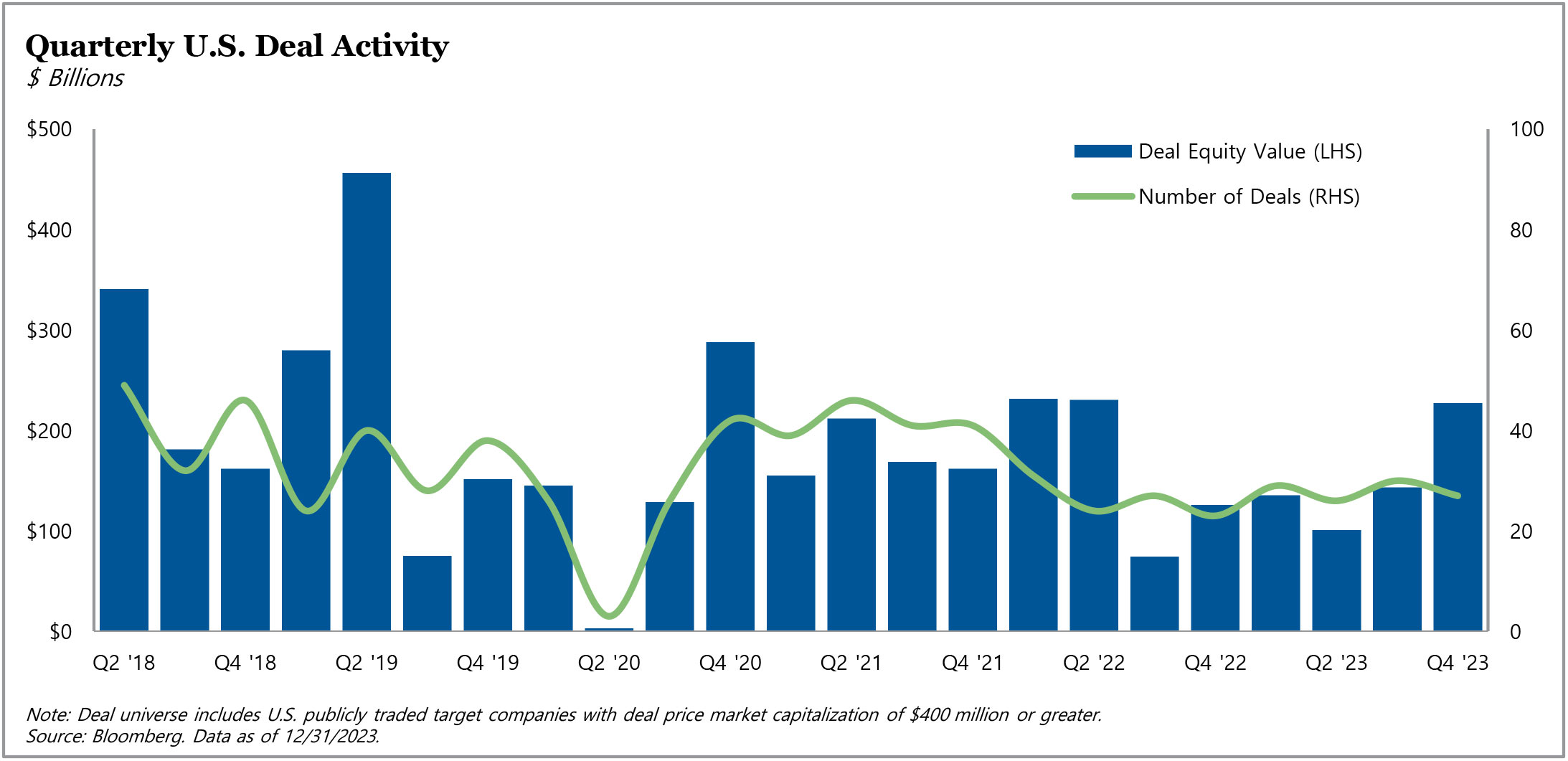

In the fourth quarter, deal volume increased 58% quarter-over-quarter as U.S. inflation data continued to cool and equity values rose, narrowing the price gap between buyers and sellers. With the Federal Reserve signaling it has completed this rate-hike cycle, declining yields led to more attractive acquisition financing. Four strategic deals, all of which were larger than $12 billion in equity value, helped drive the quarterly volume. While the average adjusted annualized spread widened during the quarter, that was primarily caused by the technical factor of the four largest deals closing during the period.

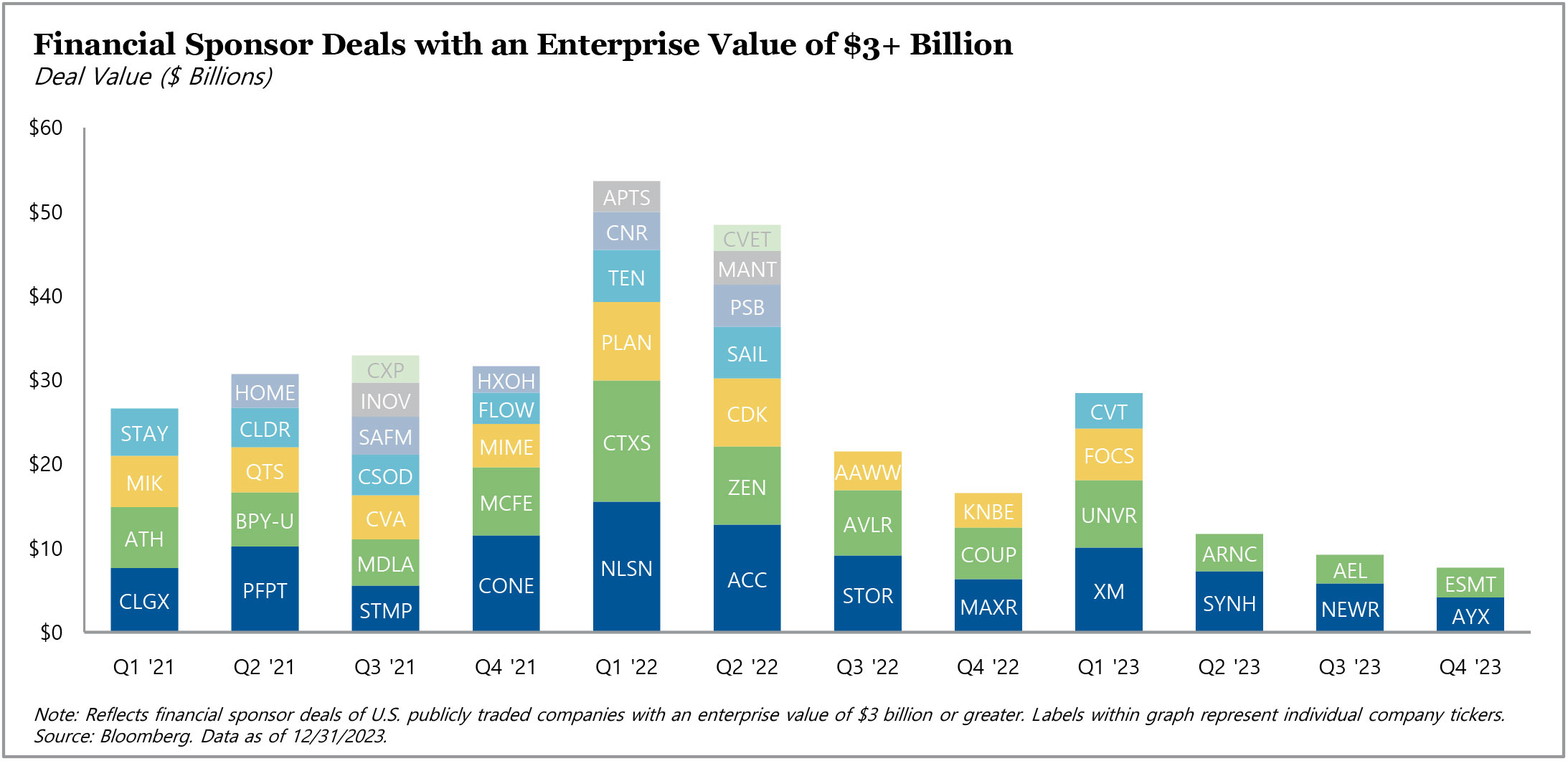

Private equity sponsors remained active in the U.S.; however, due to a significant rise in LBO financing costs throughout most of the year, larger deals generally continued to be out of reach. This led to a 52% year-over-year decline in aggregate deal volume despite the number of deals announced being slightly above the historical average. LBOs accounted for 26% of the total deal count in 2023 but only 14% of deal volume, down from 26% of volume in 2022. Private equity dry powder remains at all-time highs and the direct lending market continued to grow, increasing the potential for a wave of LBOs if the Fed embarks on its expected rate cutting cycle later this year.

Antitrust continued to be a major theme through the end of 2023. As discussed in prior CMP reports, regulatory uncertainty and U.S. antitrust agencies’ actions drove considerable trading volatility for event-driven investors throughout last year. However, the April and May showers turned into fall flowers, as Microsoft’s acquisition of Activision Blizzard, Intercontinental Exchange’s purchase of Black Knight, Amgen’s acquisition of Horizon Therapeutics plc, Pfizer’s purchase of Seagen, and Broadcom’s acquisition of VMWare all closed between September and December, after overcoming regulatory hurdles.

For 2024, there is an expectation of increased M&A from both strategic and financial buyers, as financing costs are projected to ease and the regulatory outlook has improved. There is clear pent-up demand, as M&A volumes since 2019 have been below the long-term average while corporate and private equity cash balances have grown. Market participants are anticipating the DOJ and FTC will remain active through this year, though their focus seems to have shifted from novel theories of harm to traditional antitrust and monopoly cases.

For more information on TPG AG Merger Arbitrage, visit angelogordon.com/credit/multi-strategy/arbitrage/merger-arbitrage/

U.S. M&A volume declined for the second consecutive year, as higher interest rates, shaky economic data, and an uncertain antitrust environment weighed on companies’ appetites for deals.

High LBO financing costs generally put larger deals out of reach for financial sponsors. This led to a 52% year-over-year decline in aggregate deal volume, though the number of deals announced was in line with the 10-year average.

There were four deals with a market capitalization of $10+ billion announced during Q4 2023, leading to the strongest aggregate deal equity value in a quarter since Q2 2022.

Higher financing costs and reluctant bank lenders have continued to be a drag on large LBOs.