Leveraged Loans

Leveraged loans continued their impressive performance to start the year. In the first quarter, the J.P. Morgan U.S. Leveraged Loan Index posted a 2.6% return, ending March with an 8.8% yield to maturity and a spread of 476 basis points. Leveraged loans outperformed both investment grade and high yield bonds, which returned -0.3% and +1.6%, respectively. Lower quality credits outperformed, with CCC-rated leveraged loans up 5.14% while BBs were up 2.01%. In Europe, the J.P. Morgan European Leveraged Loan Index posted a 2.5% quarterly return, ending the first quarter with a spread of 535 basis points and yield of 8.2%.

Leveraged loans continued their impressive performance to start the year. In the first quarter, the J.P. Morgan U.S. Leveraged Loan Index posted a 2.6% return, ending March with an 8.8% yield to maturity and a spread of 476 basis points. Leveraged loans outperformed both investment grade and high yield bonds, which returned -0.3% and +1.6%, respectively. Lower quality credits outperformed, with CCC-rated leveraged loans up 5.14% while BBs were up 2.01%. In Europe, the J.P. Morgan European Leveraged Loan Index posted a 2.5% quarterly return, ending the first quarter with a spread of 535 basis points and yield of 8.2%.

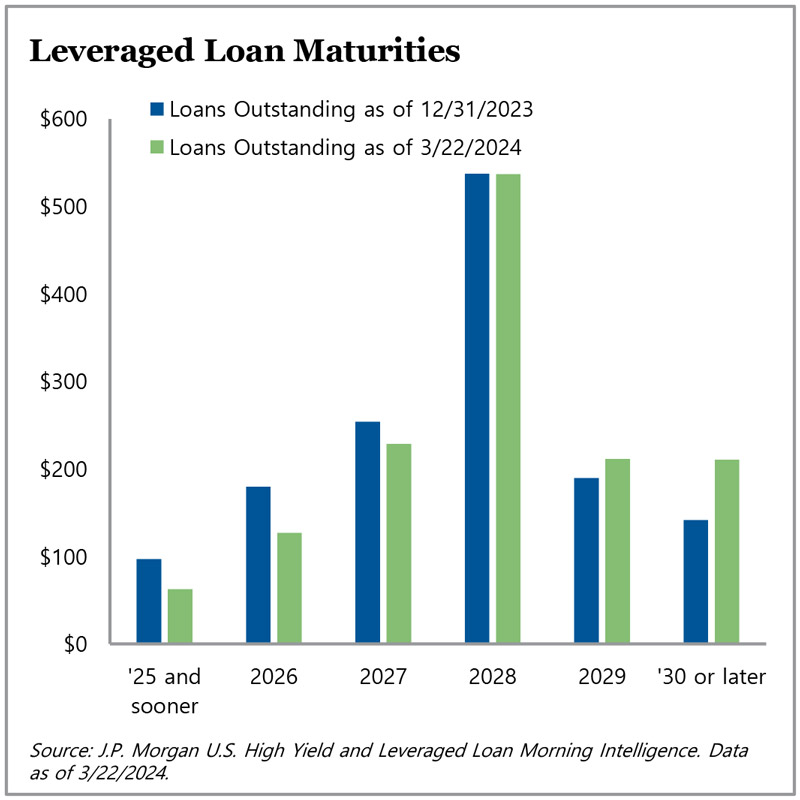

A strong technical supply-demand dynamic has been contributing to the positive performance in this space. On the supply side, first-quarter U.S. institutional loan issuance totaled $317.7 billion, marking the second-most-active quarter on record. However, proceeds were predominantly used for repricing and refinancing, which comprised 88% of total quarterly issuance. As a result, the institutional leveraged loan maturity wall saw some near-term relief, with recent refinancings taking out nearly $35 billion of loans set to mature through 2025.

On the demand front, the string of record months of CLO issuance continued; total quarterly issuance amounted to $84 billion, which represents over 60% of total CLO issuance in 2023. Additionally, leveraged loan fund flows rebounded from 2023’s $17 billion outflow, with a $2.8 billion inflow recorded in the first quarter. While strong technical signals have been observed, fundamentals have been weakening off a strong base, and distressed transactions have been a larger component of the default landscape. The trailing twelve-month default rate for U.S. leveraged loans, including distressed exchanges, ended the first quarter at 3.52% – slightly above the 25-year average of 3.0%.

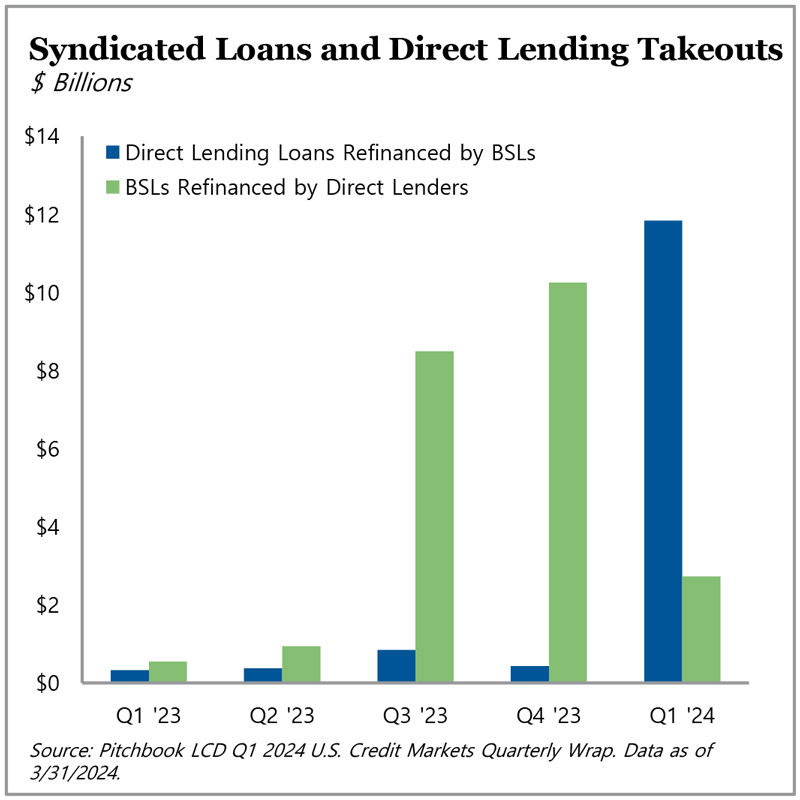

With the broadly syndicated loan (BSL) market largely closed to leveraged credits throughout 2023, BSL issuers had increasingly been tapping the private credit market to refinance their existing debt last year. Interestingly, the first quarter appeared to mark a notable shift in that trend, with $11.8 billion of private market loans being refinanced in the BSL market, whereas only $2.7 billion of broadly syndicated loans were refinanced in the private market, according to PitchBook LCD. A driver of this shift was the potential net cash interest savings versus original costs for loans refinanced into the BSL market, which approached an average of 160 basis points at the end of the first quarter.

For more information on TPG AG CLOs, visit angelogordon.com/strategies/credit/clo/

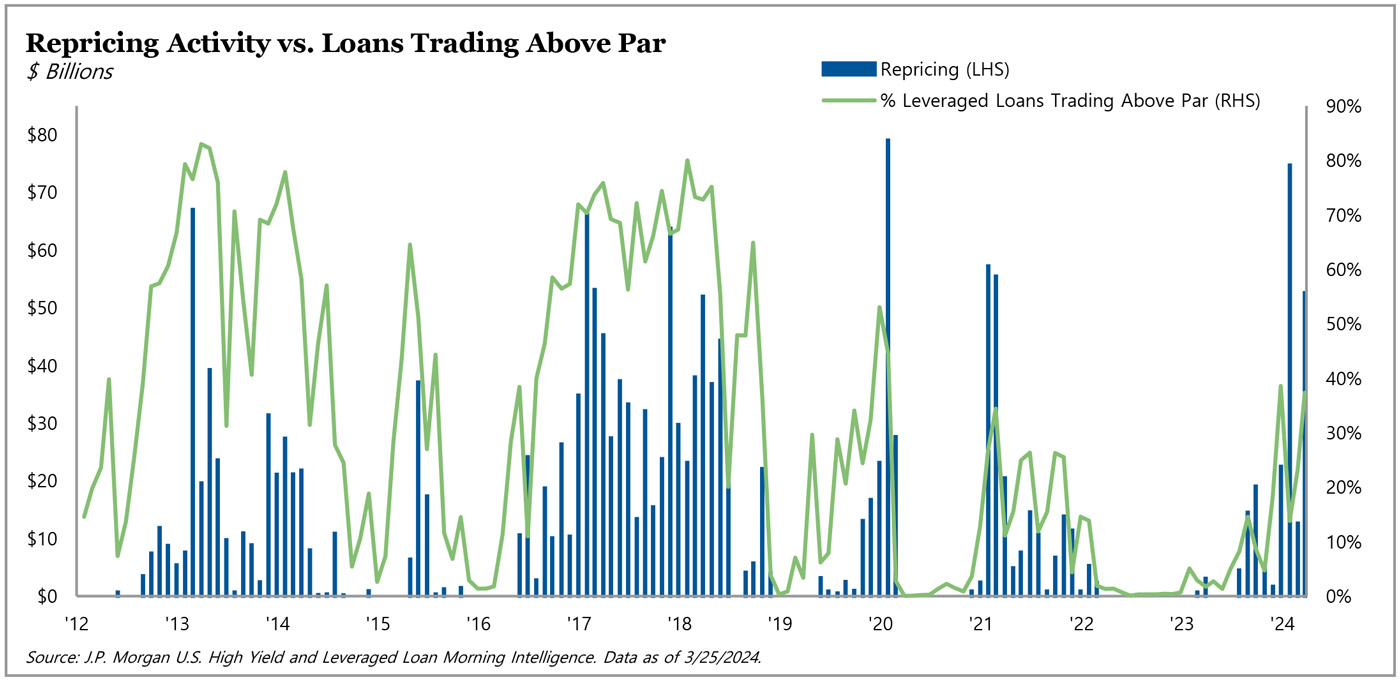

The percentage of loans trading above par remained elevated at the end of the first quarter, driven by technical tailwinds from positive fund flows and robust CLO formation.

In the U.S. leveraged loan market, the trend of increased distressed exchanges continued in the first quarter, with more than half of the default volume coming from distressed exchanges.

Significant repricing activity in the first quarter enabled issuers to push out maturities, partially relieving the near-term wall of maturities.

After a year of existing BSL issuers increasingly turning to private credit for refinancings, the first quarter marked a notable reversal of 2023’s trend.