U.S. Real Estate

The U.S. economy continued to demonstrate resilience in the first quarter, with steady GDP and employment growth. Inflation — while cooling from its 2022 peak — remained elevated, and there continues to be significant uncertainty around the timing and pace of the Fed’s rate cutting cycle. The consensus view of a soft landing has also been clouded by emerging risks, such as those in the consumer sector, where credit card and auto loan delinquency levels have increased from their pandemic-era lows.

The U.S. economy continued to demonstrate resilience in the first quarter, with steady GDP and employment growth. Inflation — while cooling from its 2022 peak — remained elevated, and there continues to be significant uncertainty around the timing and pace of the Fed’s rate cutting cycle. The consensus view of a soft landing has also been clouded by emerging risks, such as those in the consumer sector, where credit card and auto loan delinquency levels have increased from their pandemic-era lows.

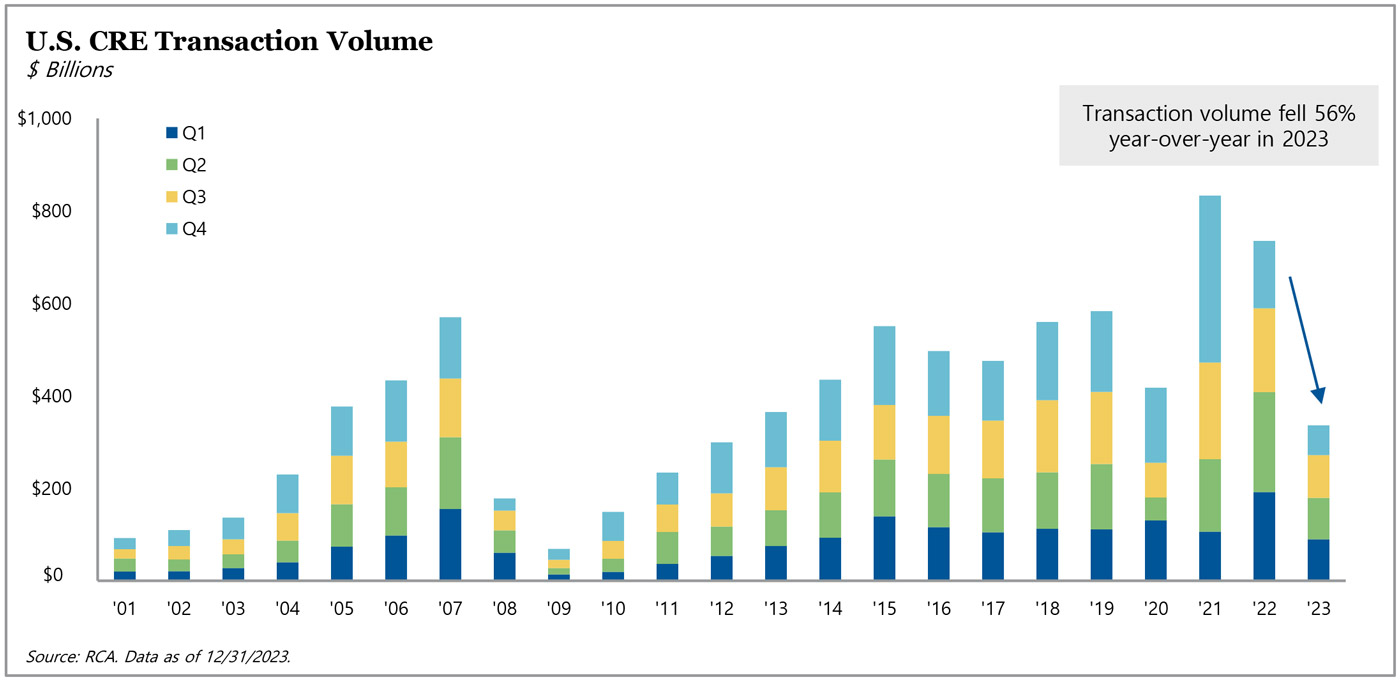

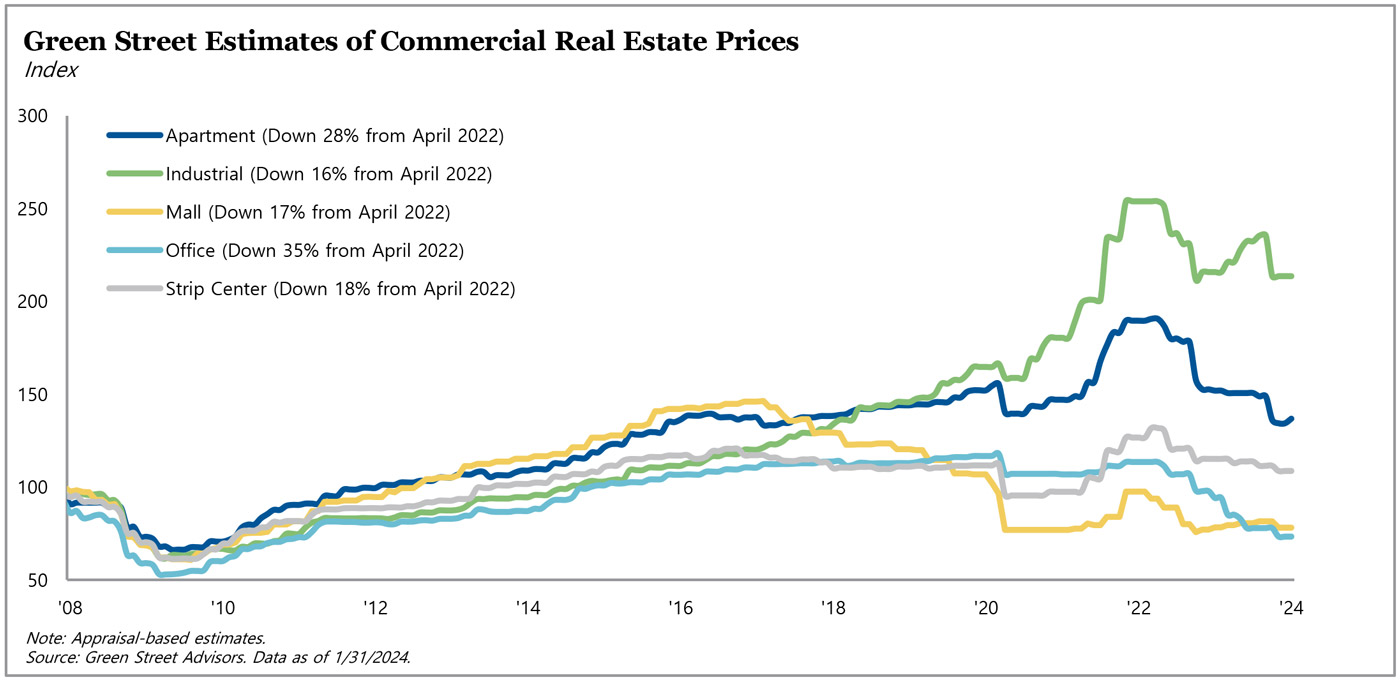

The uncertain macro backdrop contributed to a 56% year-over-year decline in overall transaction volume in 2023, as buyers navigated heightened borrowing costs and limited financing options. This trend continued into 2024, with February data indicating a 47% year-over-year decrease in transaction volume. Based on this limited transaction data, pricing has remained depressed relative to its 2022 peak, though the rate of decline in pricing seems to be moderating and there is significant dispersion across sectors. Fundamentals remained relatively stable across most sectors other than office, with generally manageable supply levels; however, there are pockets of overbuilding in multifamily and industrial in certain geographies, so market and submarket selection remains critical. We expect the sharp curtailment of the forward delivery pipeline due to escalating construction costs and financing constraints to support fundamentals in 2026 and beyond.

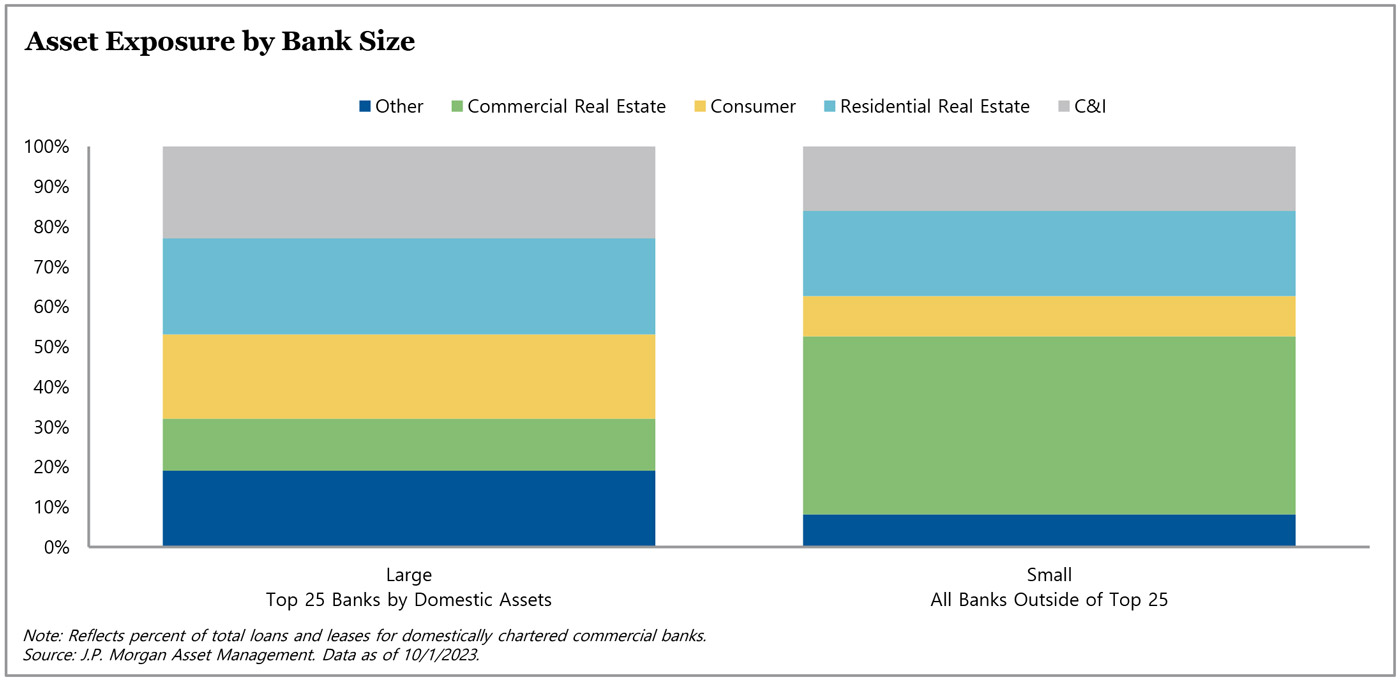

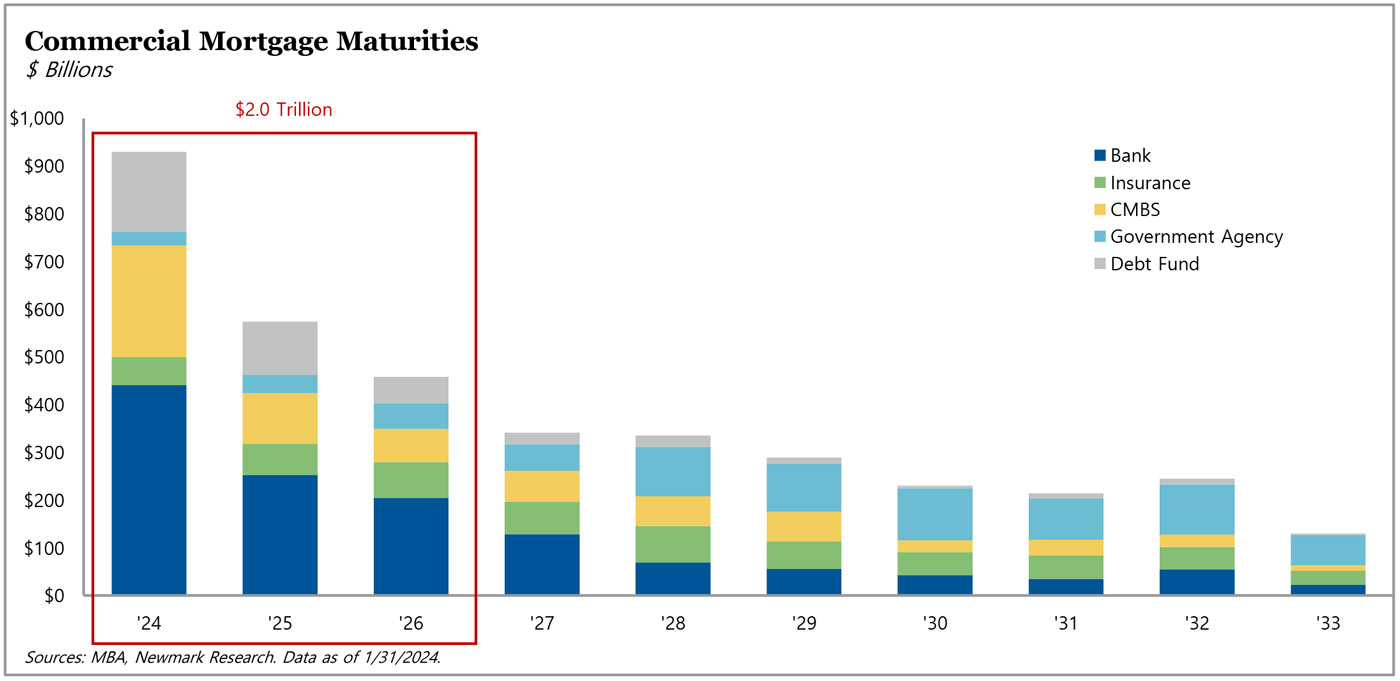

Commercial real estate (CRE) loan origination volume in the first quarter of 2024 was down more than 48% from the first quarter of 2023, as elevated base rates and more stringent lending standards continued to significantly hamper originations. Challenges in lenders’ existing loan books also contributed to a pullback in originations, as delinquencies have steadily risen since the third quarter of 2022 and are nearly triple the low recorded in the fourth quarter of 2019. Smaller banks have significantly higher exposure to CRE loans as compared to their larger counterparts, so we expect they may be more meaningfully impacted by these non-performing CRE loans. With $2 trillion of commercial mortgages set to mature over the next 36 months — approximately 43% of total outstanding loans — we believe there will be a growing opportunity to provide rescue capital or acquire high-quality assets at reset valuations.

For more information on TPG AG U.S. Real Estate, visit angelogordon.com/strategies/real-estate/u-s-real-estate/

The Fed has signaled its interest rate hiking campaign is likely finished, but there continues to be significant uncertainty around the timing and pace of rate cuts, particularly as inflation remains above the Fed’s target.

After reaching peak levels in 2021 and 2022, commercial real estate transaction volume has experienced a notable decline as buyers grapple with increased borrowing costs, limited financing, and an uncertain macroeconomic landscape.

U.S. commercial property prices were down from their 2022 peak, with variation in valuation declines across asset classes.

Commercial real estate loan exposure is significantly higher at smaller banks compared to their larger counterparts.

As loans mature, we expect increased borrowing costs and reduced proceeds for replacement financing to create distress and voids in capital structures, which will need to be filled by new equity or rescue capital.