Commercial Real Estate Debt

The biggest story of the quarter was once again interest rates. With employment measures still strong and inflation data running hotter than anticipated, market participants are being forced to push back predictions of when the Federal Reserve will begin cutting rates. This issue is particularly painful for commercial real estate values, as higher risk-free rates make the ownership of any risky asset relatively less attractive. Further adding to the challenges of the asset class, the availability and cost of financing accessible to property owners has worsened. Regional banks have historically provided approximately 38% of financing to the commercial real estate market, but challenges in the regional banking sector have greatly reduced these institutions’ willingness to lend.

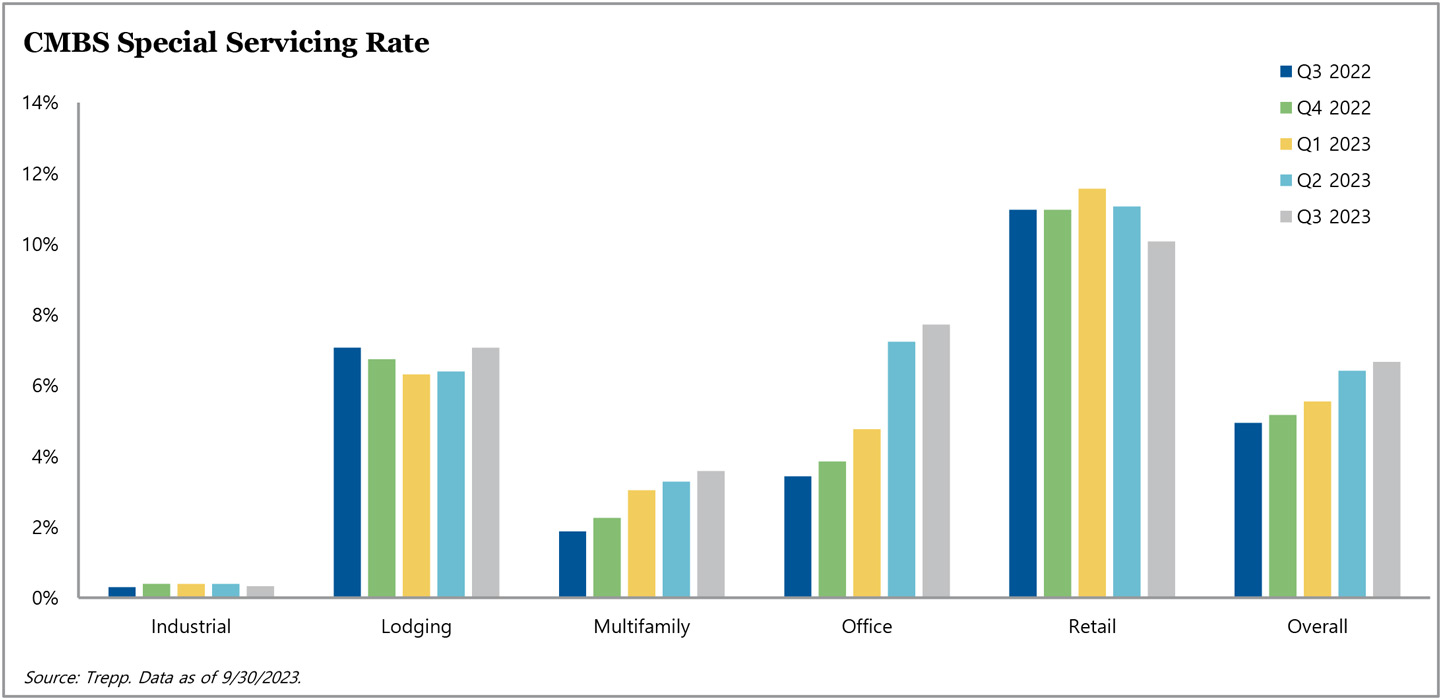

In this context, we have observed that borrowers are frequently negotiating extensions to their current loans. Within the CMBS market, $3.24 billion of loans that were scheduled to mature in 2023 had been modified by September. The most comprehensive measure of distress in the CMBS market is the percentage of loans that have been transferred to special servicing. In August, this figure rose to 6.67% – the seventh consecutive monthly increase and exceeding the 4.92% level recorded twelve months earlier. The office, mixed-use, and multifamily property types saw the greatest increases in the percentage of loans transferred to special servicing, at 7.72%, 7.03%, and 3.55%, respectively; meanwhile industrial, lodging, and retail were stable to slightly improved, at 0.33%, 7.07%, and 10.07%, respectively.

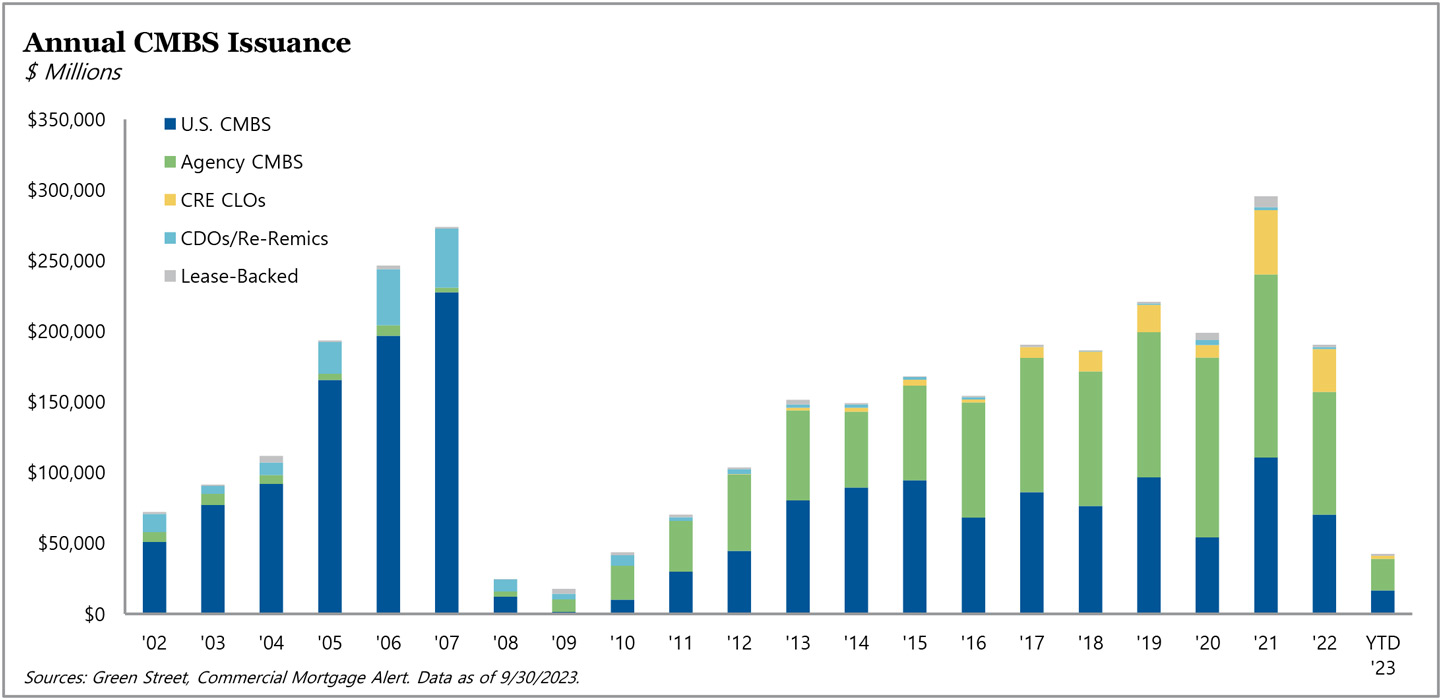

Wider spreads, higher rates, and limited real estate transaction actively have kept issuance levels subdued. For the first nine months of this year, CMBS issuance volumes are down 58% year-over-year, conduit volumes are 31% lower, and SASB volumes are down 71%. Year-to-date CRE CLO issuance has declined even further, dropping 78% year-over-year. We believe that in order for the logjam in the commercial real estate debt markets to break loose, the securitization market will need to be at the forefront.

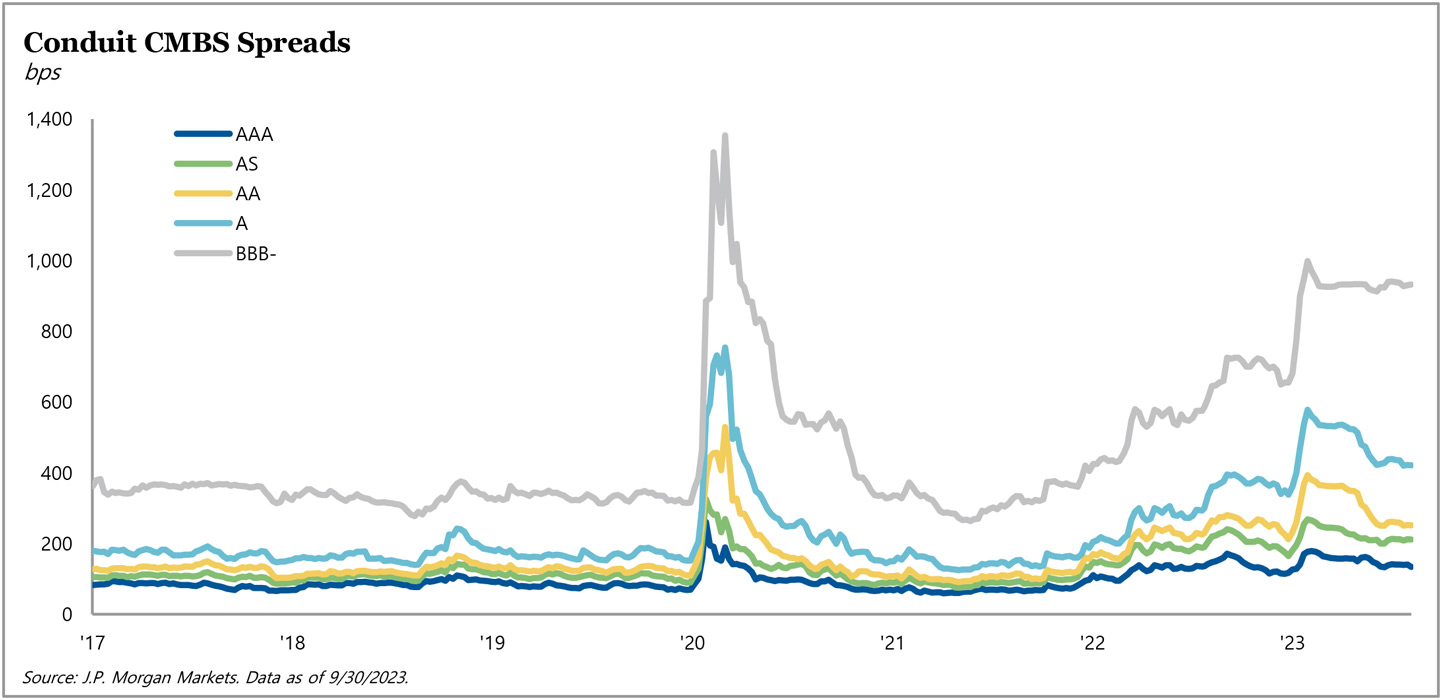

Despite the limited supply of new issue bonds, CBMS spread tightening lagged other structured products during the third quarter of 2023. Conduit bonds across the capital stack – from AAA to BBB- tranches – were relatively unchanged during the quarter. However, we saw price movement in deals across both the SASB and conduit sectors, where investors have differentiated views of credit or credit events have already occurred. As investors formulate opinions on interest rates, real estate values, and the outlook for a slowing economy, we expect the CMBS and commercial real estate credit markets will continue to diverge, providing opportunities for investors to capitalize on market dislocations.

For more information on Commercial Real Estate Debt, visit angelogordon.com/strategies/credit/real-estate-debt/

CMBS issuance continues to lag historical volumes, driven by high interest rates and lender reluctance to lend to commercial real estate. The few deals that have been issued year-to-date were primarily 5-year loans, versus 10-year loans – the historical norm.

The percentage of CMBS loans in special servicing increased by 25 basis points in the third quarter, with loans secured by lodging properties driving the majority of the increase.

Conduit CMBS spreads below the AAA level continued to drift wider during the period and are now near levels seen at the peak of the COVID-19 panic.