Middle Market Direct Lending

Total sponsored middle market volume, including direct and syndicated activity, amounted to $32 billion in the first quarter of 2024 — down 6% quarter-over-quarter but up over 45% year-over-year. The increase in volume was driven by direct lending, which was up over 80% year-over-year. Private credit continued to be the preferred source of financing, with the ratio of direct lending to syndicated volume standing at 2.6x. M&A activity in the lower middle market (LMM) increased 12% quarter-over-quarter, while core and upper middle market volumes decreased by 30% and 40%, respectively. While first-lien loans continued to account for the largest amount of financing in the middle market, unitranche structures are gaining popularity, as evidenced by a 73% increase year-over-year.

Total sponsored middle market volume, including direct and syndicated activity, amounted to $32 billion in the first quarter of 2024 — down 6% quarter-over-quarter but up over 45% year-over-year. The increase in volume was driven by direct lending, which was up over 80% year-over-year. Private credit continued to be the preferred source of financing, with the ratio of direct lending to syndicated volume standing at 2.6x. M&A activity in the lower middle market (LMM) increased 12% quarter-over-quarter, while core and upper middle market volumes decreased by 30% and 40%, respectively. While first-lien loans continued to account for the largest amount of financing in the middle market, unitranche structures are gaining popularity, as evidenced by a 73% increase year-over-year.

Terms for direct lender-led deals continued to be favorable during the first quarter, as evidenced by the consistent yield premium for middle market deals over large corporate deals, which remained elevated but flat with the fourth quarter at 265 basis points. All-in yields on first-lien term loans remained attractive at around 12%, although the direction of yields varied by company size. Spreads tightened across the direct lending market, with unitranches compressing the most — moving approximately 30 basis points. The healthcare sector led the charge, breaking a 12% all-in yield, followed by technology at 11.8% and business services at 11.7%.

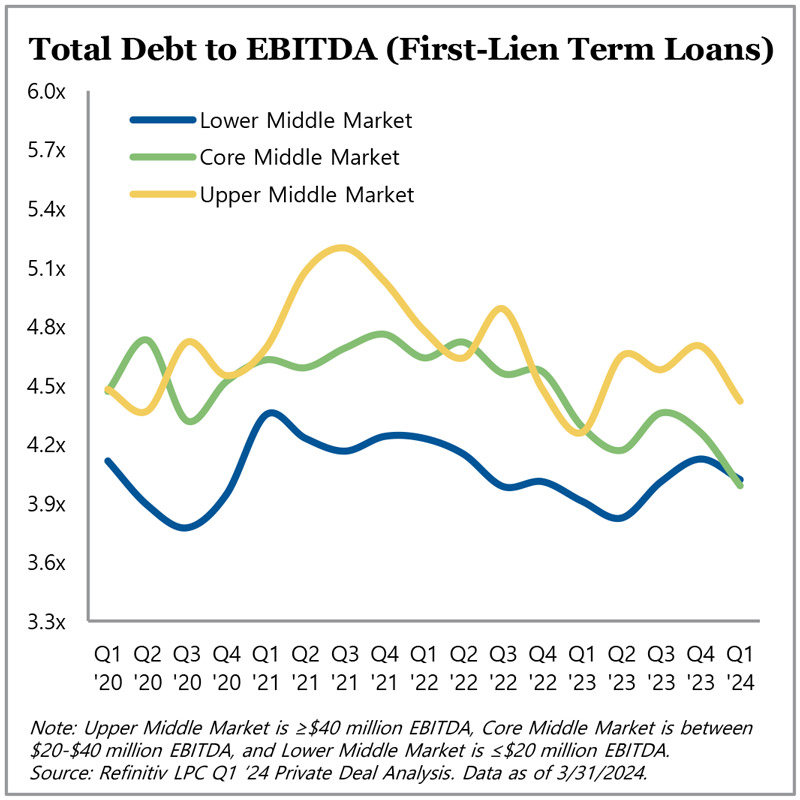

Direct lenders remained disciplined on leverage levels, with leverage tightening across all market segments. Furthermore, equity contributions for middle market LBOs returned to a peak of 62%, which was last reached in the first quarter of 2023. Despite concerns that borrowers are facing challenges due to sustained higher interest costs, interest coverage ratios generally remained flat quarter-over-quarter, decreasing less than 10 basis points to just under 2.0x.

The annualized private credit default rate increased slightly in the fourth quarter of 2023, up 20 basis points to 1.6%. However, default rates across the middle market remained muted, driven by a rate of less than 1% for LMM companies — the lowest LMM level recorded since reporting of the metric began in the first quarter of 2020. Comparatively, default rates for core and upper middle market companies ended 2023 north of 2%, with the core middle market default rate decreasing 30 basis points quarter-over-quarter and the upper middle market rate nearly doubling.

Fundraising activity in the U.S. direct lending market was off to a stronger start to the year than in 2023. According to Preqin data, nine funds focused on senior debt closed in the first quarter with nearly $8 billion raised, versus two funds for a total of $2 billion raised in the first quarter of 2023. According to Private Debt Investor’s “LP Perspectives 2024 Study,” more than 50% of investors surveyed are seeking to allocate to existing managers rather than expanding their manager roster.

For more information on TPG AG Middle Market Direct Lending, visit angelogordon.com/credit/middle-market-direct-lending/

U.S. sponsored middle market loan volume totaled $32 billion in Q1 2024, representing an increase year-over-year.

The direct lender yield premium over large corporate deals remained elevated, at over 260 basis points in the first quarter of 2024.

Total leverage remained conservative across all market segments in the first quarter of 2024.

Private credit default rates across the mid-market remained muted at the end of 2023, with the lower middle market default rate below 1%.