Asia Real Estate

China

Despite geopolitical tensions and the impact of overseas interest rate hikes, China’s economy continued to gain traction, growing 5.2% year-over-year in the fourth quarter and 5.2% for the full year of 2023, meeting the central government’s growth target of 5.0%. Since reopening from zero-COVID in December 2022, China has shifted its focus to economic growth and rolled out a series of accommodative macroeconomic policies. The People’s Bank of China cut the reserve requirement ratio by 50 basis points in February 2024, following two 25-basis-point cuts in September 2023 and March 2023. The five-year loan prime rate (LPR) was lowered by 25 basis points in February 2024, following an earlier 10-basis-point cut for one-year LPR in August 2023 and another 10-basis-point cut for one- and five-year LPR in June 2023. For the full year 2023, exports increased 0.6% year-over-year and value-added industrial output rose by 4.6%. Domestic retail sales increased 7.2% in 2023, and online retail sales increased 8.4%. China remains highly focused on developing its advanced manufacturing sector, particularly in industries such as life sciences, integrated circuitry, and new energy. While total fixed-asset investment activity grew only 3.0% year-over-year in 2023, fixed-asset investment in high-tech industries grew 10.3% year over-year.

Despite geopolitical tensions and the impact of overseas interest rate hikes, China’s economy continued to gain traction, growing 5.2% year-over-year in the fourth quarter and 5.2% for the full year of 2023, meeting the central government’s growth target of 5.0%. Since reopening from zero-COVID in December 2022, China has shifted its focus to economic growth and rolled out a series of accommodative macroeconomic policies. The People’s Bank of China cut the reserve requirement ratio by 50 basis points in February 2024, following two 25-basis-point cuts in September 2023 and March 2023. The five-year loan prime rate (LPR) was lowered by 25 basis points in February 2024, following an earlier 10-basis-point cut for one-year LPR in August 2023 and another 10-basis-point cut for one- and five-year LPR in June 2023. For the full year 2023, exports increased 0.6% year-over-year and value-added industrial output rose by 4.6%. Domestic retail sales increased 7.2% in 2023, and online retail sales increased 8.4%. China remains highly focused on developing its advanced manufacturing sector, particularly in industries such as life sciences, integrated circuitry, and new energy. While total fixed-asset investment activity grew only 3.0% year-over-year in 2023, fixed-asset investment in high-tech industries grew 10.3% year over-year.

The Shanghai industrial and logistics market improved in the fourth quarter, with net absorption of 234,000 square meters. New supply was delivered in the logistics market during the fourth quarter, adding approximately 285,000 square meters. The recovery of demand led to marginal growth in vacancy to 15% during the quarter, while industrial rents stayed flat.

The multifamily sector, particularly in leading cities such as Beijing and Shanghai, maintained strong and sustainable demand attributable to significant domestic migration and affordability of for-sale housing. To bolster this trend, the government has introduced a series of supportive policies, such as offering preferential tax treatment for the conversion of commercial properties into multifamily.

In terms of overall market activity, year-to-date transaction volume totaled RMB 206.3 billion — down 13% year-over-year due to the cautious investor sentiment. Logistics, multifamily, and business parks remained the most prevalent investment asset classes.

China’s GDP improved modestly in the first quarter of 2024.

CNY values weakened in the first quarter of 2024.

Hong Kong

In the wake of the pandemic, Hong Kong’s economy experienced a resurgence in 2023 — expanding 4.3% year-over-year in the fourth quarter and 3.2% for the full year — driven by the strong recovery of inbound tourism and private consumption. Total exports declined in 2023, falling 10.3% year-over-year amid the challenging global market environment. Total exports of services grew substantially by 21.2% in 2023. Private consumption improved, increasing 7.3% year-over-year in 2023 alongside the continued economic recovery. In February 2024, the government announced its 2024-25 budget focusing on measures to boost economic and investment activity, including the relaxation of stamp duty policies to improve residential property market liquidity and raising the loan-to-value caps for both residential and non-residential mortgage loans.

The residential rental and student housing sectors have benefitted from the influx of foreign talent, expatriates, and non-local university students to the city. As of November 2023, the talent admission program established by the Hong Kong government had received more than 205,000 applications with approximately 127,000 approved. Additionally, roughly 90,000 professionals arrived in Hong Kong in 2023, nearly three times the annual target for this new program. The number of non-local students in Hong Kong has increased 17.3% from 2021/22 to 2022/23, resulting in the non-local student ratio increasing from 22% to 25% during the same period. Within the 2024-25 budget, the government has introduced additional initiatives to attract professional talent, including relaxation of visa policies and an increase in the admissions quota of non-local students to local universities from 20% to 40%, which is a dramatic change.

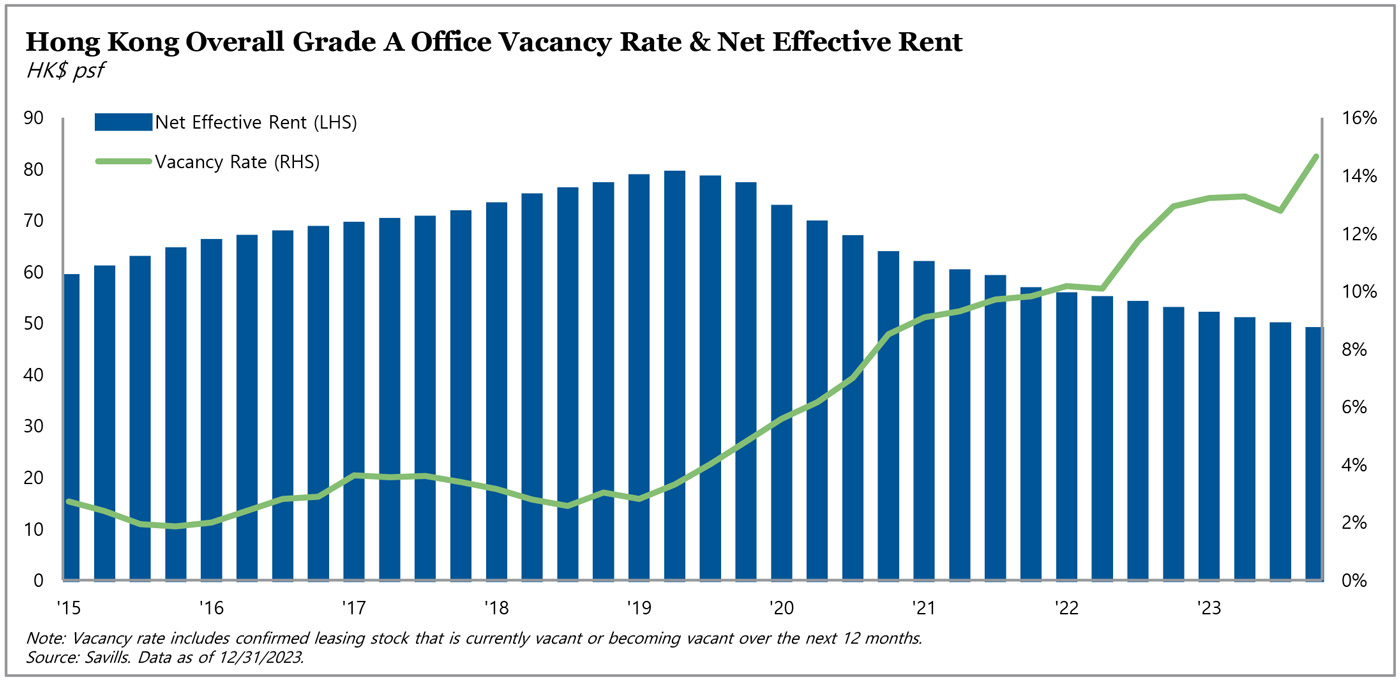

In the fourth quarter of 2023, residential prices retreated 6.4% year-over-year and 6.1% quarter-over-quarter — remaining below the high recorded in September 2021. This decline is mainly attributable to smaller residential units — decreasing by 6.0% as compared to the 4.9% price decline for larger units. On the other hand, mass residential rents grew by 6.2% in 2023, and townhouse rents grew by 8.6%. Commercial real estate investment transaction volume reached HK$40.4 billion for the full year of 2023, just 53% of the previous year’s total, as the asset class has remained out of favor. Investment demand in the fourth quarter was largely supported by end-users, accounting for 57% of the quarterly transaction volume. The office sector continued to remain weak, both in terms of tenant demand and investor interest. As of December 2023, Hong Kong’s office vacancy increased slightly to 14.7%, while rents fell by 1.8% in the fourth quarter.

Hong Kong’s office vacancy increased slightly to 14.7%.

Japan

In the final quarter of 2023, Japan’s real GDP grew 0.4% quarter-over-quarter as strong capital expenditures helped the economy avoid a technical recession. Japan’s labor market remained resilient, with unemployment at 2.4% as of January 2024. The inflation rate decreased slightly to 2.0% during the same time — a continued decline from the 41-year high of 4.2% recorded exactly a year ago — and real wages fell 0.6% year-over-year, continuing their 22-month decline.

Office real estate fundamentals strengthened in the fourth quarter, supported by unwavering tenant demand. All-grade vacancy rates decreased from 5.2% to 4.7% in Tokyo and from 3.3% to 2.9% in Osaka quarter-over-quarter. Tokyo also experienced a 0.9% decrease in the Grade A office vacancy rate during the quarter, down to 5.7%, with net absorption of 3 million square feet in newer buildings — roughly double the average seen in recent quarters. We expect office demand to remain stable, with vacancies continuing to be filled by relocations from suburban areas, consolidations, expansions, and demand from office upgrades.

Logistics vacancy for large multi-tenant facilities in greater Tokyo rose from 8.9% to 9.3% quarter-over-quarter, with the delivery of 3.7 million square feet of new supply. In the greater Osaka area, the vacancy rate for large multi-tenant facilities increased to 6.0%, up 1.5% quarter-over-quarter, due to new supply deliveries; however, for facilities that were built more than one year ago, vacancy was a mere 0.2%, as tenants prefer to sign leases after a property has been delivered rather than during construction.

Transaction volume in 2023 was ¥3.8 trillion, down 3% year-over-year. Investments by domestic investors, including Japanese REITs (J-REITs), increased 12%, while foreign investor appetite fell by 28%. The hotel sector experienced the most notable year-over-year growth, increasing by 2.5 times from 2022 to reach ¥529 billion, marking the highest amount in the past five years. The office sector continued to lead in transaction activity, with investment volume of ¥1.1 trillion, driven by strong demand from domestic buyers looking to purchase stabilized assets.

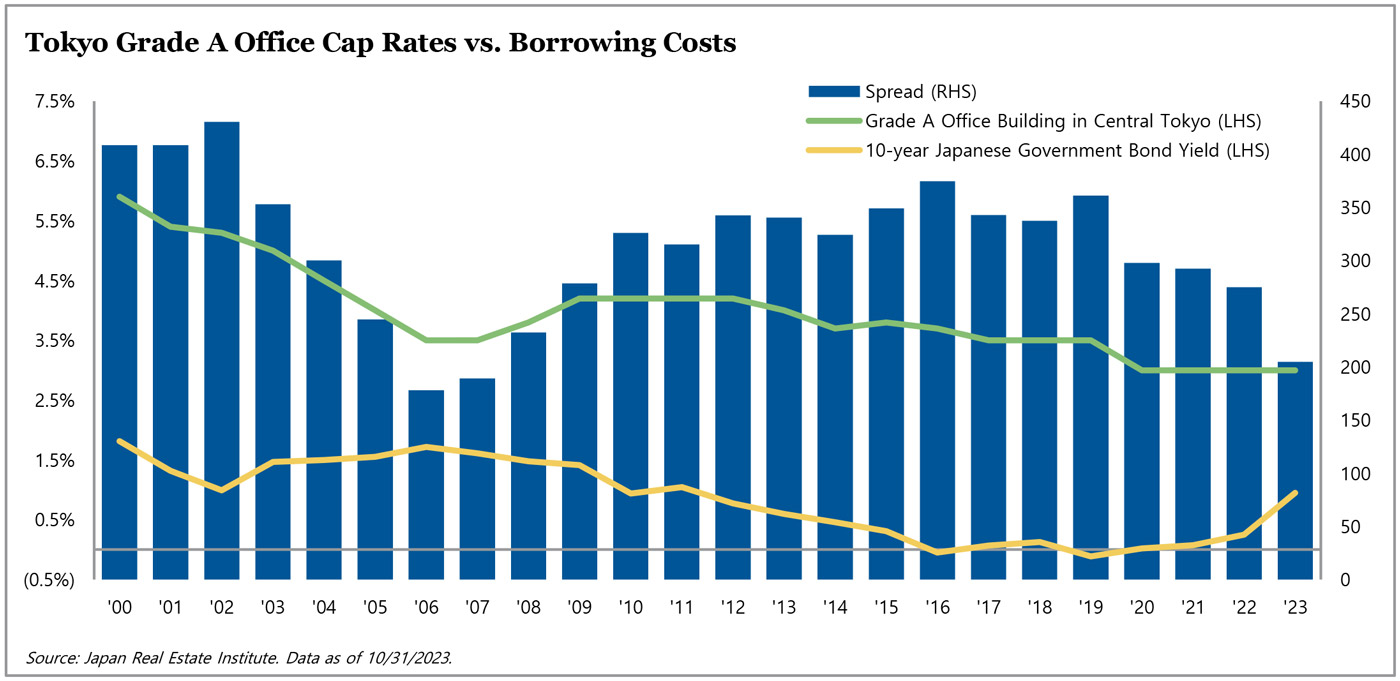

Office cap rate spreads in Japan remained wide despite an uptick in 10-year Japanese government bond yields.

J-REIT performance has declined, resulting in higher yields and limiting J-REITs’ abilities to make accretive acquisitions.

Tokyo office vacancy declined as overall market fundamentals strengthened in the fourth quarter of 2023.

South Korea

The Bank of Korea (BoK) held its base rate at 3.50% in the fourth quarter, leaving it unchanged since January 2023. Consequently, the rate gap between South Korea and the U.S. stands at an all-time high of 200 basis points, as the U.S. Federal Reserve kept its benchmark interest rate steady following a 25-basis-point increase in July 2023. In the fourth quarter, South Korea’s GDP continued its economic growth of 0.6% quarter-over-quarter. Looking ahead, the BoK has projected 2024 economic growth to reach 2.1% while inflation is expected to moderate to 2.3%.

On the real estate front, office cap rates stood at 4.5% in the fourth quarter of 2024 — up 10 basis points quarter-over-quarter. Spreads between prime office cap rates and Korean government bond yields (i.e., 10-year treasury bonds) widened and stood at approximately 130 basis points. This spread widening can be attributed to lower treasury yields, which stood at 3.2% at the end of the fourth quarter — down 80 basis points quarter-over-quarter. Such yield movement was caused by a shift in market expectations, anticipating a potential interest rate cut by the Fed in the upcoming year.

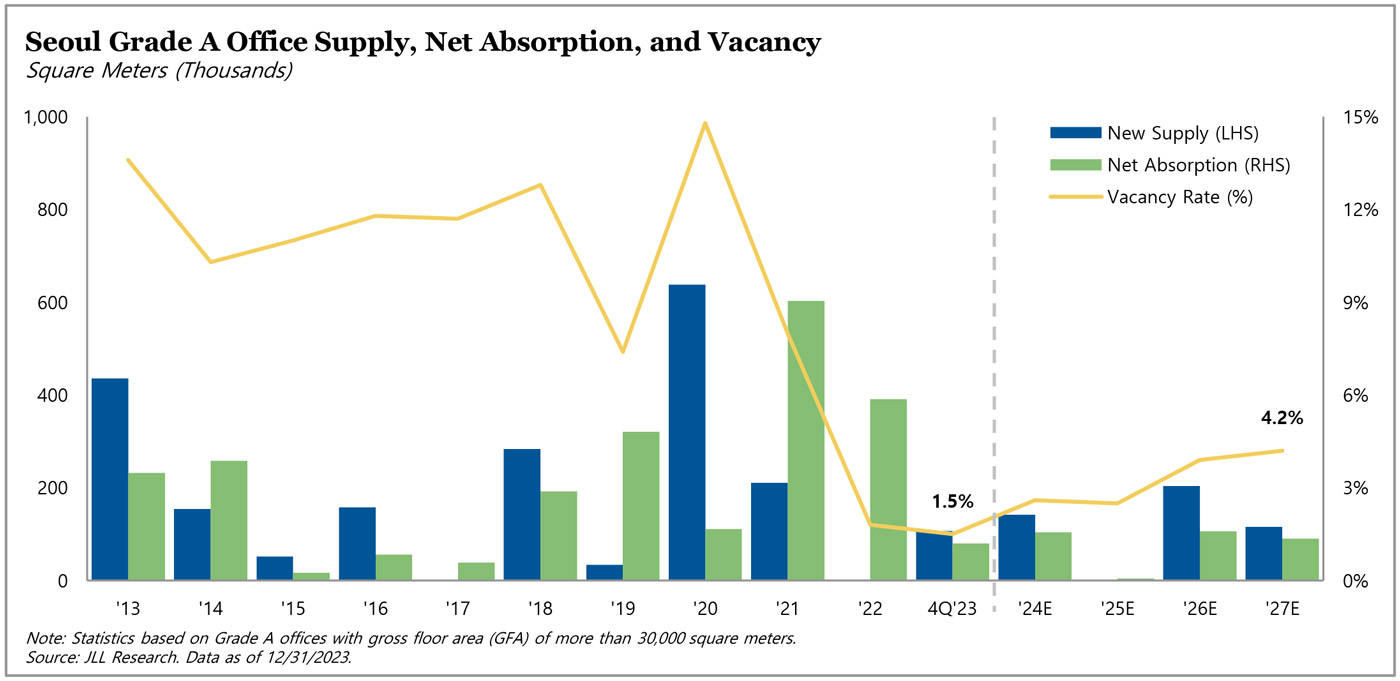

Office fundamentals remained strong backed by robust demand. Prime office vacancy in Seoul decreased to 1.5% at the end of the fourth quarter — down 50 basis points from the previous quarter. With sufficient demand and limited ongoing supply, vacancy rates are projected to remain below 5.0% for the next four years. Additionally, overall office rents increased 10.3% year-over-year, with the Gangnam Business District exhibiting a 13.6% rent growth year-over-year. Investment activity totalled ₩2.4 trillion in the fourth quarter — down 11.9% year-over-year. On a year-to-date basis, transaction volume totalled ₩11.3 trillion — down 32.0% year-over-year, mainly due to investor concerns over rising financing costs.

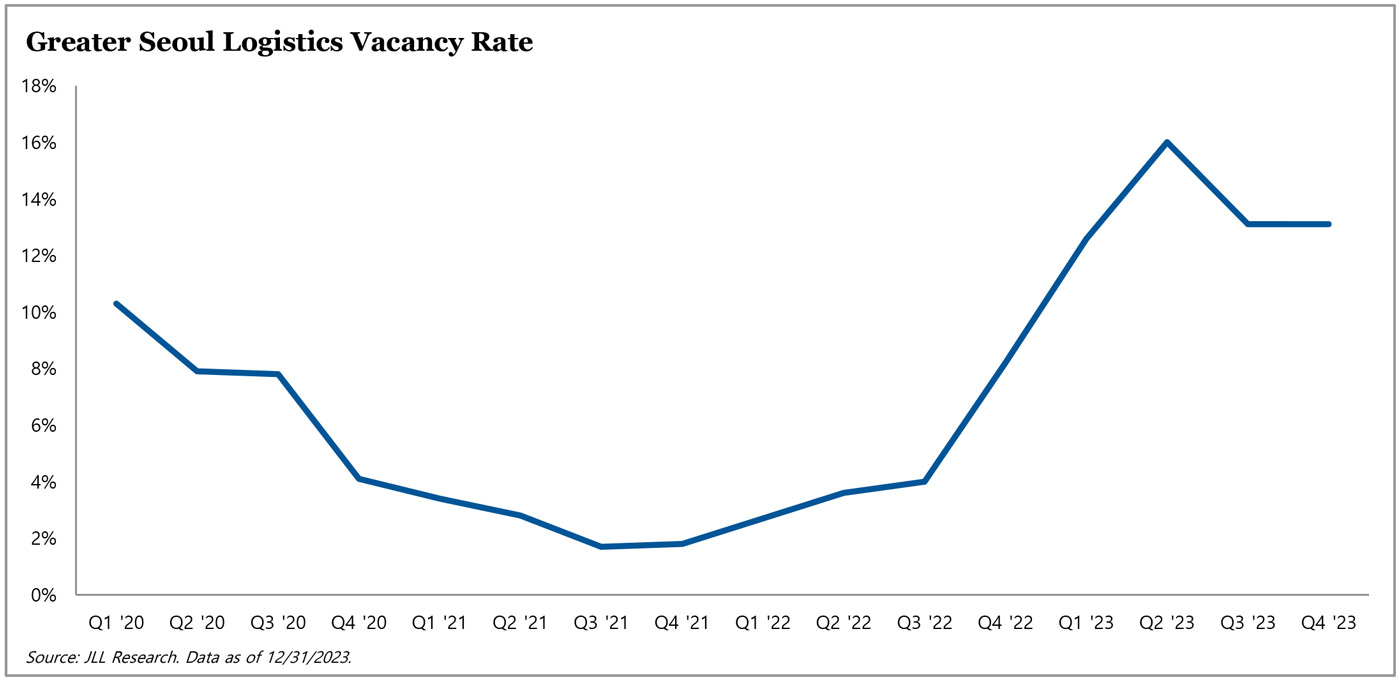

Logistics vacancy in Greater Seoul stood at 13.1% in the fourth quarter — in line with the previous quarter — despite 11.5 million square feet of new supply delivered during the period. Even with the increase in supply, demand for logistics space in Greater Seoul remained strong, with net absorption of over 10 million square feet. According to JLL, the vacancy rates in key logistics submarkets are expected to improve over the next two years, with reduced future supply and resilient demand. Meanwhile, logistics transaction volume amounted to ₩1.1 trillion in the fourth quarter — up 53.1% year-over-year. On an annual basis, transaction volume reached ₩6.4 trillion — down 2.6% year-over-year.

For more information on TPG AG Asia Real Estate, visit angelogordon.com/strategies/real-estate/asia-real-estate/

Prime office vacancy in Seoul is near a historical low and is projected to remain below 5%, underpinned by robust demand and limited future supply.

Office rents in Greater Seoul remained robust across all four major submarkets despite concerns of a global economic slowdown.

Logistics vacancy remains high due large-scale supply in recent quarters, but future supply is expected to moderate in the next two years.