Merger Arbitrage

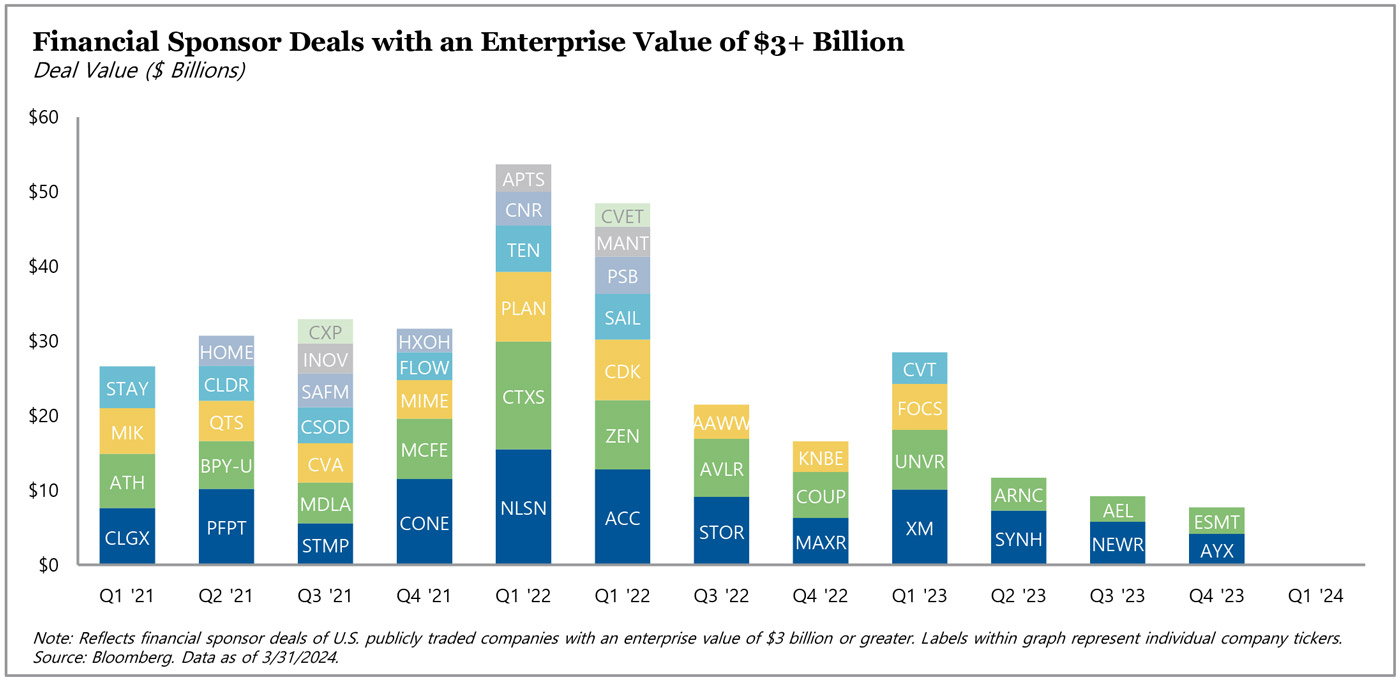

In the first quarter of 2024, U.S. M&A volume increased 28% year-over-year aided by two $35 billion deals, with Discover Financial Services agreeing to merge with Capital One Financial Corporation and Synopsys, Inc. announcing an acquisition of Ansys, Inc. While not accounting for any of the top three deals this quarter, energy and healthcare remained the most active sectors and together represented over 50% of the top ten deals during the period. Financial sponsor activity remained muted, declining to 4% of total deal value and not accounting for any of the top ten deals for the second consecutive quarter.

In the first quarter of 2024, U.S. M&A volume increased 28% year-over-year aided by two $35 billion deals, with Discover Financial Services agreeing to merge with Capital One Financial Corporation and Synopsys, Inc. announcing an acquisition of Ansys, Inc. While not accounting for any of the top three deals this quarter, energy and healthcare remained the most active sectors and together represented over 50% of the top ten deals during the period. Financial sponsor activity remained muted, declining to 4% of total deal value and not accounting for any of the top ten deals for the second consecutive quarter.

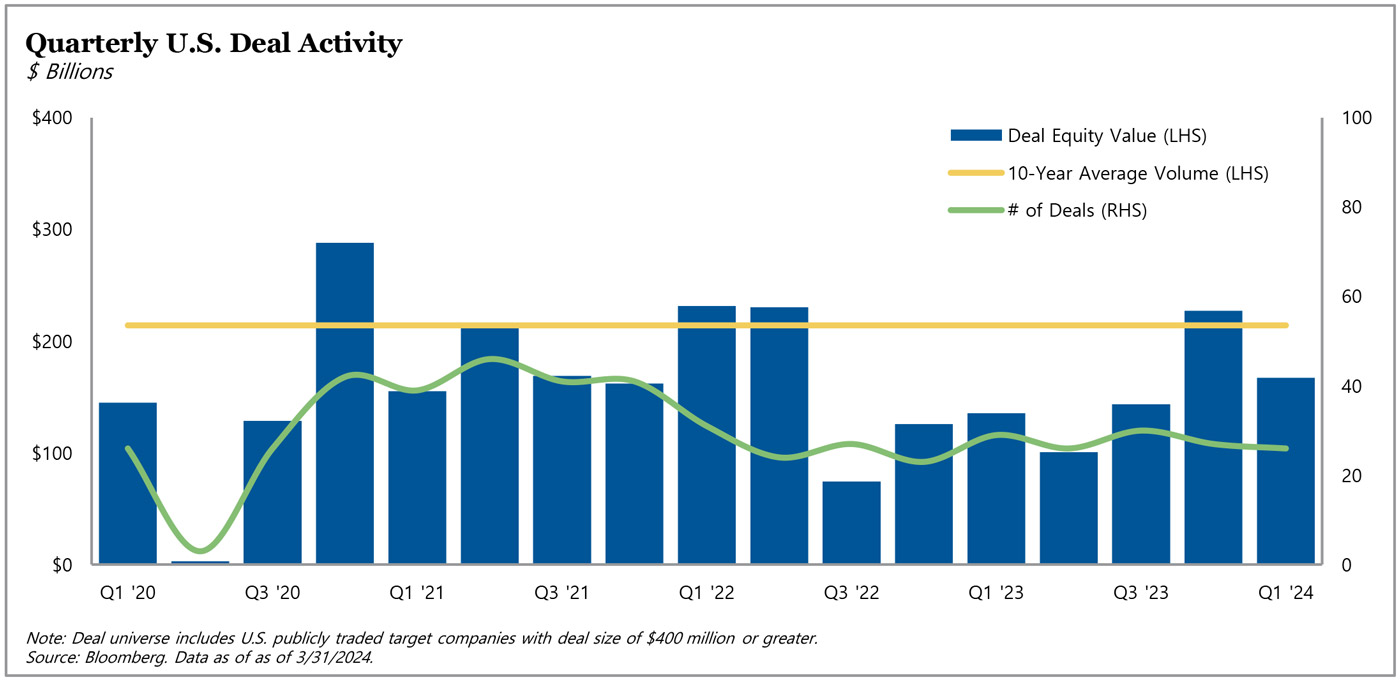

At quarter-end, aggregate U.S. deal value increased to $341 billion, and the total arbitrage profit pool grew to $27.9 billion. While the average adjusted annualized spread in the U.S. deal universe tightened from 11.4% to 9.7% in the first quarter, the market-cap-weighted adjusted gross spread widened to from 7.8% to 9.1%. Although the quarter saw PGT Innovations receive a topping bid from MITER Brands and Thoma Bravo bump up its purchase price for Everbridge, Inc., regulatory actions again dominated investor discussion during the period. The year started off with three deal terminations: Amazon had to abandon its pending acquisition of iRobot after running into European Commission concerns; Avangrid, Inc. terminated its three-year pursuit of a merger with PNM Resources; and JetBlue Airways abandoned its acquisition of Spirit Airlines after a federal judge blocked the proposed deal. These three deals were long-dated carryovers from 2023, thus their unfavorable terminations did not surprise arbitrage investors. Additionally, the FTC sued to block Kroger’s acquisition of Albertsons Companies, an event the market had anticipated for many months.

U.S. antitrust agencies appeared to be sticking to their 2023 playbook through the first quarter of this year. The FTC continued its pattern of issuing Second Requests to deals that many market participants believe historically would have easily cleared and closed, with such delays deterring some from transacting. Much like last year, these regulatory actions have resulted in deals that otherwise likely would have closed in the first quarter being pushed, with decisions not being expected until late in the second quarter or back half of 2024. Despite the regulatory environment, U.S. M&A continued its recovery toward the long-term average volume of activity.

For more information on TPG AG Merger Arbitrage, visit angelogordon.com/credit/multi-strategy/arbitrage/merger-arbitrage/

The gradual recovery in M&A continued in Q1 2024, but M&A volume continued to run below the long-term average.

Despite record investable cash and the talk of more mega-funds being raised this year, in Q1, financial sponsors failed to announce a $3 billion deal for the first time since the COVID-19 shutdown in Q3 2020.