Convertible Arbitrage

Risk assets continued to build on the strong fourth quarter of 2023, with global equities up over 10% in the first quarter of this year. A string of strong economic readings supporting a soft-landing narrative carried a number of underlying equity markets to all-time highs. However, more persistent inflation led investors to price in fewer cuts by the Fed, which led to a rate selloff, which weighed on bond performance. The BofA Global 300 Converts Index was up 3.6% led by Japan and Europe, outperforming other fixed income assets in the quarter.

Risk assets continued to build on the strong fourth quarter of 2023, with global equities up over 10% in the first quarter of this year. A string of strong economic readings supporting a soft-landing narrative carried a number of underlying equity markets to all-time highs. However, more persistent inflation led investors to price in fewer cuts by the Fed, which led to a rate selloff, which weighed on bond performance. The BofA Global 300 Converts Index was up 3.6% led by Japan and Europe, outperforming other fixed income assets in the quarter.

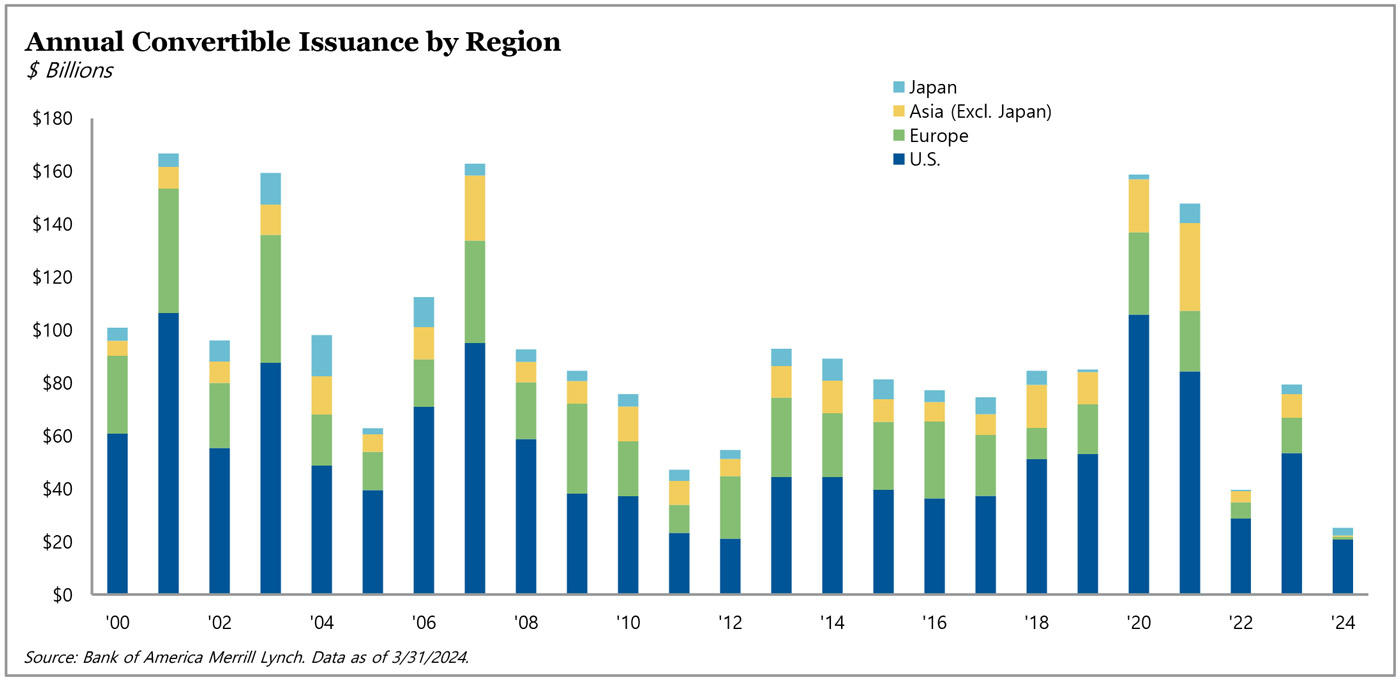

Global issuance was $25.2 billion, heavily skewed to the U.S., and about 60% of proceeds have been used to refinance outstanding debt in the face of high rates and a looming maturity wall. A key reason for the strong issuance in the convertible bond market is the cash interest savings for issuers versus conventional debt, which averaged 550 basis points of savings in the first quarter. Overall, there was a net reduction in supply of $761 million in the first quarter, driven by $4.7 billion of bond redemptions in Europe. The limited supply in Europe has supported secondary market valuations. We are closely monitoring Japan issuance, which has been strong, but new issue pricing is not as attractive compared to the U.S. and Europe. At the end of the first quarter, the global convertible market size was $368 billion.

A theme we continue to watch is the impact of the rate increases from 2022 and 2023 on the cash interest costs of even the highest quality issuers. In the first quarter, investment grade issuers that came to the converts market saved 175 basis points on average relative to a conventional debt alternative. In fact, this dynamic has brought first-time issuers to the market, representing over 40% of the market in the first quarter.

For more information on TPG AG Convertible Arbitrage, visit angelogordon.com/credit/multi-strategy/arbitrage/convertible-arbitrage/

Global new issuance picked up in the first quarter of 2024, driven by the U.S.