Europe Real Estate

The effects of higher interest rates have continued to impact European economies and real estate markets. Eurozone GDP remained flat in 2023 and will likely stagnate in the first half of 2024. The European Central Bank (ECB) decided to keep interest rates at the record-high of 4% in April, defying market expectations of a rate cut early this year. However, with headline inflation easing to 2.4% in March — closer to the ECB’s 2% target — it is possible that the central bank will cut rates in the second half of the year.

The effects of higher interest rates have continued to impact European economies and real estate markets. Eurozone GDP remained flat in 2023 and will likely stagnate in the first half of 2024. The European Central Bank (ECB) decided to keep interest rates at the record-high of 4% in April, defying market expectations of a rate cut early this year. However, with headline inflation easing to 2.4% in March — closer to the ECB’s 2% target — it is possible that the central bank will cut rates in the second half of the year.

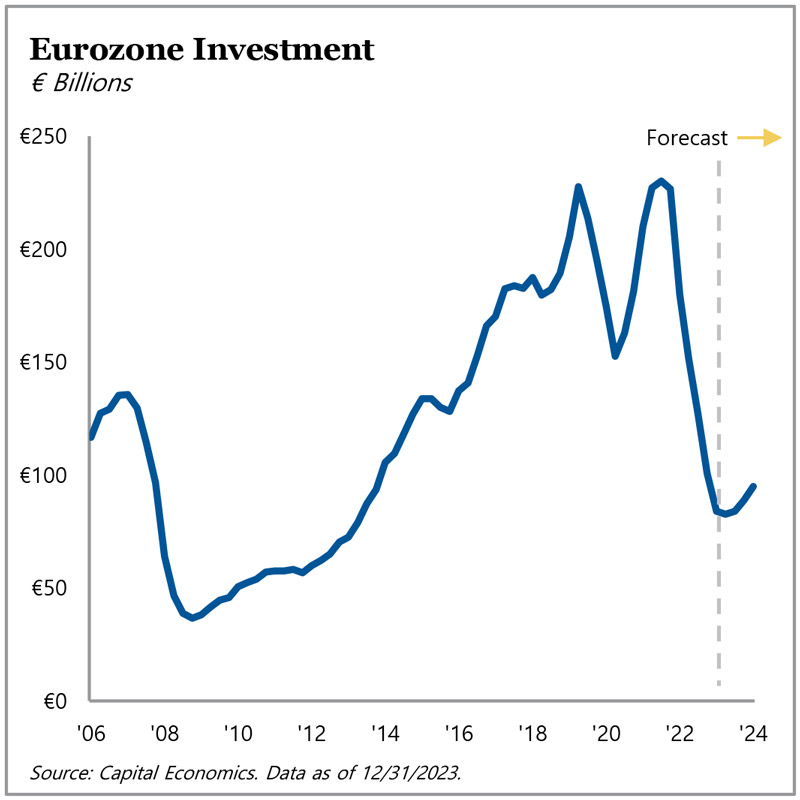

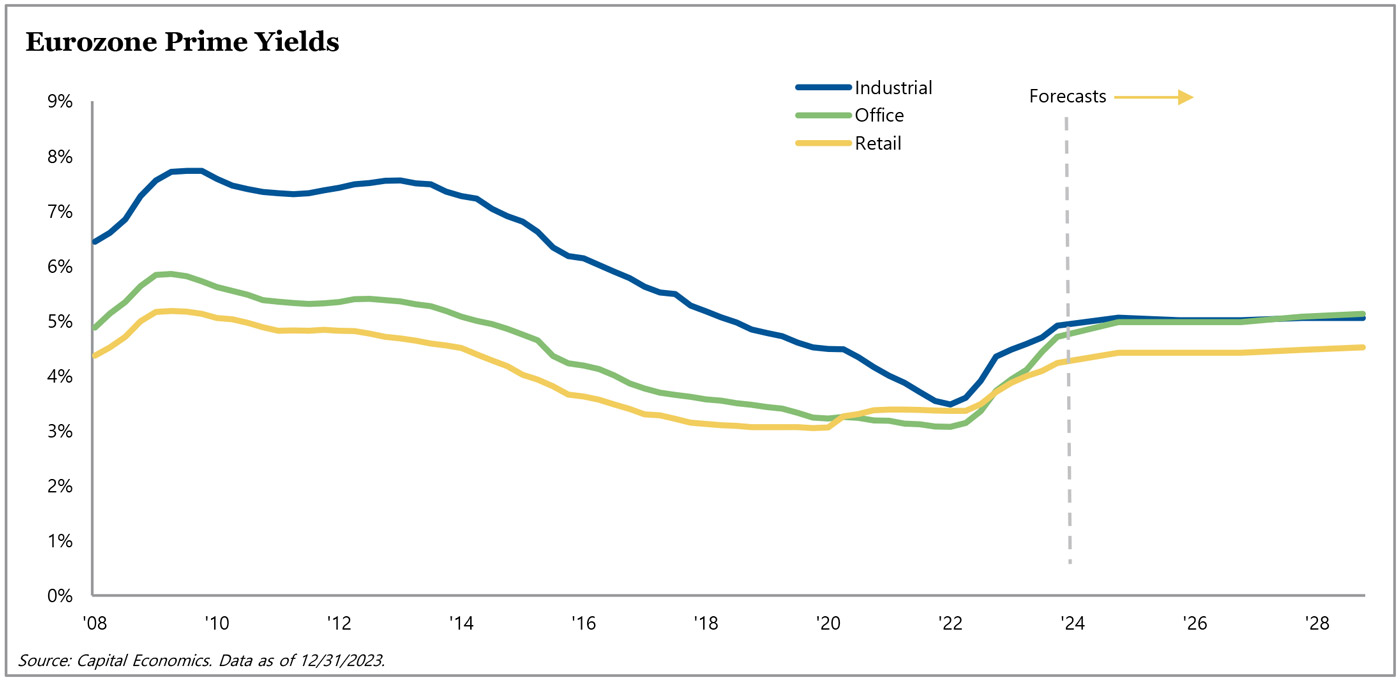

Given elevated inflation, interest rates, and a tight lending market, real estate transaction volume was the lowest it has been in over a decade in full year 2023. Overall, annual investment fell nearly 50% year-over-year, with a peak-to-trough decline since mid-2022 of approximately 65%. Muted transaction activity and expanding cap rates have led to declining prices across virtually all real estate sectors; however, the fourth quarter of 2023 showed signs of improvement, as volume notably increased in larger markets such as Spain, France, and Italy. That being said, with interest rate cuts likely delayed, bond yields edged up, which we expect will put further pressure on valuations in the near-term.

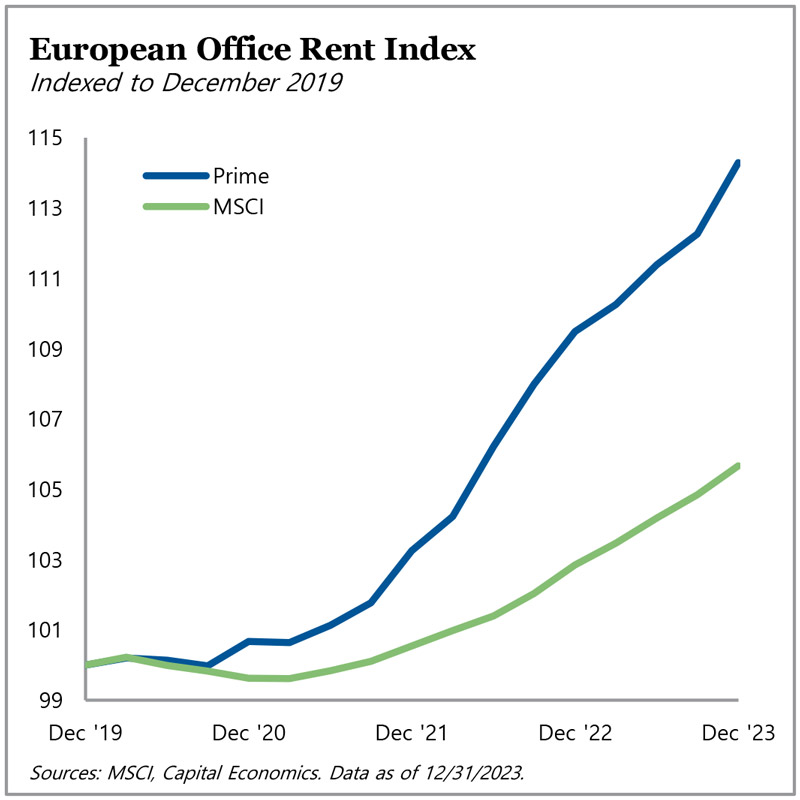

Unsurprisingly, European office leasing remained weak and full-year 2023 data shows take-up declined 15-20%. Prime office assets continued to outperform, as occupiers remained focused on location and quality. This has been reflected in rental performance, as average office rents have increased 4.5% since 2019, while prime rents have grown at twice that rate — deepening the polarization between prime and non-prime assets. In multifamily, demand for rental accommodations has been bolstered by rising rates across Europe, and the sector continues to attract institutional investment.

With potential interest rate cuts on the horizon — albeit delayed — we will likely see an increase in liquidity in the second half of 2024; however, we also expect the overall recovery to be sluggish as real estate owners adjust to a structurally higher rate environment. In this environment, credit products can offer a competitive and compelling yield compared to core commercial property, and as a result, we have been seeing some investors rotate out of core real estate, particularly through redemptions from open-ended core funds. This rotation may be structural and might mean liquidity for commercial real estate remains impaired compared to previous cycles. Combined with valuation drops and rapidly approaching 2024 and 2025 debt maturities, we have started to see stressed and distressed sellers emerge, and we expect these factors will create significant opportunities to purchase high-quality assets at discounted prices.

For more information on TPG AG Europe Real Estate, visit angelogordon.com/strategies/real-estate/europe-real-estate/

There has been a significant decline in transaction volume since the peak recorded in mid-2022; however, Q4 2023 brought increased activity.

Prime office rents have outperformed since the pandemic and continue to diverge from non-prime assets.

Expanding cap rates have led to significant valuation declines across nearly all sectors.

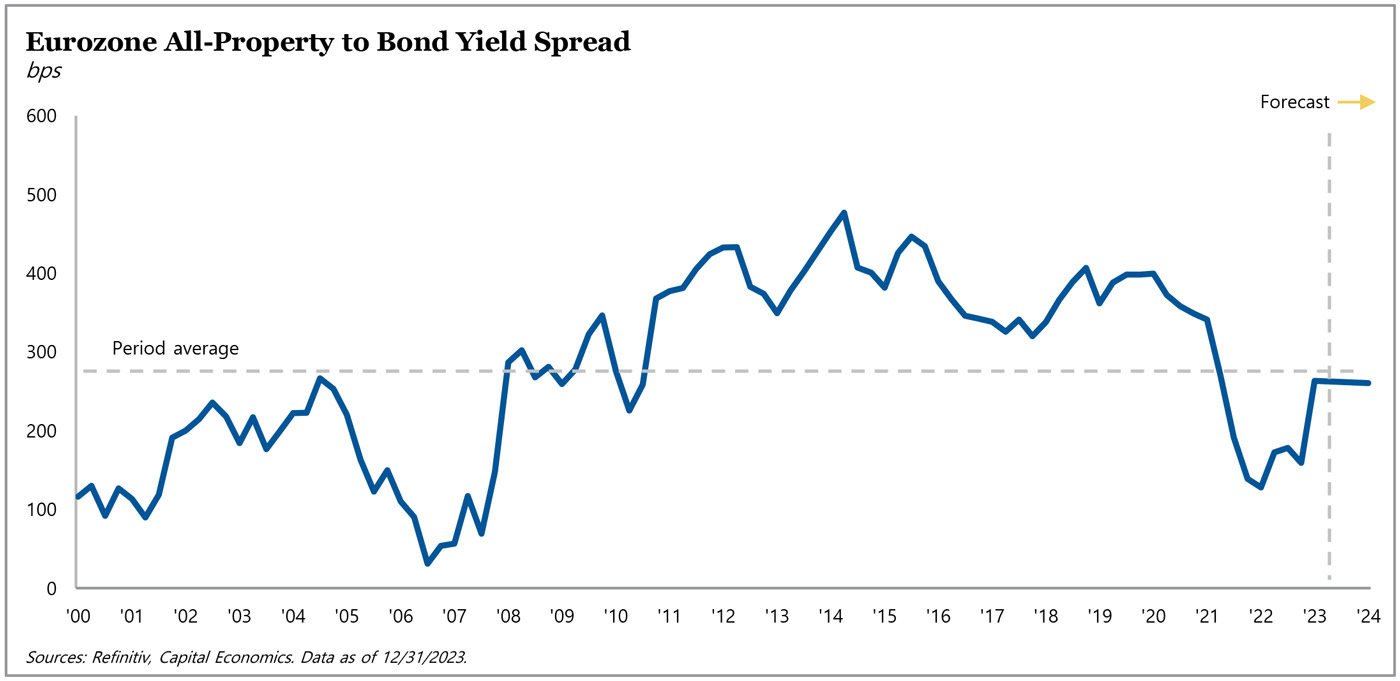

Property-to-bond spreads have narrowed compared to the 20-year average, causing some investors to rotate out of core commercial real estate investments.