Structured Credit

RMBS

RMBS spreads sharply rallied during the first quarter amid strong investor appetite for U.S. housing and mortgage credit. Credit risk transfer (CRT) tranches were tighter by 50-200 basis points, and the sector’s credit curve flattened significantly. Senior non-qualified mortgage (NQM) spreads were around 40 basis points tighter during the quarter, and BBB- and BB-rated NQM were 70 and 120 basis points tighter, respectively. First-quarter total returns were between 2-4% for mezzanine CRT tranches and 4-6% for subordinates, and legacy RMBS returned around 1-2%.

RMBS spreads sharply rallied during the first quarter amid strong investor appetite for U.S. housing and mortgage credit. Credit risk transfer (CRT) tranches were tighter by 50-200 basis points, and the sector’s credit curve flattened significantly. Senior non-qualified mortgage (NQM) spreads were around 40 basis points tighter during the quarter, and BBB- and BB-rated NQM were 70 and 120 basis points tighter, respectively. First-quarter total returns were between 2-4% for mezzanine CRT tranches and 4-6% for subordinates, and legacy RMBS returned around 1-2%.

Primary RMBS issuance was off to a strong start during the first quarter, totaling nearly $30 billion — up 56% year-over-year and 73% quarter-over-quarter. Securitizations backed by NQM and prime jumbo collateral led this trend, collectively comprising over half of the quarter’s issuance. Second-lien collateral, including closed-end loans and home equity lines of credit (HELOCs), totaled $2.6 billion — or 9% of new issuance — and CRT comprised around 11% of the activity. Primary issuance in 2023 totaled just $69 billion, amid a lull in mortgage origination activity after almost $140 billion of new bonds were issued in 2022.

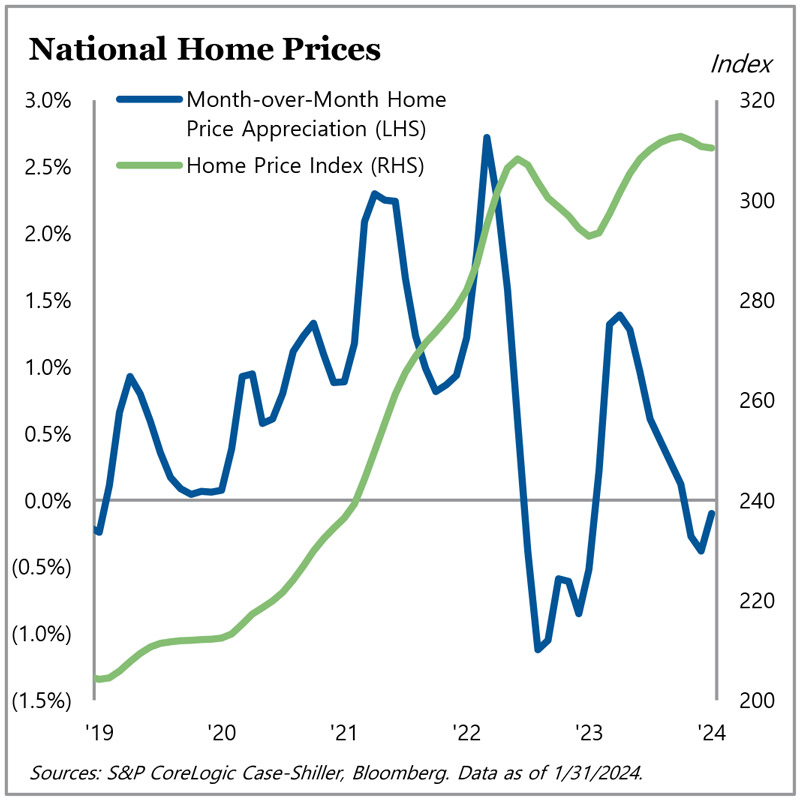

The S&P CoreLogic Case-Shiller U.S. National Home Price Index was up 6% year-over-year in January 2024. However, home prices were little changed over the preceding several months, with the Index just below its October 2023 peak and in line with the prior peak in June 2022. Recall that home prices had fallen by approximately 5% from June 2022 to January 2023, before recovering throughout last year. Home prices continue to vary by geography. Since June 2022, home prices in west coast MSAs as well as Phoenix, Dallas, and Denver have declined 6-12%, while prices in MSAs like Chicago and Detroit are up 3-5%; home prices in Miami and NYC are 6% higher as well. A survey of research shows varied home price expectations in 2024, ranging from -3% to +5.5%.

Prevailing mortgage rates inched higher to 6.8%, up from 6.6% at year-end 2023, and continued to rise in the first weeks of the second quarter. Recall that mortgage rates reached 7.8% during the fourth quarter of last year, the highest level since November 2000. The effective mortgage rate outstanding was 3.8% as of December 2023, creeping up from 3.3% in March 2022, reflecting the inclusion of higher-rate originations in the second half of 2022 and 2023. The well-publicized “lock-in effect” remains in full force, with most estimates showing a very small share of outstanding mortgages in-the-money to refinance.

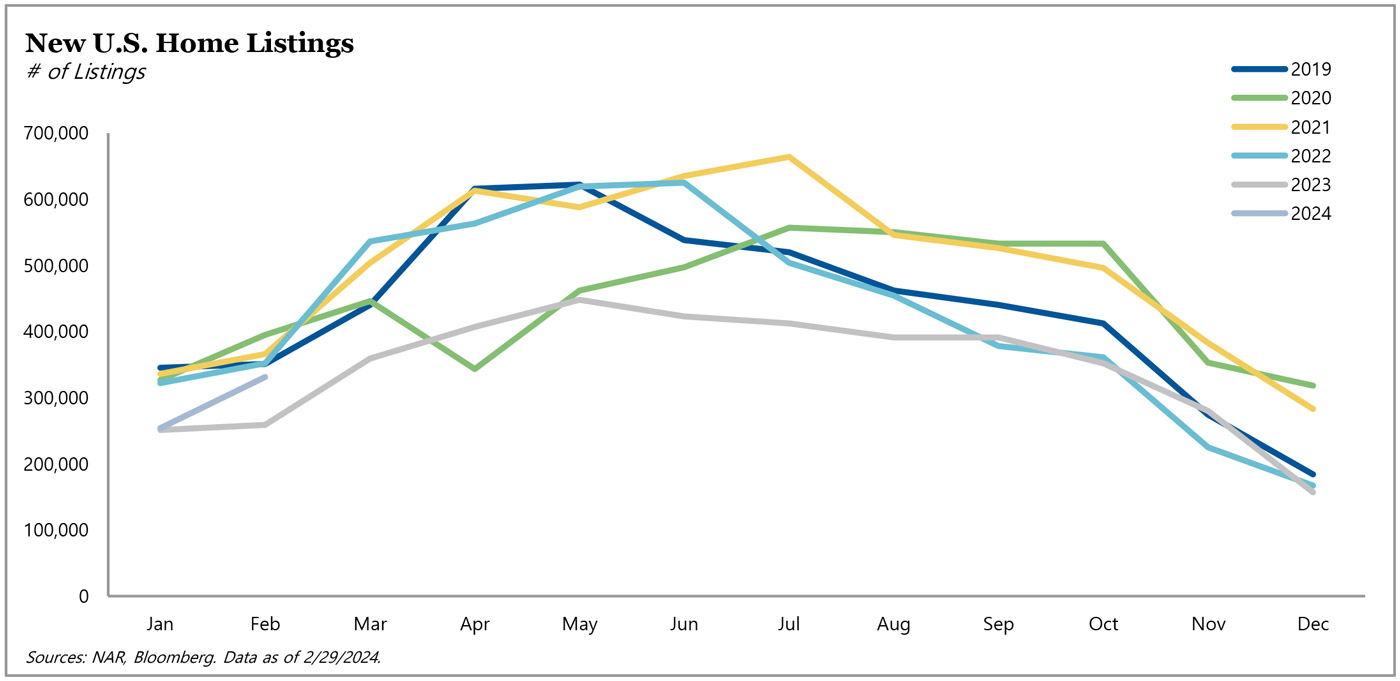

Total existing home listings were 1.07 million in February, remaining in line with most of 2023 but down significantly from pre-pandemic years. On a national level, new listings were a little higher year-over-year in January and February but still weak overall.

RMBS issuance was up 56% year-over-year in the first quarter.

Home prices have flattened since recovering in 2023.

Housing demand is evident given the percentage of listings off market within two weeks remains high.

Few new listings came to market in the first two months of 2024.

ABS

ABS spreads were off to a strong start and, like RMBS, rallied during the first quarter. Benchmark ABS sectors such as student loans and credit cards were generally 5-15 basis points tighter, though subordinate student loans were as much as 30 basis points tighter. In a reversal of last quarter, subprime auto ABS tightened by 55 basis points for single-A profiles, 70 basis points for BBB, and 145 basis points for BB, resulting in a much flatter credit curve for the quarter. The credit curve for unsecured consumer loans similarly flattened, with single-A tranches 75 basis points tighter and BB-rated tranches over 200 basis points tighter.

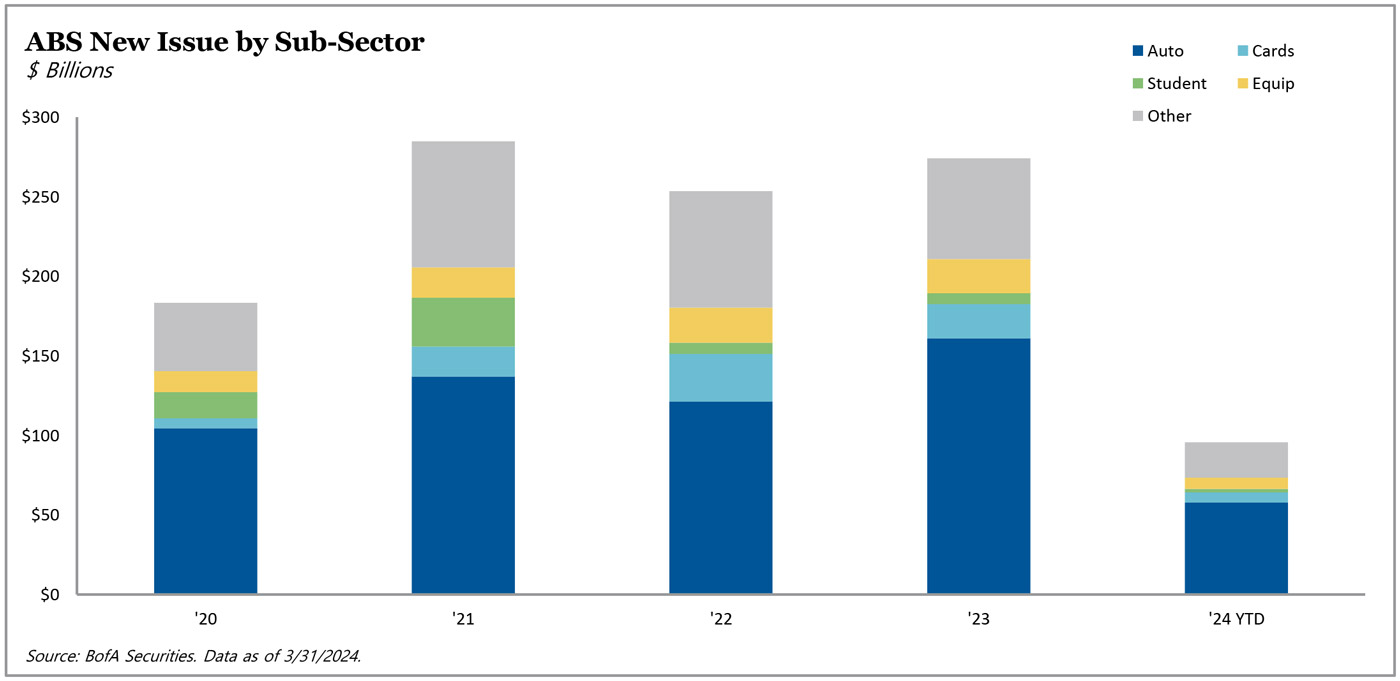

Primary issuance activity totaled $96 billion in the first quarter, up 51% from year-ago levels. While all sectors grew on an annual basis, issuance for autos led the period — rising over $20 billion to $58 billion in the first quarter — and credit cards followed, up nearly $5 billion to $6.4 billion; esoteric ABS, student loans, and equipment were higher by a few billion dollars each. Within the auto sector, prime loans comprised a majority of the issuance at $24.6 billion, followed by non-prime loans at $13 billion and leases at $12 billion.

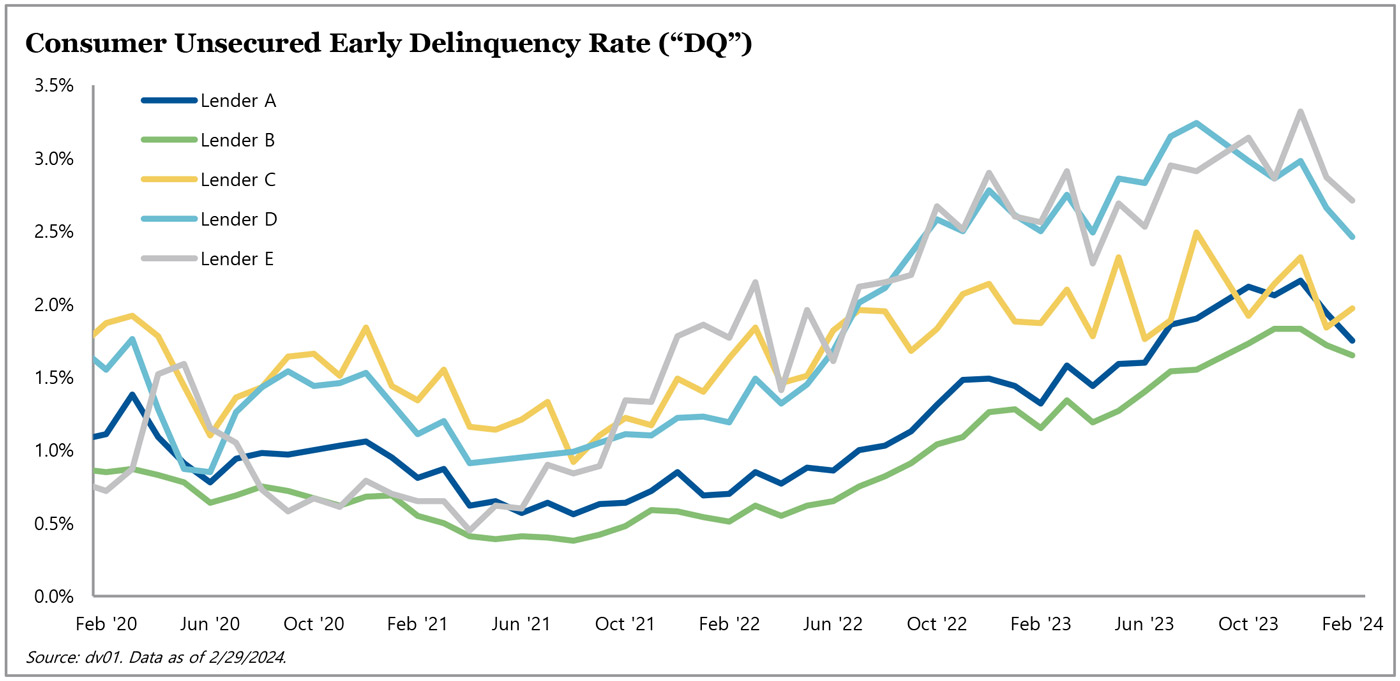

Consumer performance data felt some relief during the first quarter with the onset of the tax refund season. Unsecured consumer loans improved, and further performance improvement is anticipated over the next several months as additional borrowers receive tax refunds. Auto performance data improved for similar reasons; auto delinquency and default rates fell, and repayments for subprime and deep subprime auto loans rose but remained close to historic lows. Credit card performance continues to be stable with high payment rates and muted charge-off rates that, for now, remain below pre-pandemic levels. Overall student loan performance was benign with reduced early delinquency rates and lower defaults, also benefitting from tax refunds. Recoveries on legacy private credit student loans continued to surpass new defaults.

On the regulatory front, the CFPB finalized its rule setting a new $8 safe harbor cap for credit card late payment fees, significantly below the previous $32 average fee. Not surprisingly, the final rule prompted a lawsuit from the U.S. Chamber of Commerce and other industry groups. Federal student loan payments — proxied using remittances by the Department of Education — remain below pre-pandemic levels, as borrowers are still within the 12-month on-ramp we have discussed in previous CMP reports. We believe the payment resumption will have a limited impact on the broader consumer ABS complex, as federal student loans tend to be at the bottom of payment hierarchies given small minimum payments, the availability of forbearance, and the long delay before adverse action is taken.

ABS issuance was up 51% year-over-year in the first quarter.

ABS spreads rallied during the first quarter.

Credit card principal payment rates have been generally stable.

Delinquencies for unsecured consumer loans seasonally improved with tax refunds.

CMBS

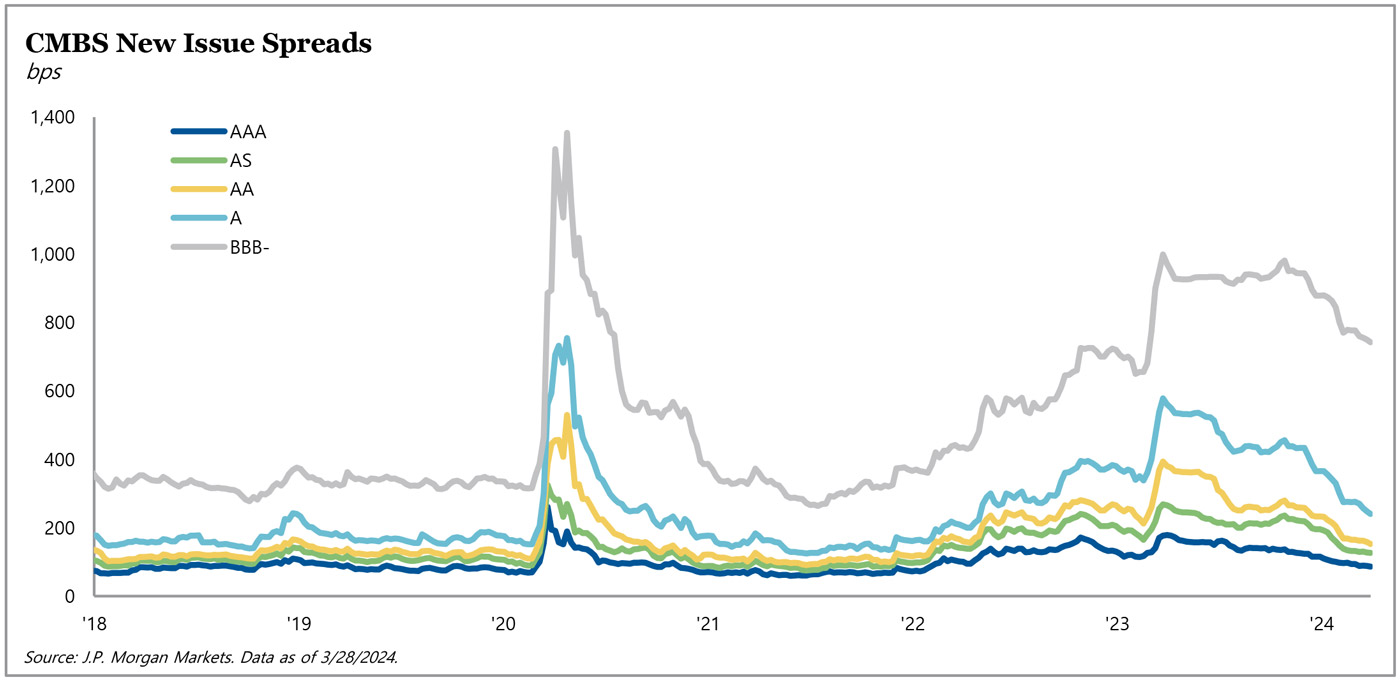

CMBS spreads and interest rates diverged in the first quarter, as benchmark rates moved higher and secondary-market CMBS spreads grinded tighter. AAA CMBS spreads are once again inside of 100 basis points, ending the quarter at 86 basis points — within 20 basis points of their 7-year average of 70 basis points. As AAA-rated tranches tightened, the investment community’s confidence that the lending market is reopening increased. As a result, secondary-market BBB- spreads tightened approximately 120 basis points during the quarter. Averages moved, but the dispersion among securities viewed as “safe” relative to those with high concentrations of out-of-favor properties remains significant.

While spreads rallied in the first quarter of 2024, credit trends remained consistent relative to 2023. As of the end of March, the CMBS special servicing rate increased 53 basis points to 7.31%. Not surprisingly, the increase was primarily due to an 18% uptick in office loans being transferred to special servicing, as maturing loans are meeting a financing market unreceptive to the office property type. Meanwhile, property types other than office experienced limited changes in special servicing rates, with loans transferred to special servicing typically being moved due to property-specific issues — not broader sector concerns.

The awakening of the CMBS market in the fourth quarter of 2023 continued into the first quarter of 2024, putting the primary CMBS market in a better place. The year started hot, with four conduit deals pricing in January. Each issuance was well received, with tranches as much as ten-times oversubscribed, leading issuers to tighten spreads as the quarter progressed. A mix of conduit and single-asset/single-borrower (SASB) deals totaling 23 transactions priced during the quarter, and the period ended with a flurry of SASB issuance, as sophisticated borrowers sought to take advantage of the healthy securitization market. The demand for these transactions will likely create a virtuous cycle, leading to increased new issuance as the year progresses.

In summary, the CMBS rally from December 2023 continued throughout the first quarter despite the stall in broader interest rate cuts. We expect spreads will continue to tighten, as there is strong demand for new issue bonds with tight underwriting standards, and CMBS remains cheap to alternative structured products. Additionally, large money managers that have been avoiding commercial real estate risk are starting to reemerge in the market.

For more information on TPG AG Structured Credit & Specialty Finance, visit angelogordon.com/credit/structured-credit-specialty-finance/

In the first quarter, the overall CMBS special servicing rate increased primarily due to an uptick in the transfer of office loans.

CMBS issuance was off to a healthy start in the first quarter, and we expect increased volume moving forward, as capital markets have reopened for commercial real estate financing.

CMBS spreads tightened across the capital stack.