High Yield Credit

U.S. high yield bonds gained 1.62% and European high yield markets rose 1.35% in the first quarter, with stronger-than-expected corporate earnings and more active new issuance in the capital markets driving positive returns.

U.S. high yield bonds gained 1.62% and European high yield markets rose 1.35% in the first quarter, with stronger-than-expected corporate earnings and more active new issuance in the capital markets driving positive returns.

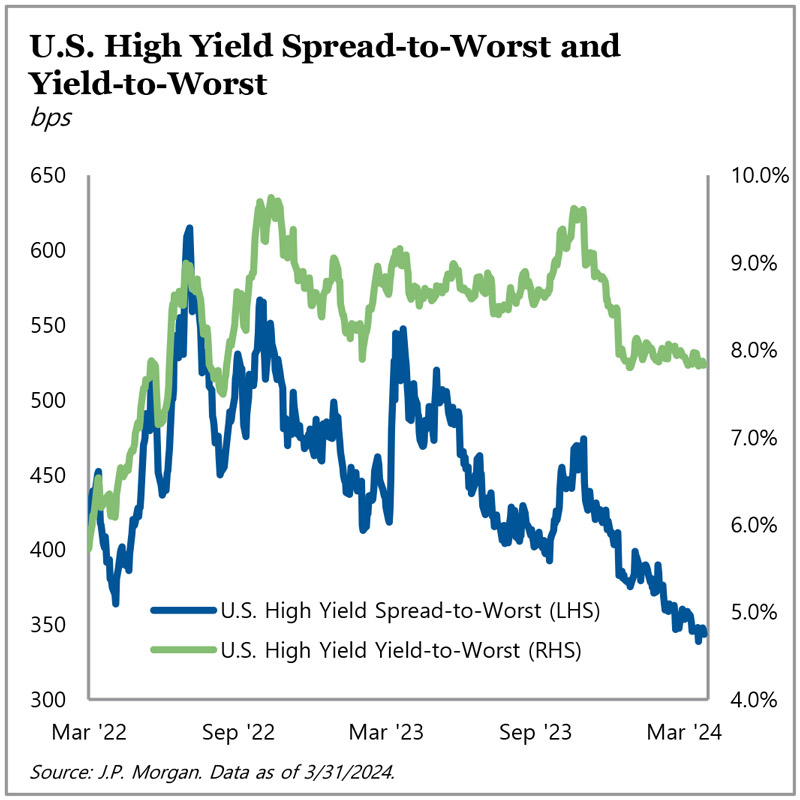

In the United States, high yield bond spreads tightened 34 basis points over the first three months of the year, ending the quarter at 343 basis points after touching a five-year low of 339 basis points in March. Yields continued to hover around 8%, ending the quarter at 7.8%. Lower-rated bonds outperformed higher-quality bonds, as CCCs gained 4.0% while BBs generated a 1.2% return in the first quarter. In Europe, high yield spreads compressed 31 basis points to close the first quarter at 430 basis points. Lower-quality CCCs significantly lagged BBs in Europe during the quarter, losing 1.9% versus gaining 1.5%.

During the first quarter, 14 U.S. companies defaulted or completed a distressed exchange on a combined $11 billion of debt. Despite this volume, the 12-month trailing default rate declined from 2.8% to 2.6%. In the same three-month period, the European high yield market experienced two defaults, which drove the default rate modestly higher, from 2.4% to 2.6%.

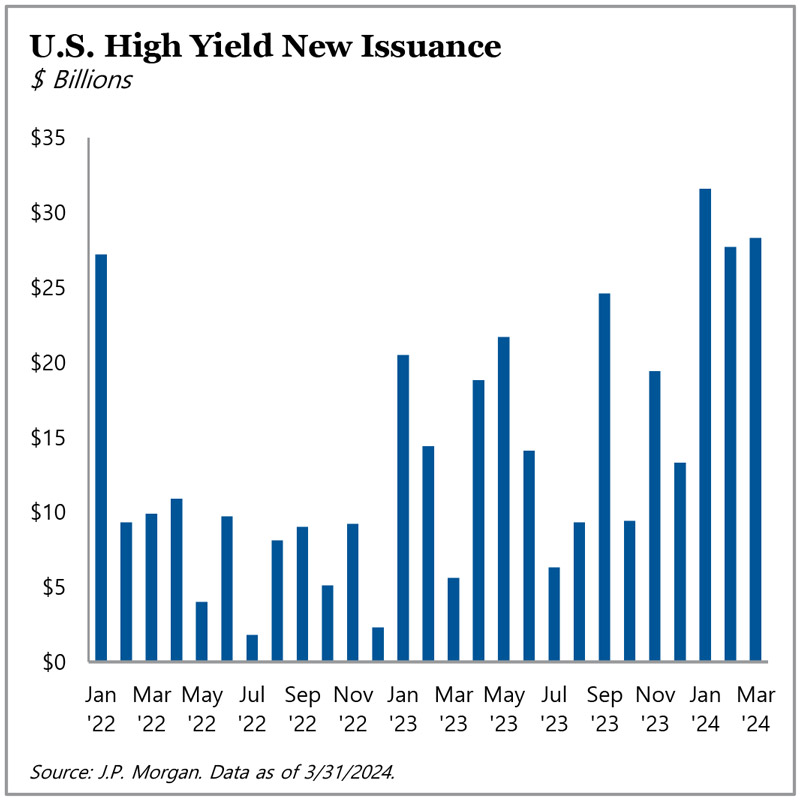

After U.S. high yield primary activity totaled just $176 billion in 2023, new issuance rebounded with approximately $88 billion of volume during the first three months of 2024, resulting in the most active quarter since the third quarter of 2021. In Europe, high yield new issuance totaled €26.5 billion in the first quarter, with €13.9 billion coming in March — the highest monthly volume since October 2021.

After $7.0 billion of outflows in 2023, U.S. high yield mutual funds experienced inflows of $2.6 billion during the first quarter. In Europe, high yield funds experienced inflows of €4.7 billion, marking the best quarter for new subscriptions since the second quarter of 2020.

For more information on TPG AG Credit Solutions, visit angelogordon.com/credit/credit-solutions/

While yields remained steady, spreads continued to tighten, ending the first quarter near a five-year low.

Primary issuance in each of the first three months of 2024 exceeded issuance in every month of 2022 and 2023.